HighTower Advisors LLC lifted its position in Target Hospitality Corp. (NASDAQ:TH - Free Report) by 10.1% in the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 1,466,356 shares of the company's stock after purchasing an additional 134,966 shares during the quarter. HighTower Advisors LLC owned 1.46% of Target Hospitality worth $11,408,000 at the end of the most recent quarter.

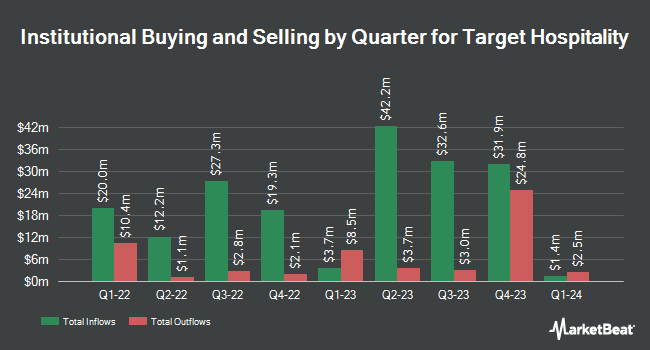

A number of other hedge funds and other institutional investors have also recently modified their holdings of the company. Vanguard Group Inc. lifted its holdings in Target Hospitality by 1.5% in the 1st quarter. Vanguard Group Inc. now owns 1,801,234 shares of the company's stock worth $19,579,000 after buying an additional 26,796 shares during the period. Renaissance Technologies LLC lifted its holdings in Target Hospitality by 6.1% in the 2nd quarter. Renaissance Technologies LLC now owns 741,036 shares of the company's stock worth $6,454,000 after buying an additional 42,800 shares during the period. LB Partners LLC lifted its holdings in Target Hospitality by 300.3% in the 3rd quarter. LB Partners LLC now owns 536,428 shares of the company's stock worth $4,173,000 after buying an additional 402,428 shares during the period. American Century Companies Inc. lifted its holdings in Target Hospitality by 39.7% in the 2nd quarter. American Century Companies Inc. now owns 397,324 shares of the company's stock worth $3,461,000 after buying an additional 112,833 shares during the period. Finally, Charles Schwab Investment Management Inc. lifted its holdings in Target Hospitality by 28.7% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 271,590 shares of the company's stock worth $2,113,000 after buying an additional 60,569 shares during the period. 32.40% of the stock is currently owned by hedge funds and other institutional investors.

Target Hospitality Trading Up 3.3 %

Shares of NASDAQ TH traded up $0.26 during trading hours on Friday, reaching $8.16. The stock had a trading volume of 464,497 shares, compared to its average volume of 571,326. The firm has a market cap of $807.35 million, a price-to-earnings ratio of 9.38, a P/E/G ratio of 0.79 and a beta of 2.12. The business's fifty day moving average price is $8.06 and its two-hundred day moving average price is $8.94. Target Hospitality Corp. has a 52-week low of $6.11 and a 52-week high of $11.84.

Analysts Set New Price Targets

TH has been the subject of a number of analyst reports. Oppenheimer reaffirmed a "market perform" rating on shares of Target Hospitality in a research report on Thursday, November 14th. Northland Securities raised their price objective on Target Hospitality from $9.00 to $11.00 and gave the company a "market perform" rating in a research report on Wednesday, November 13th.

Get Our Latest Analysis on TH

Target Hospitality Company Profile

(

Free Report)

Target Hospitality Corp. operates as a specialty rental and hospitality services company in North America. The company operates through two segments, Hospitality & Facilities Services - South and Government. It owns a network of specialty rental accommodation units. In addition, the company provides catering and food, maintenance, housekeeping, grounds-keeping, security, health and recreation facilities, workforce community management, concierge, and laundry services.

See Also

Before you consider Target Hospitality, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Target Hospitality wasn't on the list.

While Target Hospitality currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.