Hewlett Packard Enterprise (NYSE:HPE - Get Free Report) was downgraded by stock analysts at Morgan Stanley from an "overweight" rating to an "equal weight" rating in a research report issued to clients and investors on Tuesday, Marketbeat reports. They currently have a $14.00 price target on the technology company's stock. Morgan Stanley's price objective would suggest a potential downside of 0.88% from the stock's previous close.

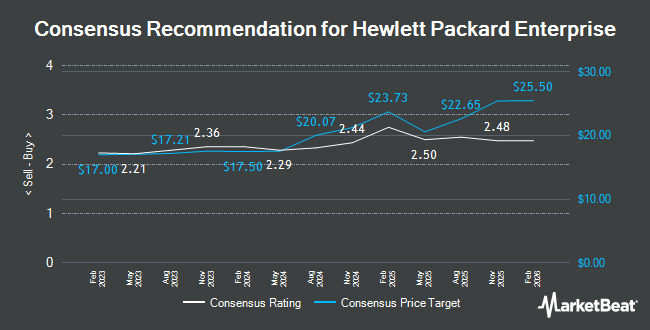

HPE has been the topic of a number of other research reports. Wells Fargo & Company reduced their price target on Hewlett Packard Enterprise from $22.00 to $17.00 and set an "equal weight" rating on the stock in a research note on Friday, March 7th. Bank of America lowered their price target on Hewlett Packard Enterprise from $26.00 to $20.00 and set a "buy" rating for the company in a report on Friday, March 7th. Daiwa Capital Markets lowered shares of Hewlett Packard Enterprise from an "outperform" rating to a "neutral" rating and set a $16.00 price objective on the stock. in a report on Wednesday, March 12th. Deutsche Bank Aktiengesellschaft upgraded shares of Hewlett Packard Enterprise from a "hold" rating to a "buy" rating and set a $25.00 target price for the company in a report on Thursday, December 19th. Finally, Daiwa America downgraded shares of Hewlett Packard Enterprise from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, March 12th. Ten research analysts have rated the stock with a hold rating, six have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $20.60.

Check Out Our Latest Research Report on Hewlett Packard Enterprise

Hewlett Packard Enterprise Price Performance

Shares of HPE stock traded up $0.38 during trading hours on Tuesday, hitting $14.12. The company's stock had a trading volume of 23,789,192 shares, compared to its average volume of 16,486,808. The company has a current ratio of 1.29, a quick ratio of 0.99 and a debt-to-equity ratio of 0.54. Hewlett Packard Enterprise has a twelve month low of $11.97 and a twelve month high of $24.66. The business has a fifty day moving average of $17.54 and a 200-day moving average of $20.08. The stock has a market cap of $18.55 billion, a price-to-earnings ratio of 7.43, a P/E/G ratio of 2.03 and a beta of 1.20.

Insider Activity at Hewlett Packard Enterprise

In related news, Director Bethany Mayer sold 6,409 shares of the stock in a transaction dated Friday, April 4th. The stock was sold at an average price of $13.19, for a total value of $84,534.71. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Company insiders own 0.36% of the company's stock.

Institutional Investors Weigh In On Hewlett Packard Enterprise

Several hedge funds and other institutional investors have recently bought and sold shares of HPE. Geode Capital Management LLC increased its stake in shares of Hewlett Packard Enterprise by 2.2% in the fourth quarter. Geode Capital Management LLC now owns 32,173,982 shares of the technology company's stock worth $686,011,000 after buying an additional 681,242 shares during the last quarter. Northern Trust Corp grew its holdings in Hewlett Packard Enterprise by 24.7% during the 4th quarter. Northern Trust Corp now owns 16,184,240 shares of the technology company's stock worth $345,534,000 after acquiring an additional 3,208,424 shares in the last quarter. Raymond James Financial Inc. bought a new stake in shares of Hewlett Packard Enterprise in the 4th quarter worth about $292,959,000. Boston Partners lifted its position in shares of Hewlett Packard Enterprise by 19.1% during the fourth quarter. Boston Partners now owns 12,848,336 shares of the technology company's stock worth $276,075,000 after purchasing an additional 2,058,562 shares during the last quarter. Finally, Slate Path Capital LP grew its stake in Hewlett Packard Enterprise by 44.8% in the fourth quarter. Slate Path Capital LP now owns 12,689,164 shares of the technology company's stock worth $270,914,000 after purchasing an additional 3,924,039 shares in the last quarter. 80.78% of the stock is currently owned by hedge funds and other institutional investors.

About Hewlett Packard Enterprise

(

Get Free Report)

Hewlett Packard Enterprise Company provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan. It operates in six segments: Compute, HPC & AI, Storage, Intelligent Edge, Financial Services, and Corporate Investments and Other.

Recommended Stories

Before you consider Hewlett Packard Enterprise, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hewlett Packard Enterprise wasn't on the list.

While Hewlett Packard Enterprise currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.