Hexcel (NYSE:HXL - Get Free Report) was upgraded by equities research analysts at Royal Bank of Canada from a "sector perform" rating to an "outperform" rating in a report released on Thursday, Marketbeat.com reports. The firm presently has a $74.00 price objective on the aerospace company's stock, up from their previous price objective of $68.00. Royal Bank of Canada's target price suggests a potential upside of 17.35% from the company's current price.

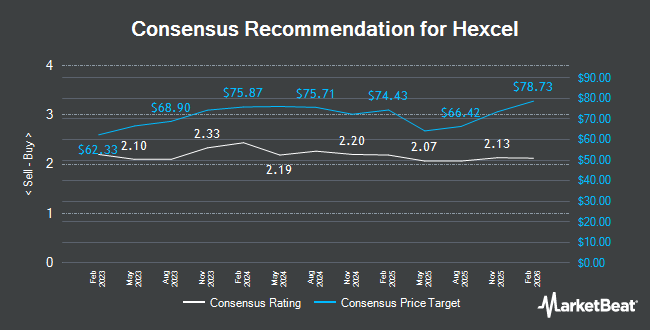

HXL has been the subject of several other research reports. BMO Capital Markets cut their target price on Hexcel from $70.00 to $68.00 and set a "market perform" rating for the company in a research report on Monday, October 28th. StockNews.com upgraded shares of Hexcel from a "hold" rating to a "buy" rating in a research report on Wednesday, October 23rd. Wells Fargo & Company upped their price objective on Hexcel from $78.00 to $81.00 and gave the company an "overweight" rating in a research report on Wednesday, December 11th. UBS Group lifted their target price on Hexcel from $67.00 to $69.00 and gave the stock a "neutral" rating in a report on Friday, October 25th. Finally, Deutsche Bank Aktiengesellschaft decreased their price target on Hexcel from $63.00 to $60.00 and set a "hold" rating on the stock in a report on Thursday, November 21st. Two equities research analysts have rated the stock with a sell rating, seven have given a hold rating and five have assigned a buy rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $71.33.

Check Out Our Latest Stock Report on Hexcel

Hexcel Stock Performance

Shares of NYSE:HXL traded up $1.45 during mid-day trading on Thursday, reaching $63.06. 1,214,556 shares of the company traded hands, compared to its average volume of 867,370. Hexcel has a 52 week low of $57.50 and a 52 week high of $77.09. The firm has a market cap of $5.11 billion, a PE ratio of 48.14, a PEG ratio of 1.96 and a beta of 1.30. The company's 50 day moving average price is $61.86 and its 200-day moving average price is $62.64. The company has a debt-to-equity ratio of 0.51, a current ratio of 2.76 and a quick ratio of 1.51.

Hexcel (NYSE:HXL - Get Free Report) last announced its quarterly earnings data on Monday, October 21st. The aerospace company reported $0.47 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.46 by $0.01. Hexcel had a net margin of 5.73% and a return on equity of 9.99%. The firm had revenue of $457.00 million during the quarter, compared to analysts' expectations of $457.07 million. During the same period in the prior year, the company posted $0.38 earnings per share. The company's revenue for the quarter was up 8.9% compared to the same quarter last year. On average, equities analysts expect that Hexcel will post 2.02 EPS for the current fiscal year.

Institutional Investors Weigh In On Hexcel

Several large investors have recently added to or reduced their stakes in the business. True Wealth Design LLC acquired a new position in shares of Hexcel in the third quarter worth $30,000. Capital Performance Advisors LLP acquired a new position in Hexcel during the 3rd quarter worth $56,000. First Horizon Advisors Inc. increased its holdings in Hexcel by 53.8% during the 3rd quarter. First Horizon Advisors Inc. now owns 932 shares of the aerospace company's stock worth $58,000 after purchasing an additional 326 shares during the period. Huntington National Bank raised its position in Hexcel by 30.8% in the 3rd quarter. Huntington National Bank now owns 955 shares of the aerospace company's stock valued at $59,000 after purchasing an additional 225 shares in the last quarter. Finally, Eastern Bank purchased a new position in shares of Hexcel in the 3rd quarter valued at about $62,000. 95.47% of the stock is owned by hedge funds and other institutional investors.

Hexcel Company Profile

(

Get Free Report)

Hexcel Corporation develops, manufactures, and markets carbon fibers, structural reinforcements, honeycomb structures, resins, and composite materials and parts for use in commercial aerospace, space and defense, and industrial applications. It operates through two segments, Composite Materials and Engineered Products.

Featured Articles

Before you consider Hexcel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hexcel wasn't on the list.

While Hexcel currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.