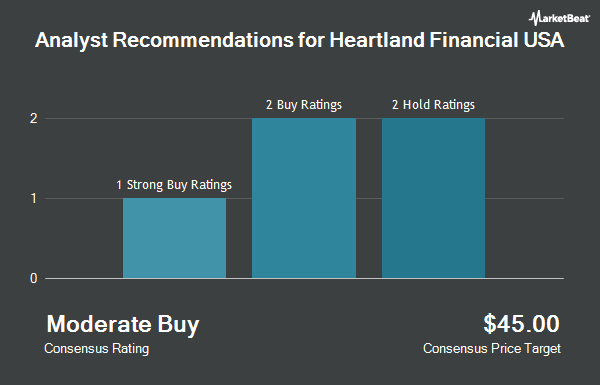

StockNews.com assumed coverage on shares of Heartland Financial USA (NASDAQ:HTLF - Free Report) in a report published on Sunday. The brokerage issued a hold rating on the bank's stock.

Heartland Financial USA Trading Up 1.9 %

Heartland Financial USA stock traded up $1.23 during midday trading on Friday, hitting $67.53. 170,002 shares of the stock were exchanged, compared to its average volume of 275,044. The stock has a market capitalization of $2.90 billion, a PE ratio of 37.73 and a beta of 0.94. The company has a quick ratio of 0.76, a current ratio of 0.76 and a debt-to-equity ratio of 0.18. Heartland Financial USA has a 52 week low of $29.67 and a 52 week high of $69.91. The company has a fifty day simple moving average of $59.88 and a two-hundred day simple moving average of $52.20.

Heartland Financial USA (NASDAQ:HTLF - Get Free Report) last released its quarterly earnings results on Tuesday, October 29th. The bank reported $1.17 EPS for the quarter, meeting analysts' consensus estimates of $1.17. Heartland Financial USA had a return on equity of 10.81% and a net margin of 8.79%. The firm had revenue of $272.79 million for the quarter, compared to analyst estimates of $189.51 million. During the same quarter in the previous year, the company posted $1.12 EPS. Equities research analysts anticipate that Heartland Financial USA will post 4.57 EPS for the current fiscal year.

Heartland Financial USA Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Tuesday, November 26th. Investors of record on Tuesday, November 12th will be given a dividend of $0.30 per share. This represents a $1.20 annualized dividend and a dividend yield of 1.78%. The ex-dividend date is Tuesday, November 12th. Heartland Financial USA's dividend payout ratio (DPR) is currently 67.04%.

Insider Transactions at Heartland Financial USA

In other news, Director John K. Schmidt sold 22,500 shares of the firm's stock in a transaction dated Monday, November 11th. The shares were sold at an average price of $68.32, for a total value of $1,537,200.00. Following the sale, the director now directly owns 60,541 shares in the company, valued at approximately $4,136,161.12. This trade represents a 27.10 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Company insiders own 1.80% of the company's stock.

Institutional Trading of Heartland Financial USA

Several large investors have recently bought and sold shares of the business. Geode Capital Management LLC boosted its stake in shares of Heartland Financial USA by 4.9% in the 3rd quarter. Geode Capital Management LLC now owns 1,023,370 shares of the bank's stock valued at $58,036,000 after buying an additional 47,480 shares during the period. Barclays PLC lifted its stake in Heartland Financial USA by 65.5% in the 3rd quarter. Barclays PLC now owns 84,767 shares of the bank's stock valued at $4,807,000 after buying an additional 33,533 shares in the last quarter. XTX Topco Ltd boosted its holdings in shares of Heartland Financial USA by 128.0% during the third quarter. XTX Topco Ltd now owns 11,541 shares of the bank's stock worth $654,000 after purchasing an additional 6,479 shares during the last quarter. Stifel Financial Corp increased its stake in Heartland Financial USA by 33.1% during the third quarter. Stifel Financial Corp now owns 27,999 shares of the bank's stock worth $1,588,000 after acquiring an additional 6,960 shares during the last quarter. Finally, HighTower Advisors LLC acquired a new stake in shares of Heartland Financial USA in the third quarter valued at about $225,000. Hedge funds and other institutional investors own 71.55% of the company's stock.

Heartland Financial USA Company Profile

(

Get Free Report)

Heartland Financial USA, Inc, a bank holding company, provides commercial, small business, and consumer banking services to individuals and businesses in the United States. The company accepts various deposit products, including checking, demand deposit accounts, NOW accounts, savings, money market, and individual retirement; certificates of deposit; and other time deposits.

Recommended Stories

Before you consider Heartland Financial USA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Heartland Financial USA wasn't on the list.

While Heartland Financial USA currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.