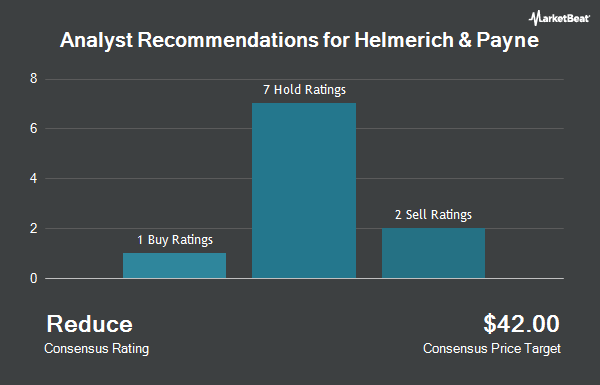

Shares of Helmerich & Payne, Inc. (NYSE:HP - Get Free Report) have been assigned an average recommendation of "Hold" from the ten analysts that are presently covering the stock, Marketbeat.com reports. One investment analyst has rated the stock with a sell recommendation, six have issued a hold recommendation and three have assigned a buy recommendation to the company. The average 1 year target price among brokerages that have covered the stock in the last year is $37.25.

HP has been the subject of several research reports. Benchmark reissued a "hold" rating on shares of Helmerich & Payne in a research report on Thursday, November 21st. Royal Bank of Canada lowered their price target on Helmerich & Payne from $41.00 to $35.00 and set a "sector perform" rating for the company in a report on Friday, February 7th. Argus raised Helmerich & Payne to a "hold" rating in a research note on Tuesday, February 11th. Evercore ISI reaffirmed an "in-line" rating and set a $39.00 target price (down from $48.00) on shares of Helmerich & Payne in a research report on Wednesday, January 15th. Finally, Barclays dropped their price target on Helmerich & Payne from $36.00 to $24.00 and set an "equal weight" rating on the stock in a research report on Wednesday, February 19th.

Get Our Latest Analysis on HP

Helmerich & Payne Trading Down 2.0 %

Shares of HP opened at $24.78 on Friday. The company has a current ratio of 2.81, a quick ratio of 2.52 and a debt-to-equity ratio of 0.60. The company has a market cap of $2.46 billion, a P/E ratio of 8.15, a P/E/G ratio of 3.52 and a beta of 1.42. Helmerich & Payne has a twelve month low of $23.80 and a twelve month high of $44.11. The company's fifty day simple moving average is $30.18 and its 200-day simple moving average is $32.17.

Helmerich & Payne (NYSE:HP - Get Free Report) last released its earnings results on Wednesday, February 5th. The oil and gas company reported $0.71 earnings per share for the quarter, topping analysts' consensus estimates of $0.69 by $0.02. Helmerich & Payne had a return on equity of 11.31% and a net margin of 11.02%. As a group, analysts expect that Helmerich & Payne will post 2.93 EPS for the current year.

Helmerich & Payne Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, May 30th. Investors of record on Thursday, May 15th will be given a dividend of $0.25 per share. This represents a $1.00 dividend on an annualized basis and a yield of 4.04%. The ex-dividend date of this dividend is Thursday, May 15th. Helmerich & Payne's payout ratio is currently 32.89%.

Insider Buying and Selling at Helmerich & Payne

In other Helmerich & Payne news, Director Belgacem Chariag bought 37,356 shares of Helmerich & Payne stock in a transaction that occurred on Monday, February 10th. The shares were bought at an average cost of $27.08 per share, with a total value of $1,011,600.48. Following the transaction, the director now directly owns 54,606 shares of the company's stock, valued at approximately $1,478,730.48. This represents a 216.56 % increase in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO John W. Lindsay purchased 20,000 shares of the firm's stock in a transaction on Monday, February 10th. The stock was acquired at an average price of $27.55 per share, with a total value of $551,000.00. Following the completion of the purchase, the chief executive officer now owns 691,214 shares of the company's stock, valued at $19,042,945.70. The trade was a 2.98 % increase in their position. The disclosure for this purchase can be found here. 4.51% of the stock is owned by insiders.

Hedge Funds Weigh In On Helmerich & Payne

Several hedge funds have recently modified their holdings of the stock. Covestor Ltd grew its position in Helmerich & Payne by 76.9% during the 3rd quarter. Covestor Ltd now owns 1,479 shares of the oil and gas company's stock worth $45,000 after purchasing an additional 643 shares during the last quarter. State of New Jersey Common Pension Fund D grew its holdings in shares of Helmerich & Payne by 18.1% during the third quarter. State of New Jersey Common Pension Fund D now owns 58,634 shares of the oil and gas company's stock valued at $1,784,000 after buying an additional 9,004 shares during the last quarter. Versor Investments LP increased its position in shares of Helmerich & Payne by 56.1% in the 3rd quarter. Versor Investments LP now owns 19,512 shares of the oil and gas company's stock valued at $594,000 after acquiring an additional 7,015 shares during the period. Entropy Technologies LP raised its stake in Helmerich & Payne by 8.9% in the 3rd quarter. Entropy Technologies LP now owns 17,192 shares of the oil and gas company's stock worth $523,000 after acquiring an additional 1,402 shares during the last quarter. Finally, KBC Group NV lifted its position in Helmerich & Payne by 20.3% during the 3rd quarter. KBC Group NV now owns 3,130 shares of the oil and gas company's stock worth $95,000 after acquiring an additional 529 shares during the period. Institutional investors and hedge funds own 96.05% of the company's stock.

About Helmerich & Payne

(

Get Free ReportFounded in 1920, Helmerich & Payne, Inc (H&P) NYSE: HP is committed to delivering industry leading levels of drilling productivity and reliability. H&P operates with the highest level of integrity, safety and innovation to deliver superior results for its customers and returns for shareholders.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Helmerich & Payne, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Helmerich & Payne wasn't on the list.

While Helmerich & Payne currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.