Y Intercept Hong Kong Ltd lessened its stake in shares of Hess Midstream LP (NYSE:HESM - Free Report) by 58.8% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 16,176 shares of the company's stock after selling 23,120 shares during the quarter. Y Intercept Hong Kong Ltd's holdings in Hess Midstream were worth $571,000 at the end of the most recent quarter.

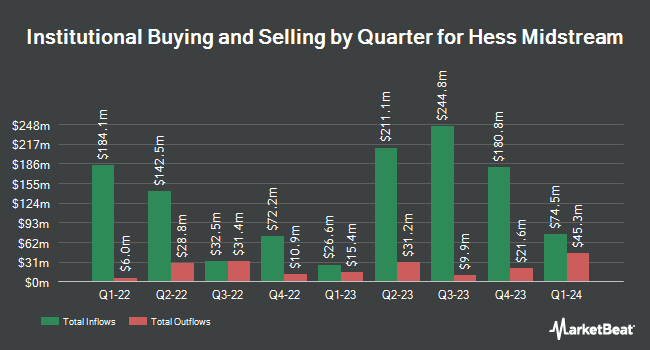

A number of other large investors also recently bought and sold shares of the company. Tompkins Financial Corp purchased a new stake in shares of Hess Midstream during the 3rd quarter worth $71,000. KBC Group NV boosted its stake in Hess Midstream by 83.9% in the 3rd quarter. KBC Group NV now owns 2,803 shares of the company's stock worth $99,000 after buying an additional 1,279 shares during the last quarter. Millburn Ridgefield Corp purchased a new stake in Hess Midstream in the third quarter valued at approximately $100,000. Icon Wealth Advisors LLC boosted its holdings in shares of Hess Midstream by 11.1% in the 3rd quarter. Icon Wealth Advisors LLC now owns 3,288 shares of the company's stock valued at $116,000 after purchasing an additional 329 shares during the last quarter. Finally, Brown Brothers Harriman & Co. grew its position in Hess Midstream by 487.4% during the third quarter. Brown Brothers Harriman & Co. now owns 3,366 shares of the company's stock valued at $119,000 after acquiring an additional 2,793 shares during the period. Hedge funds and other institutional investors own 98.97% of the company's stock.

Insider Activity

In other Hess Midstream news, CFO Jonathan C. Stein sold 7,923 shares of the business's stock in a transaction dated Monday, November 11th. The shares were sold at an average price of $35.32, for a total value of $279,840.36. Following the sale, the chief financial officer now directly owns 59,945 shares in the company, valued at approximately $2,117,257.40. The trade was a 11.67 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Infrastructure Investor Global sold 12,650,000 shares of the stock in a transaction that occurred on Friday, September 20th. The shares were sold at an average price of $35.12, for a total transaction of $444,268,000.00. The disclosure for this sale can be found here.

Analyst Upgrades and Downgrades

Separately, JPMorgan Chase & Co. increased their target price on Hess Midstream from $38.00 to $39.00 and gave the company a "neutral" rating in a research note on Wednesday, August 21st.

Check Out Our Latest Report on HESM

Hess Midstream Stock Up 2.6 %

Shares of Hess Midstream stock traded up $0.93 on Friday, hitting $36.70. 780,950 shares of the company's stock traded hands, compared to its average volume of 877,137. The firm's 50-day moving average is $35.91 and its 200 day moving average is $36.19. The stock has a market cap of $8.00 billion, a P/E ratio of 15.55 and a beta of 1.53. Hess Midstream LP has a 52-week low of $30.72 and a 52-week high of $39.11. The company has a quick ratio of 0.70, a current ratio of 0.70 and a debt-to-equity ratio of 7.85.

Hess Midstream (NYSE:HESM - Get Free Report) last released its earnings results on Wednesday, October 30th. The company reported $0.63 earnings per share for the quarter, beating the consensus estimate of $0.58 by $0.05. Hess Midstream had a net margin of 13.06% and a return on equity of 47.87%. The firm had revenue of $378.50 million during the quarter, compared to analyst estimates of $376.98 million. During the same quarter in the previous year, the firm earned $0.57 earnings per share. The firm's revenue for the quarter was up 4.2% compared to the same quarter last year. Equities analysts anticipate that Hess Midstream LP will post 2.41 earnings per share for the current year.

Hess Midstream Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Thursday, November 14th. Stockholders of record on Thursday, November 7th were issued a dividend of $0.6846 per share. This is an increase from Hess Midstream's previous quarterly dividend of $0.67. The ex-dividend date was Thursday, November 7th. This represents a $2.74 annualized dividend and a dividend yield of 7.46%. Hess Midstream's payout ratio is 116.10%.

About Hess Midstream

(

Free Report)

Hess Midstream LP owns, develops, operates, and acquires midstream assets and provide fee-based services to Hess and third-party customers in the United States. It operates through three segments: Gathering; Processing and Storage; and Terminaling and Export. The Gathering segment owns natural gas gathering and compression systems; crude oil gathering systems; and produced water gathering and disposal facilities.

See Also

Before you consider Hess Midstream, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hess Midstream wasn't on the list.

While Hess Midstream currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.