Keefe, Bruyette & Woods upgraded shares of Hercules Capital (NYSE:HTGC - Free Report) from a market perform rating to an outperform rating in a research report report published on Thursday morning, Marketbeat.com reports. They currently have $21.50 price target on the financial services provider's stock, up from their previous price target of $19.50.

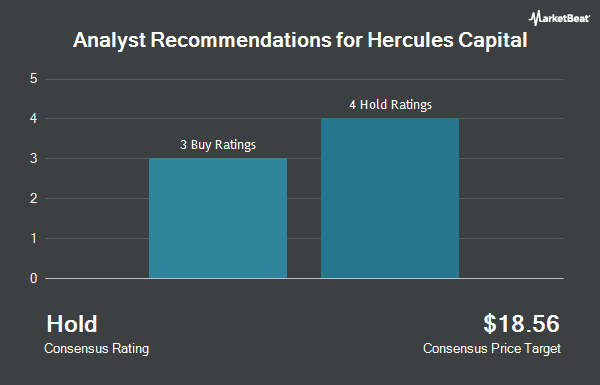

A number of other equities research analysts also recently weighed in on the stock. Wells Fargo & Company boosted their price objective on shares of Hercules Capital from $20.00 to $21.00 and gave the company an "overweight" rating in a research report on Tuesday, October 29th. JMP Securities reiterated a "market outperform" rating and set a $22.00 price target on shares of Hercules Capital in a research report on Friday, December 6th. One investment analyst has rated the stock with a hold rating and four have given a buy rating to the company. According to MarketBeat.com, Hercules Capital presently has a consensus rating of "Moderate Buy" and an average price target of $20.90.

Get Our Latest Report on Hercules Capital

Hercules Capital Stock Up 0.2 %

Hercules Capital stock traded up $0.04 during midday trading on Thursday, hitting $19.44. The stock had a trading volume of 1,860,600 shares, compared to its average volume of 949,143. The company has a current ratio of 1.61, a quick ratio of 1.61 and a debt-to-equity ratio of 0.94. The business has a fifty day moving average price of $19.51 and a 200 day moving average price of $19.65. Hercules Capital has a 12 month low of $15.32 and a 12 month high of $21.78. The stock has a market cap of $3.16 billion, a P/E ratio of 9.60 and a beta of 1.36.

Hercules Capital (NYSE:HTGC - Get Free Report) last posted its quarterly earnings results on Wednesday, October 30th. The financial services provider reported $0.51 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.51. The business had revenue of $125.25 million for the quarter, compared to analyst estimates of $125.80 million. Hercules Capital had a return on equity of 17.88% and a net margin of 65.07%. During the same period in the prior year, the company posted $0.52 EPS. Research analysts predict that Hercules Capital will post 2.01 EPS for the current year.

Hercules Capital Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Wednesday, November 20th. Stockholders of record on Wednesday, November 13th were issued a dividend of $0.48 per share. The ex-dividend date of this dividend was Wednesday, November 13th. This represents a $1.92 dividend on an annualized basis and a dividend yield of 9.88%. Hercules Capital's dividend payout ratio (DPR) is presently 79.21%.

Insider Transactions at Hercules Capital

In other Hercules Capital news, CEO Scott Bluestein sold 100,000 shares of the firm's stock in a transaction dated Thursday, September 26th. The shares were sold at an average price of $19.59, for a total transaction of $1,959,000.00. Following the transaction, the chief executive officer now owns 2,161,207 shares of the company's stock, valued at approximately $42,338,045.13. This trade represents a 4.42 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Insiders own 1.90% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently made changes to their positions in HTGC. HHM Wealth Advisors LLC bought a new position in Hercules Capital during the second quarter valued at about $31,000. Kathleen S. Wright Associates Inc. acquired a new stake in Hercules Capital in the 3rd quarter valued at about $31,000. Farther Finance Advisors LLC boosted its position in shares of Hercules Capital by 59,650.0% during the 3rd quarter. Farther Finance Advisors LLC now owns 2,390 shares of the financial services provider's stock valued at $47,000 after purchasing an additional 2,386 shares in the last quarter. Strategic Financial Concepts LLC grew its stake in shares of Hercules Capital by 2,067.0% in the 2nd quarter. Strategic Financial Concepts LLC now owns 353,221 shares of the financial services provider's stock worth $72,000 after purchasing an additional 336,921 shares during the last quarter. Finally, Nomura Asset Management Co. Ltd. raised its holdings in shares of Hercules Capital by 45.6% in the 3rd quarter. Nomura Asset Management Co. Ltd. now owns 4,086 shares of the financial services provider's stock worth $80,000 after purchasing an additional 1,279 shares in the last quarter. 19.69% of the stock is currently owned by institutional investors.

About Hercules Capital

(

Get Free Report)

Hercules Capital, Inc is a business development company. The firm specializing in providing venture debt, debt, senior secured loans, and growth capital to privately held venture capital-backed companies at all stages of development from startups to expansion stage including select publicly listed companies and select special opportunity lower middle market companies that require additional capital to fund acquisitions, recapitalizations and refinancing and established-stage companies.

Further Reading

Before you consider Hercules Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hercules Capital wasn't on the list.

While Hercules Capital currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.