HighTower Advisors LLC grew its stake in shares of Infosys Limited (NYSE:INFY - Free Report) by 32.8% during the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 118,938 shares of the technology company's stock after buying an additional 29,407 shares during the period. HighTower Advisors LLC's holdings in Infosys were worth $2,607,000 as of its most recent filing with the Securities and Exchange Commission.

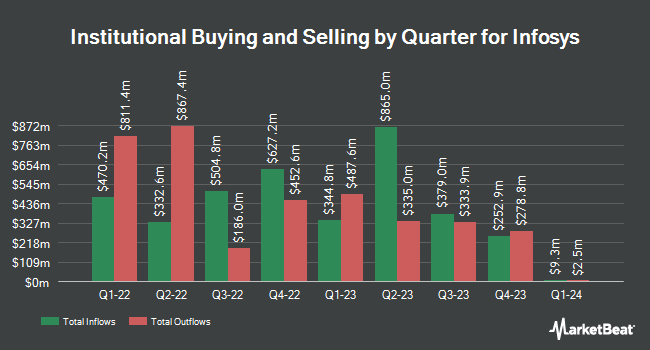

Other institutional investors and hedge funds also recently modified their holdings of the company. Sierra Ocean LLC bought a new position in Infosys during the 4th quarter worth approximately $29,000. Brooklyn Investment Group bought a new stake in shares of Infosys in the fourth quarter worth about $52,000. Wilmington Savings Fund Society FSB acquired a new position in shares of Infosys in the 3rd quarter valued at approximately $57,000. GAMMA Investing LLC increased its stake in Infosys by 14.2% during the 4th quarter. GAMMA Investing LLC now owns 4,496 shares of the technology company's stock worth $99,000 after purchasing an additional 560 shares in the last quarter. Finally, Principal Securities Inc. increased its stake in Infosys by 210.1% during the 4th quarter. Principal Securities Inc. now owns 4,822 shares of the technology company's stock worth $106,000 after purchasing an additional 3,267 shares in the last quarter. 16.20% of the stock is owned by institutional investors.

Infosys Stock Performance

Infosys stock traded up $0.27 during midday trading on Tuesday, reaching $18.86. 11,605,208 shares of the company's stock were exchanged, compared to its average volume of 9,355,374. The stock's 50-day simple moving average is $20.73 and its 200 day simple moving average is $21.86. The firm has a market cap of $78.12 billion, a price-to-earnings ratio of 23.87, a P/E/G ratio of 3.50 and a beta of 1.01. Infosys Limited has a 52 week low of $16.04 and a 52 week high of $23.81.

Infosys (NYSE:INFY - Get Free Report) last posted its earnings results on Thursday, January 16th. The technology company reported $0.19 earnings per share for the quarter, hitting analysts' consensus estimates of $0.19. Infosys had a return on equity of 31.60% and a net margin of 17.28%. During the same quarter last year, the firm posted $0.18 EPS. Research analysts forecast that Infosys Limited will post 0.74 earnings per share for the current year.

Analysts Set New Price Targets

Several research analysts have recently weighed in on INFY shares. StockNews.com cut shares of Infosys from a "buy" rating to a "hold" rating in a report on Thursday, March 20th. Guggenheim reiterated a "neutral" rating on shares of Infosys in a report on Friday, January 17th. Hsbc Global Res raised Infosys from a "hold" rating to a "strong-buy" rating in a research report on Monday, December 9th. CLSA raised Infosys from a "hold" rating to an "outperform" rating in a research report on Friday, March 7th. Finally, HSBC upgraded shares of Infosys from a "hold" rating to a "buy" rating in a report on Monday, December 9th. Two analysts have rated the stock with a sell rating, four have assigned a hold rating, four have given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, Infosys currently has a consensus rating of "Hold" and a consensus price target of $19.70.

Check Out Our Latest Research Report on Infosys

Infosys Profile

(

Free Report)

Infosys Ltd. is a digital services and consulting company, which engages in the provision of end-to-end business solutions. It operates through the following segments: Financial Services, Retail, Communication, Energy, Utilities, Resources, and Services, Manufacturing, Hi-Tech, Life Sciences, and All Other.

Recommended Stories

Before you consider Infosys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Infosys wasn't on the list.

While Infosys currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.