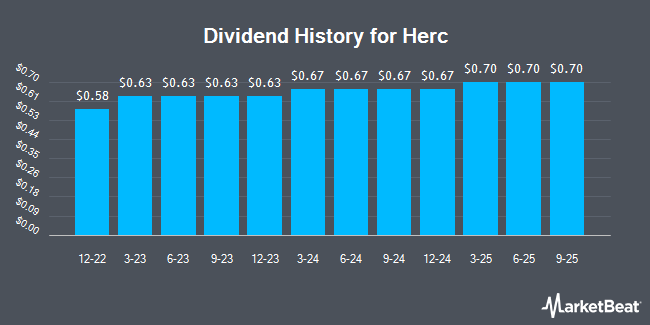

Herc Holdings Inc. (NYSE:HRI - Get Free Report) announced a quarterly dividend on Friday, December 6th,RTT News reports. Stockholders of record on Monday, December 16th will be paid a dividend of 0.665 per share by the transportation company on Friday, December 27th. This represents a $2.66 annualized dividend and a dividend yield of 1.16%.

Herc has a payout ratio of 17.9% meaning its dividend is sufficiently covered by earnings. Equities analysts expect Herc to earn $15.81 per share next year, which means the company should continue to be able to cover its $2.66 annual dividend with an expected future payout ratio of 16.8%.

Herc Stock Up 0.7 %

Shares of HRI stock traded up $1.52 during trading hours on Friday, reaching $230.14. The company had a trading volume of 152,458 shares, compared to its average volume of 251,568. The company has a market capitalization of $6.54 billion, a P/E ratio of 18.82, a price-to-earnings-growth ratio of 1.31 and a beta of 2.02. The stock's fifty day simple moving average is $202.77 and its 200 day simple moving average is $161.86. Herc has a twelve month low of $119.98 and a twelve month high of $246.88. The company has a debt-to-equity ratio of 2.89, a quick ratio of 1.22 and a current ratio of 1.22.

Herc (NYSE:HRI - Get Free Report) last released its earnings results on Tuesday, October 22nd. The transportation company reported $4.35 EPS for the quarter, missing analysts' consensus estimates of $4.48 by ($0.13). The firm had revenue of $965.00 million for the quarter, compared to the consensus estimate of $931.33 million. Herc had a return on equity of 26.35% and a net margin of 10.09%. The company's quarterly revenue was up 6.3% on a year-over-year basis. During the same period in the prior year, the business earned $4.00 EPS. As a group, sell-side analysts expect that Herc will post 13.59 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Several analysts have issued reports on the stock. The Goldman Sachs Group boosted their target price on shares of Herc from $178.00 to $204.00 and gave the company a "buy" rating in a research note on Wednesday, October 23rd. JPMorgan Chase & Co. raised their price objective on Herc from $200.00 to $240.00 and gave the company a "neutral" rating in a research note on Wednesday, October 23rd. Finally, Barclays upped their price target on shares of Herc from $175.00 to $250.00 and gave the company an "overweight" rating in a report on Wednesday, October 23rd. Three research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Hold" and an average price target of $212.25.

Check Out Our Latest Research Report on HRI

Insider Activity

In other news, SVP Samuel Wade Sheek sold 5,000 shares of the business's stock in a transaction that occurred on Tuesday, October 29th. The stock was sold at an average price of $213.12, for a total transaction of $1,065,600.00. Following the completion of the sale, the senior vice president now owns 21,586 shares in the company, valued at $4,600,408.32. The trade was a 18.81 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, Director Michael A. Kelly sold 3,880 shares of the company's stock in a transaction dated Thursday, October 24th. The stock was sold at an average price of $208.83, for a total transaction of $810,260.40. Following the completion of the sale, the director now owns 13,774 shares in the company, valued at $2,876,424.42. This represents a 21.98 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 1.80% of the company's stock.

About Herc

(

Get Free Report)

Herc Holdings Inc, together with its subsidiaries, operates as an equipment rental supplier. It rents aerial, earthmoving, material handling, trucks and trailers, air compressors, compaction, and lighting equipment, as well as generators, and safety supplies and expendables; and provides ProSolutions, an industry specific solution based services, such as pumping solutions, power generation, climate control, remediation and restoration, and studio and production equipment.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Herc, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Herc wasn't on the list.

While Herc currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.