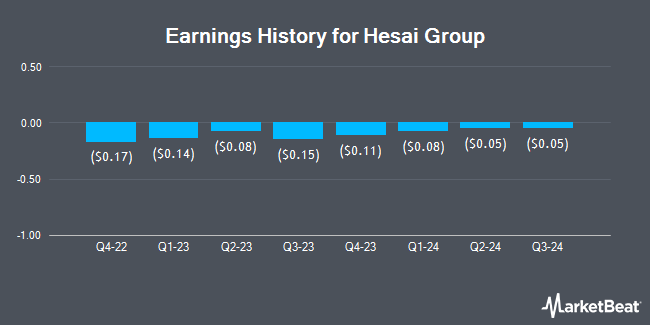

Hesai Group (NASDAQ:HSAI - Get Free Report) posted its quarterly earnings results on Monday. The company reported $0.15 EPS for the quarter, missing the consensus estimate of $1.42 by ($1.27), Zacks reports. Hesai Group had a negative net margin of 20.31% and a negative return on equity of 6.79%. The business had revenue of $98.58 million during the quarter, compared to analyst estimates of $723.60 million. Hesai Group updated its FY 2025 guidance to EPS and its Q1 2025 guidance to EPS.

Hesai Group Trading Down 4.1 %

HSAI traded down $0.85 during midday trading on Friday, hitting $19.71. The company's stock had a trading volume of 5,367,165 shares, compared to its average volume of 3,969,144. The company has a current ratio of 3.08, a quick ratio of 2.65 and a debt-to-equity ratio of 0.08. The firm has a market cap of $2.50 billion, a P/E ratio of -44.80, a PEG ratio of 1.44 and a beta of 1.07. Hesai Group has a 52-week low of $3.52 and a 52-week high of $24.18. The firm has a 50-day moving average price of $16.59 and a two-hundred day moving average price of $9.97.

Analysts Set New Price Targets

Several equities analysts recently weighed in on HSAI shares. The Goldman Sachs Group raised Hesai Group from a "neutral" rating to a "buy" rating and raised their price objective for the company from $5.50 to $18.40 in a research note on Tuesday, January 14th. Morgan Stanley downgraded shares of Hesai Group from an "overweight" rating to an "equal weight" rating and upped their price target for the company from $5.80 to $15.00 in a report on Monday, January 13th. Finally, Daiwa Capital Markets initiated coverage on Hesai Group in a research report on Tuesday. They set a "buy" rating and a $35.00 price objective for the company.

Get Our Latest Analysis on HSAI

About Hesai Group

(

Get Free Report)

Hesai Group, through with its subsidiaries, engages in the development, manufacture, and sale of three-dimensional light detection and ranging solutions (LiDAR). Its LiDAR products are used in passenger and commercial vehicles with advanced driver assistance systems; autonomous passenger and freight mobility services; and other applications, such as delivery robots, street sweeping robots, and logistics robots in restricted areas.

Read More

Before you consider Hesai Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hesai Group wasn't on the list.

While Hesai Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.