Heritage Oak Wealth Advisors LLC bought a new stake in Humana Inc. (NYSE:HUM - Free Report) during the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm bought 9,232 shares of the insurance provider's stock, valued at approximately $2,342,000. Humana comprises about 1.1% of Heritage Oak Wealth Advisors LLC's holdings, making the stock its 18th biggest position.

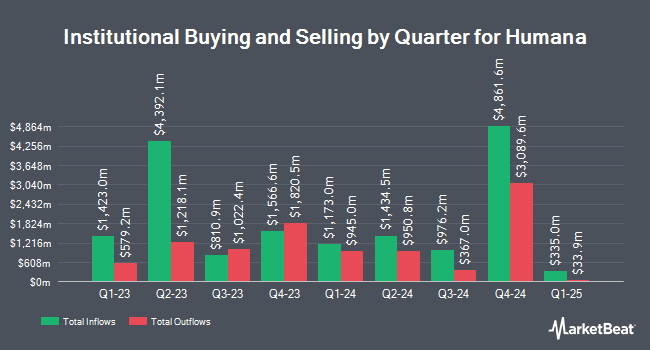

Several other institutional investors also recently added to or reduced their stakes in HUM. Creative Financial Designs Inc. ADV raised its position in shares of Humana by 244.0% during the third quarter. Creative Financial Designs Inc. ADV now owns 86 shares of the insurance provider's stock valued at $27,000 after buying an additional 61 shares during the last quarter. FPC Investment Advisory Inc. bought a new position in Humana during the fourth quarter valued at about $27,000. Centricity Wealth Management LLC acquired a new position in Humana in the 4th quarter valued at approximately $30,000. Ashton Thomas Securities LLC acquired a new position in Humana in the 3rd quarter valued at approximately $31,000. Finally, Your Advocates Ltd. LLP lifted its position in shares of Humana by 81.8% in the 3rd quarter. Your Advocates Ltd. LLP now owns 100 shares of the insurance provider's stock worth $32,000 after acquiring an additional 45 shares during the period. 92.38% of the stock is owned by institutional investors.

Analyst Ratings Changes

A number of brokerages recently commented on HUM. Piper Sandler upped their target price on Humana from $270.00 to $288.00 and gave the company a "neutral" rating in a research note on Wednesday, January 15th. Bank of America upgraded shares of Humana from an "underperform" rating to a "neutral" rating and increased their price objective for the company from $247.00 to $308.00 in a research note on Wednesday, November 6th. StockNews.com upgraded shares of Humana from a "hold" rating to a "buy" rating in a research report on Tuesday, February 25th. Morgan Stanley dropped their price target on shares of Humana from $301.00 to $285.00 and set an "equal weight" rating for the company in a research report on Wednesday, February 12th. Finally, Wells Fargo & Company decreased their price objective on Humana from $387.00 to $290.00 and set an "overweight" rating on the stock in a report on Monday, November 4th. Nineteen equities research analysts have rated the stock with a hold rating and six have assigned a buy rating to the company. According to MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $285.68.

Read Our Latest Research Report on Humana

Insider Buying and Selling at Humana

In other Humana news, insider Timothy S. Huval sold 3,703 shares of the company's stock in a transaction that occurred on Tuesday, December 31st. The shares were sold at an average price of $256.26, for a total value of $948,930.78. Following the completion of the sale, the insider now owns 8,181 shares of the company's stock, valued at approximately $2,096,463.06. This represents a 31.16 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders own 0.32% of the company's stock.

Humana Trading Down 3.2 %

HUM stock traded down $8.77 during midday trading on Monday, reaching $261.65. The stock had a trading volume of 1,561,123 shares, compared to its average volume of 1,707,235. The firm has a market cap of $31.57 billion, a price-to-earnings ratio of 26.30, a PEG ratio of 2.05 and a beta of 0.56. Humana Inc. has a twelve month low of $213.31 and a twelve month high of $406.46. The company has a quick ratio of 1.76, a current ratio of 1.76 and a debt-to-equity ratio of 0.68. The business has a fifty day simple moving average of $271.11 and a two-hundred day simple moving average of $286.36.

Humana (NYSE:HUM - Get Free Report) last issued its quarterly earnings results on Tuesday, February 11th. The insurance provider reported ($2.16) EPS for the quarter, topping the consensus estimate of ($2.26) by $0.10. Humana had a net margin of 1.02% and a return on equity of 11.70%. As a group, research analysts expect that Humana Inc. will post 16.47 EPS for the current fiscal year.

Humana Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, April 25th. Investors of record on Friday, March 28th will be paid a dividend of $0.885 per share. The ex-dividend date of this dividend is Friday, March 28th. This represents a $3.54 dividend on an annualized basis and a dividend yield of 1.35%. Humana's dividend payout ratio (DPR) is presently 35.58%.

Humana Profile

(

Free Report)

Humana Inc, together with its subsidiaries, provides medical and specialty insurance products in the United States. It operates through two segments, Insurance and CenterWell. The company offers medical and supplemental benefit plans to individuals. It has a contract with Centers for Medicare and Medicaid Services to administer the Limited Income Newly Eligible Transition prescription drug plan program; and contracts with various states to provide Medicaid, dual eligible, and long-term support services benefits.

See Also

Before you consider Humana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Humana wasn't on the list.

While Humana currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.