HighTower Advisors LLC lifted its stake in Whirlpool Co. (NYSE:WHR - Free Report) by 1.9% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 1,033,263 shares of the company's stock after purchasing an additional 18,936 shares during the period. HighTower Advisors LLC owned about 1.87% of Whirlpool worth $110,567,000 at the end of the most recent quarter.

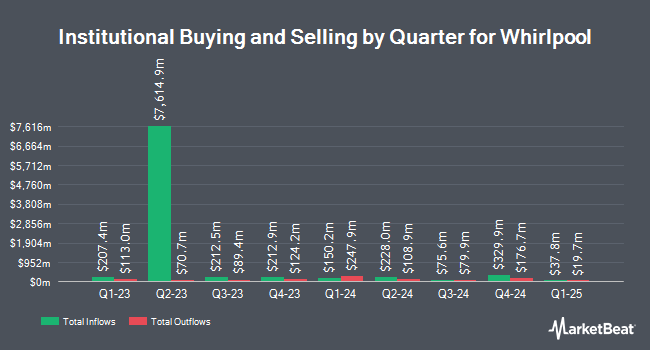

A number of other hedge funds and other institutional investors have also recently bought and sold shares of the stock. Sigma Planning Corp boosted its holdings in Whirlpool by 6.4% in the third quarter. Sigma Planning Corp now owns 2,170 shares of the company's stock valued at $232,000 after purchasing an additional 130 shares during the period. Dakota Wealth Management lifted its holdings in Whirlpool by 2.0% during the 3rd quarter. Dakota Wealth Management now owns 7,395 shares of the company's stock worth $791,000 after buying an additional 145 shares during the last quarter. Moors & Cabot Inc. lifted its holdings in Whirlpool by 2.2% during the 3rd quarter. Moors & Cabot Inc. now owns 6,979 shares of the company's stock worth $747,000 after buying an additional 150 shares during the last quarter. Arizona State Retirement System lifted its holdings in Whirlpool by 1.1% during the 2nd quarter. Arizona State Retirement System now owns 15,247 shares of the company's stock worth $1,558,000 after buying an additional 172 shares during the last quarter. Finally, Verdence Capital Advisors LLC lifted its holdings in Whirlpool by 5.1% during the 3rd quarter. Verdence Capital Advisors LLC now owns 3,565 shares of the company's stock worth $381,000 after buying an additional 173 shares during the last quarter. 90.78% of the stock is currently owned by hedge funds and other institutional investors.

Insider Transactions at Whirlpool

In other news, CFO James W. Peters sold 6,000 shares of the business's stock in a transaction that occurred on Monday, October 28th. The stock was sold at an average price of $104.48, for a total transaction of $626,880.00. Following the sale, the chief financial officer now owns 41,570 shares of the company's stock, valued at $4,343,233.60. The trade was a 12.61 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Corporate insiders own 2.05% of the company's stock.

Wall Street Analysts Forecast Growth

A number of analysts have issued reports on WHR shares. Bank of America lifted their price target on Whirlpool from $101.00 to $103.00 and gave the stock an "underperform" rating in a report on Friday, October 25th. Royal Bank of Canada decreased their price target on Whirlpool from $76.00 to $74.00 and set an "underperform" rating for the company in a report on Friday, October 25th. Finally, JPMorgan Chase & Co. boosted their target price on Whirlpool from $103.00 to $109.00 and gave the company a "neutral" rating in a report on Tuesday, October 29th. Two analysts have rated the stock with a sell rating, two have assigned a hold rating and one has assigned a buy rating to the stock. According to data from MarketBeat, the company presently has an average rating of "Hold" and an average target price of $106.50.

Check Out Our Latest Stock Report on Whirlpool

Whirlpool Stock Performance

WHR stock traded down $0.84 during trading on Wednesday, hitting $109.55. The company had a trading volume of 482,254 shares, compared to its average volume of 1,142,214. The firm has a market cap of $6.04 billion, a PE ratio of 10.80 and a beta of 1.46. Whirlpool Co. has a 1-year low of $84.18 and a 1-year high of $125.68. The firm has a 50-day moving average price of $107.53 and a 200-day moving average price of $100.77. The company has a quick ratio of 0.55, a current ratio of 0.94 and a debt-to-equity ratio of 1.94.

Whirlpool (NYSE:WHR - Get Free Report) last released its earnings results on Wednesday, October 23rd. The company reported $3.43 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.99 by $0.44. The company had revenue of $3.99 billion for the quarter, compared to analysts' expectations of $4.09 billion. Whirlpool had a return on equity of 21.41% and a net margin of 3.19%. The firm's quarterly revenue was down 18.9% on a year-over-year basis. During the same quarter in the previous year, the firm posted $5.45 EPS. On average, analysts expect that Whirlpool Co. will post 12.27 earnings per share for the current year.

Whirlpool Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Sunday, December 15th. Stockholders of record on Friday, November 15th will be paid a dividend of $1.75 per share. This represents a $7.00 annualized dividend and a dividend yield of 6.39%. The ex-dividend date of this dividend is Friday, November 15th. Whirlpool's dividend payout ratio (DPR) is 69.03%.

Whirlpool Profile

(

Free Report)

Whirlpool Corporation manufactures and markets home appliances and related products and services in the North America, Europe, the Middle East, Africa, Latin America, and Asia. The company's principal products include refrigerators, freezers, ice makers, and refrigerator water filters; laundry appliances, and commercial laundry products and related laundry accessories; cooking and other small domestic appliances; and dishwasher appliances and related accessories, as well as mixers.

Featured Stories

Before you consider Whirlpool, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Whirlpool wasn't on the list.

While Whirlpool currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.