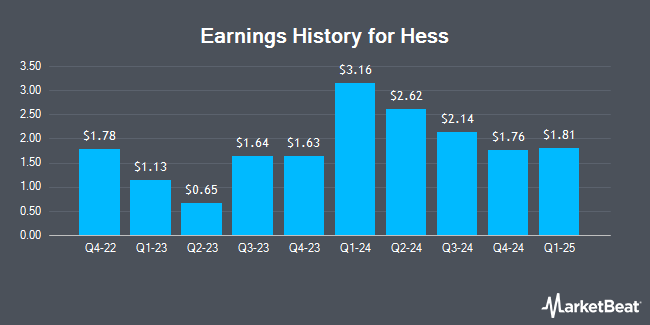

Hess (NYSE:HES - Get Free Report) is projected to announce its Q1 2025 earnings results before the market opens on Wednesday, April 30th. Analysts expect Hess to post earnings of $1.95 per share and revenue of $2.95 billion for the quarter.

Hess (NYSE:HES - Get Free Report) last issued its earnings results on Wednesday, January 29th. The oil and gas producer reported $1.76 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.44 by $0.32. Hess had a net margin of 21.27% and a return on equity of 26.32%. On average, analysts expect Hess to post $8 EPS for the current fiscal year and $12 EPS for the next fiscal year.

Hess Trading Up 3.2 %

HES stock opened at $130.40 on Wednesday. Hess has a 12 month low of $123.79 and a 12 month high of $163.98. The firm's 50-day moving average is $144.46 and its 200 day moving average is $142.13. The company has a market capitalization of $40.20 billion, a PE ratio of 14.49 and a beta of 0.88. The company has a debt-to-equity ratio of 0.72, a current ratio of 1.12 and a quick ratio of 1.13.

Hess Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Monday, March 31st. Shareholders of record on Monday, March 17th were paid a $0.50 dividend. The ex-dividend date was Monday, March 17th. This represents a $2.00 dividend on an annualized basis and a yield of 1.53%. Hess's dividend payout ratio is currently 22.22%.

Insider Activity at Hess

In related news, CEO John B. Hess sold 175,000 shares of the business's stock in a transaction on Thursday, March 27th. The stock was sold at an average price of $159.30, for a total transaction of $27,877,500.00. Following the transaction, the chief executive officer now directly owns 2,384,679 shares in the company, valued at $379,879,364.70. The trade was a 6.84 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. 9.10% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

HES has been the topic of several research analyst reports. Pickering Energy Partners raised Hess to a "hold" rating in a research note on Friday, January 3rd. StockNews.com initiated coverage on Hess in a research report on Saturday. They set a "hold" rating on the stock. UBS Group decreased their price objective on Hess from $170.00 to $163.00 and set a "buy" rating for the company in a report on Wednesday, April 16th. Susquehanna dropped their target price on shares of Hess from $160.00 to $136.00 and set a "neutral" rating on the stock in a report on Tuesday. Finally, Scotiabank reduced their price target on shares of Hess from $164.00 to $146.58 and set a "sector perform" rating for the company in a report on Friday, April 11th. Six analysts have rated the stock with a hold rating and five have issued a buy rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus price target of $164.46.

Get Our Latest Analysis on HES

About Hess

(

Get Free Report)

Hess Corporation, an exploration and production company, explores, develops, produces, purchases, transports, and sells crude oil, natural gas liquids (NGLs), and natural gas. The company operates in two segments, Exploration and Production, and Midstream. It conducts production operations primarily in the United States, Guyana, the Malaysia/Thailand Joint Development Area, and Malaysia; and exploration activities principally offshore Guyana, the U.S.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Hess, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hess wasn't on the list.

While Hess currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.