Hennion & Walsh Asset Management Inc. increased its holdings in shares of Costco Wholesale Co. (NASDAQ:COST - Free Report) by 31.4% during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 5,070 shares of the retailer's stock after acquiring an additional 1,213 shares during the period. Hennion & Walsh Asset Management Inc.'s holdings in Costco Wholesale were worth $4,645,000 at the end of the most recent reporting period.

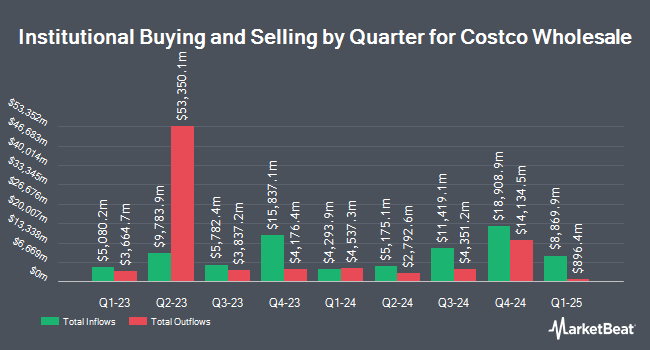

Other hedge funds have also bought and sold shares of the company. Geode Capital Management LLC lifted its stake in shares of Costco Wholesale by 1.7% in the third quarter. Geode Capital Management LLC now owns 9,487,057 shares of the retailer's stock worth $8,380,648,000 after buying an additional 162,191 shares in the last quarter. FMR LLC lifted its stake in shares of Costco Wholesale by 3.6% in the third quarter. FMR LLC now owns 9,308,615 shares of the retailer's stock worth $8,252,274,000 after buying an additional 324,973 shares in the last quarter. International Assets Investment Management LLC lifted its stake in shares of Costco Wholesale by 113,947.9% in the third quarter. International Assets Investment Management LLC now owns 7,370,916 shares of the retailer's stock worth $6,534,464,000 after buying an additional 7,364,453 shares in the last quarter. Legal & General Group Plc lifted its stake in shares of Costco Wholesale by 2.5% in the second quarter. Legal & General Group Plc now owns 3,650,562 shares of the retailer's stock worth $3,102,941,000 after buying an additional 88,550 shares in the last quarter. Finally, Jennison Associates LLC lifted its stake in shares of Costco Wholesale by 3.8% in the third quarter. Jennison Associates LLC now owns 3,399,127 shares of the retailer's stock worth $3,013,394,000 after buying an additional 125,444 shares in the last quarter. Institutional investors own 68.48% of the company's stock.

Costco Wholesale Stock Performance

NASDAQ COST traded up $23.44 on Friday, hitting $943.19. 2,353,178 shares of the company's stock traded hands, compared to its average volume of 1,881,797. The company has a current ratio of 0.98, a quick ratio of 0.43 and a debt-to-equity ratio of 0.23. Costco Wholesale Co. has a 1-year low of $675.96 and a 1-year high of $1,008.25. The firm's 50-day moving average price is $949.84 and its two-hundred day moving average price is $900.50. The firm has a market capitalization of $418.68 billion, a PE ratio of 55.38, a P/E/G ratio of 5.60 and a beta of 0.84.

Insider Buying and Selling at Costco Wholesale

In related news, EVP Richard A. Galanti sold 1,416 shares of the business's stock in a transaction on Thursday, October 24th. The shares were sold at an average price of $894.68, for a total value of $1,266,866.88. Following the completion of the transaction, the executive vice president now directly owns 27,400 shares in the company, valued at $24,514,232. The trade was a 4.91 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Company insiders own 0.18% of the company's stock.

Analysts Set New Price Targets

Several brokerages have recently issued reports on COST. BMO Capital Markets upped their target price on shares of Costco Wholesale from $1,075.00 to $1,175.00 and gave the stock an "outperform" rating in a research note on Friday, December 13th. TD Cowen increased their price objective on shares of Costco Wholesale from $975.00 to $1,090.00 and gave the company a "buy" rating in a research report on Friday, December 13th. Telsey Advisory Group restated an "outperform" rating and set a $1,100.00 price objective on shares of Costco Wholesale in a research report on Thursday, January 9th. DA Davidson increased their price objective on shares of Costco Wholesale from $880.00 to $900.00 and gave the company a "neutral" rating in a research report on Friday, December 13th. Finally, Oppenheimer restated an "outperform" rating and set a $1,075.00 price objective (up previously from $980.00) on shares of Costco Wholesale in a research report on Tuesday, December 10th. Nine research analysts have rated the stock with a hold rating and nineteen have issued a buy rating to the company. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $1,013.59.

Read Our Latest Report on Costco Wholesale

About Costco Wholesale

(

Free Report)

Costco Wholesale Corporation, together with its subsidiaries, engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden. The company offers branded and private-label products in a range of merchandise categories.

Featured Articles

Before you consider Costco Wholesale, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Costco Wholesale wasn't on the list.

While Costco Wholesale currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.