Lord Abbett & CO. LLC trimmed its holdings in HEICO Co. (NYSE:HEI - Free Report) by 1.7% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 122,540 shares of the aerospace company's stock after selling 2,058 shares during the quarter. Lord Abbett & CO. LLC owned about 0.09% of HEICO worth $32,042,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

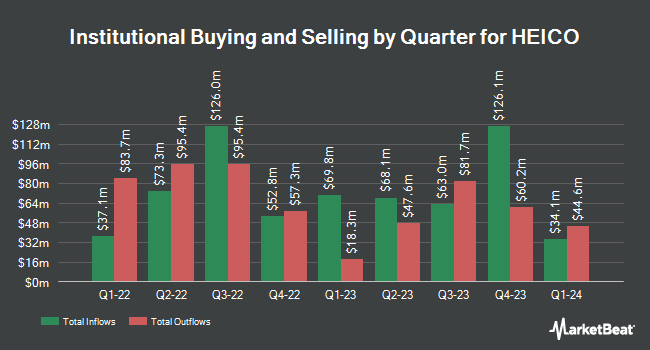

Several other institutional investors and hedge funds also recently made changes to their positions in the business. MONECO Advisors LLC acquired a new stake in shares of HEICO during the 2nd quarter worth approximately $203,000. Hennion & Walsh Asset Management Inc. raised its holdings in shares of HEICO by 52.0% during the second quarter. Hennion & Walsh Asset Management Inc. now owns 2,444 shares of the aerospace company's stock valued at $547,000 after purchasing an additional 836 shares during the period. Sanibel Captiva Trust Company Inc. bought a new position in shares of HEICO during the 2nd quarter worth about $206,000. American National Bank acquired a new stake in shares of HEICO in the 2nd quarter valued at about $66,000. Finally, Avalon Capital Management increased its position in HEICO by 3.5% in the 2nd quarter. Avalon Capital Management now owns 3,613 shares of the aerospace company's stock valued at $808,000 after buying an additional 123 shares in the last quarter. Institutional investors own 27.12% of the company's stock.

HEICO Stock Performance

HEI stock traded up $6.13 during mid-day trading on Monday, hitting $263.02. The company had a trading volume of 623,256 shares, compared to its average volume of 387,587. HEICO Co. has a 12 month low of $169.70 and a 12 month high of $283.60. The stock's fifty day moving average price is $262.66 and its two-hundred day moving average price is $247.55. The firm has a market cap of $36.45 billion, a PE ratio of 77.13, a price-to-earnings-growth ratio of 3.14 and a beta of 1.24. The company has a debt-to-equity ratio of 0.63, a quick ratio of 1.47 and a current ratio of 3.30.

Analysts Set New Price Targets

Several equities research analysts have recently commented on HEI shares. Stifel Nicolaus boosted their price objective on HEICO from $250.00 to $280.00 and gave the company a "buy" rating in a report on Tuesday, August 27th. Bank of America raised their target price on HEICO from $250.00 to $285.00 and gave the company a "buy" rating in a report on Thursday, September 19th. Barclays initiated coverage on HEICO in a report on Monday, August 19th. They set an "equal weight" rating and a $250.00 price target for the company. Royal Bank of Canada raised their price objective on HEICO from $250.00 to $272.00 and gave the company an "outperform" rating in a research note on Wednesday, August 28th. Finally, Deutsche Bank Aktiengesellschaft upped their target price on shares of HEICO from $235.00 to $271.00 and gave the stock a "buy" rating in a research note on Wednesday, September 4th. Three equities research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $270.70.

Read Our Latest Stock Analysis on HEICO

Insider Buying and Selling

In related news, CEO Laurans A. Mendelson bought 725 shares of the business's stock in a transaction on Friday, October 18th. The stock was acquired at an average price of $262.94 per share, for a total transaction of $190,631.50. Following the purchase, the chief executive officer now directly owns 929,984 shares in the company, valued at $244,529,992.96. This trade represents a 0.08 % increase in their ownership of the stock. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Victor H. Mendelson purchased 726 shares of the stock in a transaction dated Friday, October 18th. The stock was purchased at an average cost of $262.94 per share, for a total transaction of $190,894.44. Following the completion of the acquisition, the insider now owns 1,234,950 shares of the company's stock, valued at approximately $324,717,753. This represents a 0.06 % increase in their position. The disclosure for this purchase can be found here. In the last quarter, insiders have purchased 2,175 shares of company stock valued at $571,895. 8.10% of the stock is owned by company insiders.

HEICO Profile

(

Free Report)

HEICO Corporation, through its subsidiaries, designs, manufactures, and sells aerospace, defense, and electronic related products and services in the United States and internationally. Its Flight Support Group segment provides jet engine and aircraft component replacement parts; thermal insulation blankets and parts; renewable/reusable insulation systems; and specialty components.

See Also

Before you consider HEICO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HEICO wasn't on the list.

While HEICO currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.