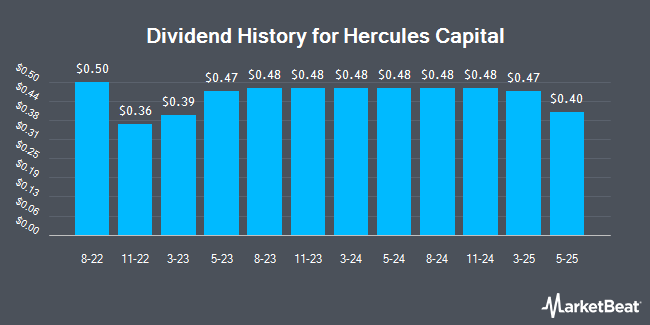

Hercules Capital, Inc. (NYSE:HTGC - Get Free Report) announced a quarterly dividend on Tuesday, February 11th,RTT News reports. Stockholders of record on Wednesday, February 26th will be paid a dividend of 0.47 per share by the financial services provider on Wednesday, March 5th. This represents a $1.88 dividend on an annualized basis and a dividend yield of 8.84%. The ex-dividend date is Wednesday, February 26th.

Hercules Capital has raised its dividend by an average of 14.4% per year over the last three years. Hercules Capital has a payout ratio of 81.2% meaning its dividend is currently covered by earnings, but may not be in the future if the company's earnings tumble. Research analysts expect Hercules Capital to earn $1.99 per share next year, which means the company should continue to be able to cover its $1.60 annual dividend with an expected future payout ratio of 80.4%.

Hercules Capital Stock Performance

Hercules Capital stock traded up $0.21 during mid-day trading on Friday, reaching $21.26. 1,585,275 shares of the company traded hands, compared to its average volume of 890,631. The company has a market capitalization of $3.45 billion, a price-to-earnings ratio of 10.52 and a beta of 1.35. The company has a debt-to-equity ratio of 0.94, a current ratio of 1.61 and a quick ratio of 1.61. The firm's fifty day moving average is $20.20 and its two-hundred day moving average is $19.62. Hercules Capital has a fifty-two week low of $16.95 and a fifty-two week high of $21.78.

Hercules Capital (NYSE:HTGC - Get Free Report) last posted its quarterly earnings results on Thursday, February 13th. The financial services provider reported $0.49 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.49. Hercules Capital had a net margin of 65.07% and a return on equity of 17.88%. On average, equities research analysts expect that Hercules Capital will post 2.01 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several research firms recently issued reports on HTGC. Keefe, Bruyette & Woods upgraded shares of Hercules Capital from a "market perform" rating to an "outperform" rating and boosted their target price for the company from $19.50 to $21.50 in a research note on Thursday, December 12th. JMP Securities reiterated a "market outperform" rating and issued a $22.00 price objective on shares of Hercules Capital in a report on Friday. Finally, Wells Fargo & Company upped their target price on shares of Hercules Capital from $20.00 to $21.00 and gave the stock an "overweight" rating in a report on Tuesday, October 29th.

Check Out Our Latest Stock Report on Hercules Capital

Hercules Capital Company Profile

(

Get Free Report)

Hercules Capital, Inc is a business development company. The firm specializing in providing venture debt, debt, senior secured loans, and growth capital to privately held venture capital-backed companies at all stages of development from startups to expansion stage including select publicly listed companies and select special opportunity lower middle market companies that require additional capital to fund acquisitions, recapitalizations and refinancing and established-stage companies.

Further Reading

Before you consider Hercules Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hercules Capital wasn't on the list.

While Hercules Capital currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.