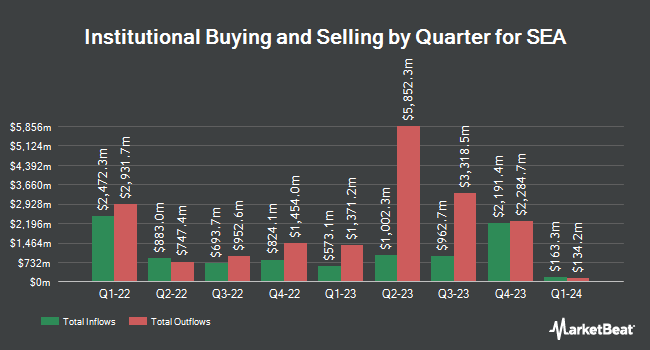

Healthcare of Ontario Pension Plan Trust Fund cut its stake in shares of Sea Limited (NYSE:SE - Free Report) by 31.2% during the third quarter, according to its most recent disclosure with the SEC. The institutional investor owned 534,100 shares of the Internet company based in Singapore's stock after selling 241,800 shares during the period. Healthcare of Ontario Pension Plan Trust Fund owned about 0.09% of SEA worth $50,355,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in SE. Sequoia Financial Advisors LLC lifted its stake in SEA by 6.2% in the third quarter. Sequoia Financial Advisors LLC now owns 3,081 shares of the Internet company based in Singapore's stock valued at $290,000 after acquiring an additional 180 shares during the last quarter. Canton Hathaway LLC lifted its stake in SEA by 20.0% in the second quarter. Canton Hathaway LLC now owns 1,200 shares of the Internet company based in Singapore's stock valued at $86,000 after acquiring an additional 200 shares during the last quarter. Rosenberg Matthew Hamilton lifted its stake in SEA by 213.7% in the third quarter. Rosenberg Matthew Hamilton now owns 298 shares of the Internet company based in Singapore's stock valued at $28,000 after acquiring an additional 203 shares during the last quarter. Gulf International Bank UK Ltd lifted its stake in shares of SEA by 0.7% in the second quarter. Gulf International Bank UK Ltd now owns 28,958 shares of the Internet company based in Singapore's stock worth $2,068,000 after buying an additional 213 shares during the last quarter. Finally, Parallel Advisors LLC lifted its stake in shares of SEA by 5.2% in the second quarter. Parallel Advisors LLC now owns 5,063 shares of the Internet company based in Singapore's stock worth $362,000 after buying an additional 250 shares during the last quarter. 59.53% of the stock is owned by hedge funds and other institutional investors.

SEA Stock Performance

SEA stock traded up $1.78 on Thursday, hitting $115.71. The company's stock had a trading volume of 3,350,955 shares, compared to its average volume of 5,374,637. The firm has a market cap of $66.23 billion, a P/E ratio of 771.40 and a beta of 1.52. The company has a quick ratio of 1.60, a current ratio of 1.62 and a debt-to-equity ratio of 0.36. The company has a fifty day moving average price of $99.42 and a 200-day moving average price of $82.14. Sea Limited has a one year low of $34.35 and a one year high of $117.85.

SEA (NYSE:SE - Get Free Report) last announced its quarterly earnings results on Tuesday, November 12th. The Internet company based in Singapore reported $0.24 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.59 by ($0.35). The business had revenue of $4.33 billion during the quarter, compared to the consensus estimate of $4.09 billion. SEA had a net margin of 0.64% and a return on equity of 1.40%. The company's quarterly revenue was up 30.8% compared to the same quarter last year. During the same period last year, the firm earned ($0.26) EPS. On average, equities analysts anticipate that Sea Limited will post 0.81 earnings per share for the current year.

Wall Street Analysts Forecast Growth

A number of analysts have recently weighed in on SE shares. Dbs Bank upgraded shares of SEA from a "hold" rating to a "strong-buy" rating in a research note on Wednesday, November 13th. Barclays boosted their price objective on shares of SEA from $94.00 to $131.00 and gave the stock an "overweight" rating in a research note on Thursday, November 14th. JPMorgan Chase & Co. upgraded shares of SEA from a "neutral" rating to an "overweight" rating and boosted their price objective for the stock from $66.00 to $90.00 in a research note on Wednesday, August 14th. Benchmark boosted their price objective on shares of SEA from $94.00 to $130.00 and gave the stock a "buy" rating in a research note on Wednesday, November 13th. Finally, Phillip Securities reaffirmed a "reduce" rating and set a $100.00 target price (up previously from $80.00) on shares of SEA in a research report on Tuesday, November 19th. One analyst has rated the stock with a sell rating, two have assigned a hold rating, eleven have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, SEA has an average rating of "Moderate Buy" and a consensus price target of $91.21.

View Our Latest Report on SEA

SEA Profile

(

Free Report)

Sea Limited, together with its subsidiaries, engages in the digital entertainment, e-commerce, and digital financial service businesses in Southeast Asia, Latin America, rest of Asia, and internationally. It offers Garena digital entertainment platform for users to access mobile and PC online games, as well as promotes eSports operations.

Further Reading

Before you consider SEA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SEA wasn't on the list.

While SEA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.