Invesco Ltd. lifted its holdings in shares of Heritage Insurance Holdings, Inc. (NYSE:HRTG - Free Report) by 24.0% in the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 944,639 shares of the insurance provider's stock after buying an additional 182,624 shares during the period. Invesco Ltd. owned 3.08% of Heritage Insurance worth $11,430,000 at the end of the most recent reporting period.

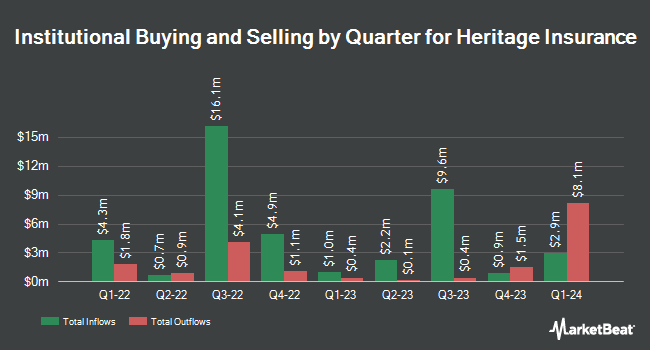

Several other institutional investors and hedge funds have also recently bought and sold shares of HRTG. New York State Common Retirement Fund grew its position in shares of Heritage Insurance by 222.2% during the fourth quarter. New York State Common Retirement Fund now owns 2,900 shares of the insurance provider's stock worth $35,000 after acquiring an additional 2,000 shares during the last quarter. Wells Fargo & Company MN increased its stake in shares of Heritage Insurance by 18.1% in the fourth quarter. Wells Fargo & Company MN now owns 13,419 shares of the insurance provider's stock valued at $162,000 after purchasing an additional 2,058 shares during the period. Brandywine Global Investment Management LLC increased its stake in shares of Heritage Insurance by 21.7% in the fourth quarter. Brandywine Global Investment Management LLC now owns 12,400 shares of the insurance provider's stock valued at $150,000 after purchasing an additional 2,210 shares during the period. Charles Schwab Investment Management Inc. raised its holdings in shares of Heritage Insurance by 4.4% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 66,874 shares of the insurance provider's stock valued at $809,000 after buying an additional 2,808 shares during the last quarter. Finally, Trexquant Investment LP boosted its position in shares of Heritage Insurance by 3.0% during the fourth quarter. Trexquant Investment LP now owns 146,569 shares of the insurance provider's stock worth $1,773,000 after buying an additional 4,224 shares during the period. Institutional investors and hedge funds own 59.03% of the company's stock.

Heritage Insurance Stock Up 3.4 %

Heritage Insurance stock opened at $19.35 on Wednesday. Heritage Insurance Holdings, Inc. has a 52 week low of $6.14 and a 52 week high of $19.90. The stock has a market cap of $828.87 million, a price-to-earnings ratio of 7.74 and a beta of 0.93. The company's 50-day moving average price is $13.96 and its two-hundred day moving average price is $12.36. The company has a current ratio of 0.76, a quick ratio of 0.76 and a debt-to-equity ratio of 0.42.

Heritage Insurance (NYSE:HRTG - Get Free Report) last announced its earnings results on Tuesday, March 11th. The insurance provider reported $0.66 EPS for the quarter, topping the consensus estimate of ($0.17) by $0.83. The firm had revenue of $210.26 million for the quarter, compared to analysts' expectations of $199.87 million. Heritage Insurance had a return on equity of 29.17% and a net margin of 9.10%. On average, analysts expect that Heritage Insurance Holdings, Inc. will post 1.86 EPS for the current fiscal year.

Insider Activity at Heritage Insurance

In other Heritage Insurance news, CEO Ernie J. Garateix bought 5,000 shares of the business's stock in a transaction that occurred on Friday, March 14th. The stock was acquired at an average cost of $12.77 per share, with a total value of $63,850.00. Following the completion of the purchase, the chief executive officer now directly owns 1,270,808 shares in the company, valued at approximately $16,228,218.16. This trade represents a 0.40 % increase in their ownership of the stock. The purchase was disclosed in a filing with the SEC, which is available through this link. Also, CFO Kirk Lusk purchased 6,000 shares of the firm's stock in a transaction on Friday, March 14th. The stock was acquired at an average price of $13.85 per share, for a total transaction of $83,100.00. Following the transaction, the chief financial officer now owns 618,756 shares of the company's stock, valued at $8,569,770.60. The trade was a 0.98 % increase in their position. The disclosure for this purchase can be found here. Insiders bought 21,000 shares of company stock valued at $280,450 over the last 90 days. 14.00% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

Separately, StockNews.com downgraded Heritage Insurance from a "strong-buy" rating to a "buy" rating in a research note on Tuesday, March 18th.

Check Out Our Latest Analysis on Heritage Insurance

Heritage Insurance Profile

(

Free Report)

Heritage Insurance Holdings, Inc, through its subsidiaries, provides personal and commercial residential insurance products. The company offers personal residential insurance in Alabama, California, Connecticut, Delaware, Florida, Georgia, Hawaii, Maryland, Massachusetts, Mississippi, New Jersey, New York, North Carolina, Rhode Island, South Carolina, and Virginia; commercial residential insurance for properties in Florida, New Jersey, and New York; and licensed in the state of Pennsylvania, as well as personal residential and wind-only property insurance.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Heritage Insurance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Heritage Insurance wasn't on the list.

While Heritage Insurance currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.