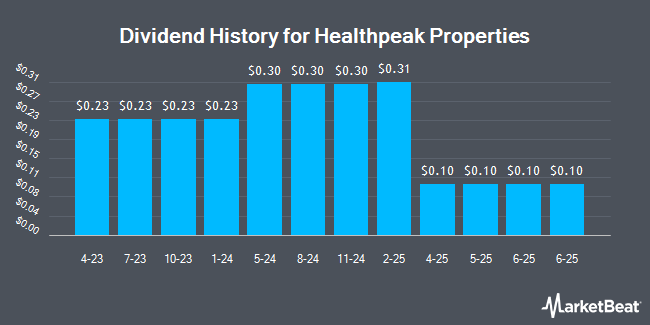

Healthpeak Properties, Inc. (NYSE:DOC - Get Free Report) declared a dividend on Wednesday, April 16th, investing.com reports. Investors of record on Friday, April 18th will be given a dividend of 0.1017 per share by the real estate investment trust on Wednesday, April 30th. This represents a yield of 6.5%. The ex-dividend date is Thursday, April 17th.

Healthpeak Properties has increased its dividend payment by an average of 26.4% per year over the last three years. Healthpeak Properties has a payout ratio of 406.7% indicating that the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Equities analysts expect Healthpeak Properties to earn $1.95 per share next year, which means the company should continue to be able to cover its $1.22 annual dividend with an expected future payout ratio of 62.6%.

Healthpeak Properties Price Performance

Shares of NYSE DOC traded up $0.17 during midday trading on Friday, reaching $18.75. 4,277,247 shares of the company were exchanged, compared to its average volume of 4,907,835. Healthpeak Properties has a one year low of $17.33 and a one year high of $23.26. The stock has a market cap of $13.11 billion, a P/E ratio of 53.56, a PEG ratio of 2.17 and a beta of 1.02. The company has a quick ratio of 1.35, a current ratio of 1.35 and a debt-to-equity ratio of 0.96. The stock's 50-day moving average price is $19.68 and its 200-day moving average price is $20.69.

Analyst Upgrades and Downgrades

Several equities analysts have commented on the company. Wedbush reiterated an "outperform" rating and issued a $24.00 target price on shares of Healthpeak Properties in a research report on Friday, April 11th. StockNews.com downgraded shares of Healthpeak Properties from a "hold" rating to a "sell" rating in a research report on Monday. Scotiabank decreased their price target on shares of Healthpeak Properties from $24.00 to $23.00 and set a "sector outperform" rating for the company in a research report on Friday, February 28th. Robert W. Baird reduced their price objective on shares of Healthpeak Properties from $25.00 to $24.00 and set an "outperform" rating on the stock in a research note on Tuesday, February 11th. Finally, Morgan Stanley raised Healthpeak Properties from an "equal weight" rating to an "overweight" rating and set a $25.00 target price for the company in a research report on Wednesday, January 15th. One equities research analyst has rated the stock with a sell rating, three have given a hold rating, nine have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, Healthpeak Properties has a consensus rating of "Moderate Buy" and a consensus price target of $23.83.

View Our Latest Research Report on Healthpeak Properties

Healthpeak Properties Company Profile

(

Get Free Report)

Healthpeak Properties, Inc is a fully integrated real estate investment trust (REIT) and S&P 500 company. Healthpeak owns, operates, and develops high-quality real estate for healthcare discovery and delivery.

Recommended Stories

Before you consider Healthpeak Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Healthpeak Properties wasn't on the list.

While Healthpeak Properties currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.