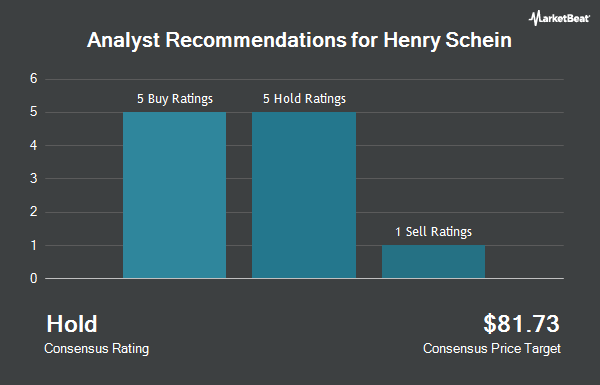

Henry Schein, Inc. (NASDAQ:HSIC - Get Free Report) has been assigned an average recommendation of "Moderate Buy" from the eleven brokerages that are presently covering the firm, Marketbeat Ratings reports. Six research analysts have rated the stock with a hold rating, four have given a buy rating and one has given a strong buy rating to the company. The average 12 month price objective among brokers that have issued ratings on the stock in the last year is $78.89.

HSIC has been the topic of a number of recent analyst reports. Mizuho initiated coverage on shares of Henry Schein in a research note on Wednesday, December 4th. They issued a "neutral" rating and a $75.00 target price on the stock. Barrington Research restated an "outperform" rating and set a $82.00 price objective on shares of Henry Schein in a research note on Wednesday, November 6th. StockNews.com upgraded Henry Schein from a "sell" rating to a "hold" rating in a research report on Thursday, November 7th. Finally, Evercore ISI upped their price target on Henry Schein from $70.00 to $74.00 and gave the company an "in-line" rating in a research report on Tuesday, October 8th.

Get Our Latest Report on Henry Schein

Henry Schein Stock Down 2.6 %

Henry Schein stock traded down $1.96 during midday trading on Tuesday, hitting $73.18. 1,507,179 shares of the company were exchanged, compared to its average volume of 1,406,688. The company has a market cap of $9.12 billion, a PE ratio of 30.12, a price-to-earnings-growth ratio of 2.31 and a beta of 0.87. Henry Schein has a fifty-two week low of $63.67 and a fifty-two week high of $82.63. The company's fifty day moving average price is $72.36 and its 200-day moving average price is $70.10. The company has a debt-to-equity ratio of 0.46, a current ratio of 1.42 and a quick ratio of 0.82.

Henry Schein (NASDAQ:HSIC - Get Free Report) last released its quarterly earnings results on Tuesday, November 5th. The company reported $1.22 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.17 by $0.05. Henry Schein had a net margin of 2.51% and a return on equity of 12.90%. The firm had revenue of $3.17 billion for the quarter, compared to the consensus estimate of $3.24 billion. During the same quarter in the previous year, the firm posted $1.32 EPS. The firm's quarterly revenue was up .4% on a year-over-year basis. On average, research analysts predict that Henry Schein will post 4.78 EPS for the current fiscal year.

Insider Buying and Selling at Henry Schein

In other Henry Schein news, COO Michael S. Ettinger sold 12,240 shares of the company's stock in a transaction dated Monday, November 18th. The shares were sold at an average price of $75.00, for a total value of $918,000.00. Following the completion of the sale, the chief operating officer now directly owns 87,706 shares of the company's stock, valued at approximately $6,577,950. This represents a 12.25 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. 1.14% of the stock is owned by company insiders.

Institutional Investors Weigh In On Henry Schein

Institutional investors and hedge funds have recently modified their holdings of the stock. ING Groep NV purchased a new stake in shares of Henry Schein in the 3rd quarter valued at approximately $63,226,000. Holocene Advisors LP purchased a new stake in shares of Henry Schein in the third quarter valued at $58,319,000. Thompson Siegel & Walmsley LLC acquired a new stake in shares of Henry Schein in the second quarter worth $46,683,000. Healthcare of Ontario Pension Plan Trust Fund purchased a new position in Henry Schein during the 3rd quarter valued at about $43,740,000. Finally, Southpoint Capital Advisors LP increased its holdings in shares of Henry Schein by 30.0% in the 3rd quarter. Southpoint Capital Advisors LP now owns 2,600,000 shares of the company's stock valued at $189,540,000 after purchasing an additional 600,000 shares during the period. Institutional investors and hedge funds own 96.62% of the company's stock.

Henry Schein Company Profile

(

Get Free ReportHenry Schein, Inc provides health care products and services to dental practitioners, laboratories, physician practices, and ambulatory surgery centers, government, institutional health care clinics, and other alternate care clinics worldwide. It operates through two segments, Health Care Distribution, and Technology and Value-Added Services.

Recommended Stories

Before you consider Henry Schein, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Henry Schein wasn't on the list.

While Henry Schein currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.