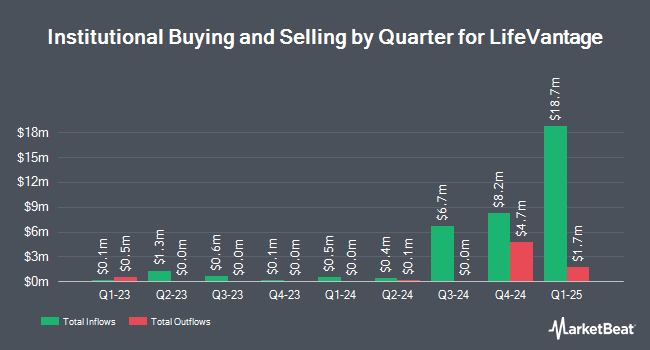

HighTower Advisors LLC acquired a new position in shares of LifeVantage Co. (NASDAQ:LFVN - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 52,743 shares of the company's stock, valued at approximately $638,000. HighTower Advisors LLC owned about 0.42% of LifeVantage at the end of the most recent quarter.

Other institutional investors and hedge funds have also modified their holdings of the company. Renaissance Technologies LLC lifted its stake in LifeVantage by 2.1% in the second quarter. Renaissance Technologies LLC now owns 855,118 shares of the company's stock valued at $5,490,000 after buying an additional 17,300 shares during the period. Capital Management Corp VA bought a new position in LifeVantage during the 3rd quarter worth approximately $5,073,000. Ritholtz Wealth Management grew its holdings in LifeVantage by 62.0% during the third quarter. Ritholtz Wealth Management now owns 28,666 shares of the company's stock valued at $346,000 after purchasing an additional 10,974 shares during the period. Finally, Hantz Financial Services Inc. bought a new stake in LifeVantage in the second quarter valued at approximately $91,000. 35.32% of the stock is owned by institutional investors.

Analyst Ratings Changes

Separately, Lake Street Capital initiated coverage on shares of LifeVantage in a research report on Thursday. They set a "buy" rating and a $26.00 price target on the stock.

Get Our Latest Stock Analysis on LFVN

LifeVantage Stock Down 2.1 %

Shares of NASDAQ:LFVN traded down $0.37 during mid-day trading on Friday, reaching $17.36. 77,166 shares of the stock were exchanged, compared to its average volume of 64,864. The stock's 50 day simple moving average is $13.88 and its 200-day simple moving average is $10.24. LifeVantage Co. has a one year low of $5.22 and a one year high of $18.41. The company has a market cap of $217.43 million, a P/E ratio of 54.25 and a beta of 0.87.

LifeVantage (NASDAQ:LFVN - Get Free Report) last released its earnings results on Tuesday, October 29th. The company reported $0.15 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.15. The business had revenue of $47.21 million for the quarter. LifeVantage had a return on equity of 29.24% and a net margin of 2.11%.

LifeVantage Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Monday, December 16th. Shareholders of record on Monday, December 2nd were given a dividend of $0.04 per share. The ex-dividend date of this dividend was Monday, December 2nd. This represents a $0.16 dividend on an annualized basis and a yield of 0.92%. LifeVantage's dividend payout ratio (DPR) is 50.00%.

LifeVantage Company Profile

(

Free Report)

LifeVantage Corporation engages in the identification, research, development, formulation, and sale of advanced nutrigenomic activators, dietary supplements, nootropics, pre- and pro-biotics, weight management, skin and hair care, bath and body, and targeted relief products. It offers Protandim, a dietary supplement; LifeVantage Omega+, a dietary supplement that combines DHA and EPA Omega-3 fatty acids, Omega-7 fatty acids, and vitamin D3; LifeVantage ProBio, a dietary supplement to support gut health; PhysIQ, a weight management system; LifeVantage IC Bright, a supplement to support eye and brain health, reduce eye fatigue and strain, supports cognitive functions, and support normal sleep patterns; Petandim for Dogs, a supplement to combat oxidative stress in dogs; and Axio, a nootropic energy drink mix.

Further Reading

Before you consider LifeVantage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LifeVantage wasn't on the list.

While LifeVantage currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.