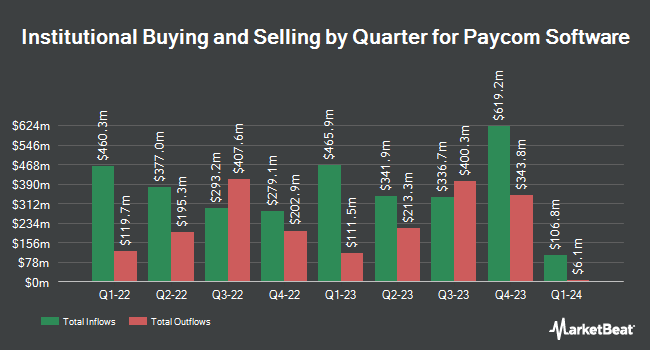

Heritage Trust Co bought a new stake in shares of Paycom Software, Inc. (NYSE:PAYC - Free Report) in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm bought 25,433 shares of the software maker's stock, valued at approximately $5,213,000.

Other institutional investors also recently bought and sold shares of the company. Murphy & Mullick Capital Management Corp acquired a new stake in Paycom Software in the fourth quarter valued at approximately $30,000. IFP Advisors Inc lifted its position in shares of Paycom Software by 635.7% during the 4th quarter. IFP Advisors Inc now owns 206 shares of the software maker's stock worth $43,000 after purchasing an additional 178 shares during the last quarter. Blue Trust Inc. grew its stake in shares of Paycom Software by 33.3% during the fourth quarter. Blue Trust Inc. now owns 352 shares of the software maker's stock worth $72,000 after purchasing an additional 88 shares in the last quarter. Wilmington Savings Fund Society FSB acquired a new stake in Paycom Software in the third quarter valued at $79,000. Finally, Huntington National Bank lifted its holdings in Paycom Software by 46.5% during the 4th quarter. Huntington National Bank now owns 551 shares of the software maker's stock worth $113,000 after buying an additional 175 shares during the last quarter. 87.77% of the stock is owned by institutional investors and hedge funds.

Paycom Software Price Performance

Shares of NYSE:PAYC traded down $3.11 during trading on Wednesday, reaching $216.18. The company had a trading volume of 124,489 shares, compared to its average volume of 719,442. The stock's fifty day moving average price is $213.23 and its 200 day moving average price is $207.37. Paycom Software, Inc. has a fifty-two week low of $139.50 and a fifty-two week high of $242.74. The firm has a market capitalization of $12.51 billion, a price-to-earnings ratio of 24.29, a price-to-earnings-growth ratio of 2.40 and a beta of 0.97.

Paycom Software (NYSE:PAYC - Get Free Report) last announced its quarterly earnings data on Wednesday, February 12th. The software maker reported $2.02 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.99 by $0.03. Paycom Software had a net margin of 26.66% and a return on equity of 33.53%. On average, equities analysts anticipate that Paycom Software, Inc. will post 7.15 EPS for the current fiscal year.

Paycom Software Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Monday, March 24th. Shareholders of record on Monday, March 10th were given a dividend of $0.375 per share. This represents a $1.50 annualized dividend and a yield of 0.69%. The ex-dividend date of this dividend was Monday, March 10th. Paycom Software's payout ratio is 16.85%.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently weighed in on PAYC shares. KeyCorp raised Paycom Software from a "sector weight" rating to an "overweight" rating and set a $245.00 target price on the stock in a research report on Monday, March 10th. Needham & Company LLC reissued a "hold" rating on shares of Paycom Software in a report on Thursday, February 13th. Piper Sandler upped their target price on shares of Paycom Software from $191.00 to $224.00 and gave the company a "neutral" rating in a report on Friday, February 14th. StockNews.com lowered shares of Paycom Software from a "buy" rating to a "hold" rating in a research note on Tuesday, March 4th. Finally, JPMorgan Chase & Co. upped their price objective on shares of Paycom Software from $185.00 to $200.00 and gave the company a "neutral" rating in a research note on Thursday, February 13th. Twelve analysts have rated the stock with a hold rating and one has assigned a buy rating to the company. According to data from MarketBeat.com, Paycom Software currently has an average rating of "Hold" and a consensus target price of $212.80.

Get Our Latest Stock Report on PAYC

Insider Activity at Paycom Software

In other Paycom Software news, COO Randall Peck sold 3,600 shares of the company's stock in a transaction dated Friday, February 21st. The shares were sold at an average price of $212.19, for a total transaction of $763,884.00. Following the transaction, the chief operating officer now directly owns 50,665 shares in the company, valued at approximately $10,750,606.35. This represents a 6.63 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, insider Bradley Scott Smith sold 3,000 shares of Paycom Software stock in a transaction that occurred on Thursday, March 13th. The shares were sold at an average price of $201.01, for a total transaction of $603,030.00. Following the sale, the insider now owns 28,733 shares of the company's stock, valued at approximately $5,775,620.33. The trade was a 9.45 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 7,100 shares of company stock worth $1,476,024 over the last three months. 14.50% of the stock is currently owned by corporate insiders.

Paycom Software Profile

(

Free Report)

Paycom Software, Inc provides cloud-based human capital management (HCM) solution delivered as software-as-a-service for small to mid-sized companies in the United States. It offers functionality and data analytics that businesses need to manage the employment life cycle from recruitment to retirement.

See Also

Before you consider Paycom Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paycom Software wasn't on the list.

While Paycom Software currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.