Heritage Wealth Advisors lifted its holdings in shares of NewMarket Co. (NYSE:NEU - Free Report) by 78.4% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 1,340 shares of the specialty chemicals company's stock after buying an additional 589 shares during the quarter. Heritage Wealth Advisors' holdings in NewMarket were worth $708,000 at the end of the most recent quarter.

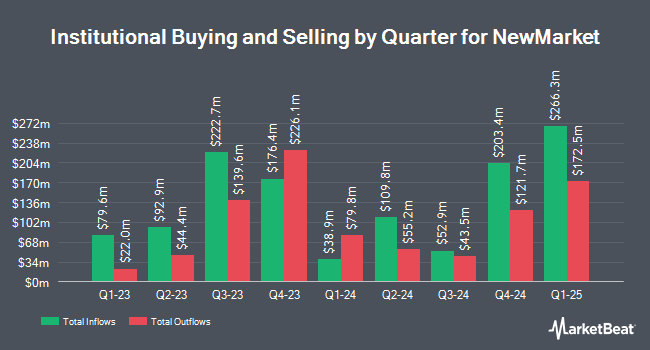

Several other institutional investors and hedge funds also recently bought and sold shares of the business. Eagle Bay Advisors LLC purchased a new position in shares of NewMarket in the fourth quarter valued at $40,000. Centricity Wealth Management LLC purchased a new position in NewMarket during the 4th quarter valued at about $56,000. Blue Trust Inc. increased its position in shares of NewMarket by 55.3% during the fourth quarter. Blue Trust Inc. now owns 118 shares of the specialty chemicals company's stock valued at $65,000 after buying an additional 42 shares during the period. Kohmann Bosshard Financial Services LLC bought a new stake in NewMarket during the 4th quarter worth approximately $74,000. Finally, Steward Partners Investment Advisory LLC grew its position in shares of NewMarket by 481.5% during the 4th quarter. Steward Partners Investment Advisory LLC now owns 157 shares of the specialty chemicals company's stock valued at $83,000 after purchasing an additional 130 shares in the last quarter. 61.09% of the stock is owned by institutional investors.

NewMarket Price Performance

Shares of NEU traded down $6.34 during midday trading on Friday, reaching $552.19. The stock had a trading volume of 36,138 shares, compared to its average volume of 35,919. The company has a market capitalization of $5.24 billion, a price-to-earnings ratio of 11.45 and a beta of 0.41. The company has a current ratio of 2.75, a quick ratio of 1.40 and a debt-to-equity ratio of 0.66. NewMarket Co. has a 12-month low of $480.00 and a 12-month high of $637.40. The company's 50-day moving average is $532.52 and its 200 day moving average is $532.96.

NewMarket (NYSE:NEU - Get Free Report) last announced its quarterly earnings data on Monday, February 3rd. The specialty chemicals company reported $11.56 earnings per share (EPS) for the quarter. NewMarket had a net margin of 16.59% and a return on equity of 35.48%.

NewMarket Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, April 1st. Investors of record on Monday, March 17th will be given a dividend of $2.75 per share. This represents a $11.00 annualized dividend and a yield of 1.99%. This is a positive change from NewMarket's previous quarterly dividend of $2.50. The ex-dividend date is Monday, March 17th. NewMarket's dividend payout ratio (DPR) is presently 22.82%.

Analyst Ratings Changes

Separately, StockNews.com cut NewMarket from a "strong-buy" rating to a "buy" rating in a report on Wednesday, February 19th.

Check Out Our Latest Research Report on NEU

NewMarket Profile

(

Free Report)

NewMarket Corporation, through its subsidiaries, primarily engages in the manufacture and sale of petroleum additives. The company offers lubricant additives for use in various vehicle and industrial applications, including engine oils, transmission fluids, off-road powertrain and hydraulic systems, gear oils, hydraulic oils, turbine oils, and other applications where metal-to-metal moving parts are utilized; engine oil additives designed for passenger cars, motorcycles, on and off-road heavy duty commercial equipment, locomotives, and engines in ocean-going vessels; driveline additives designed for products, such as transmission fluids, axle fluids, and off-road powertrain fluids; and industrial additives designed for products for industrial applications consisting of hydraulic fluids, grease, industrial gear fluids, and industrial specialty applications, such as turbine oils.

Read More

Before you consider NewMarket, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NewMarket wasn't on the list.

While NewMarket currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.