HighTower Advisors LLC reduced its position in Stride, Inc. (NYSE:LRN - Free Report) by 14.3% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 88,950 shares of the company's stock after selling 14,828 shares during the quarter. HighTower Advisors LLC owned approximately 0.20% of Stride worth $7,584,000 at the end of the most recent quarter.

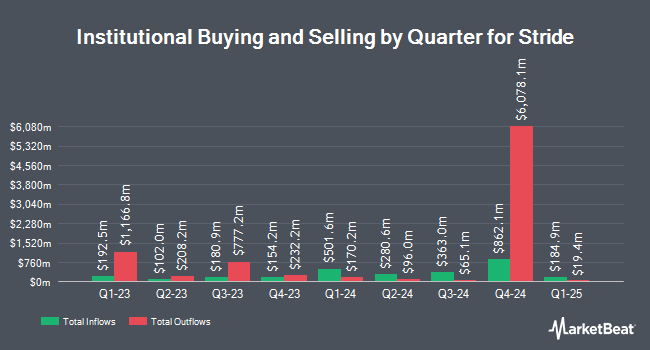

Several other hedge funds and other institutional investors have also recently bought and sold shares of LRN. Blue Trust Inc. increased its stake in Stride by 795.5% during the second quarter. Blue Trust Inc. now owns 11,543 shares of the company's stock valued at $814,000 after purchasing an additional 10,254 shares during the last quarter. Vaughan Nelson Investment Management L.P. bought a new position in shares of Stride in the 2nd quarter worth about $43,387,000. Kirr Marbach & Co. LLC IN boosted its holdings in shares of Stride by 0.3% in the 2nd quarter. Kirr Marbach & Co. LLC IN now owns 107,595 shares of the company's stock valued at $7,585,000 after buying an additional 348 shares during the period. Hennessy Advisors Inc. bought a new stake in shares of Stride during the 2nd quarter valued at about $9,398,000. Finally, SummerHaven Investment Management LLC raised its stake in Stride by 1.1% during the second quarter. SummerHaven Investment Management LLC now owns 20,454 shares of the company's stock worth $1,442,000 after acquiring an additional 217 shares during the period. 98.24% of the stock is owned by institutional investors.

Insider Activity

In other Stride news, Director Todd Goldthwaite sold 8,028 shares of the business's stock in a transaction dated Friday, October 25th. The shares were sold at an average price of $91.54, for a total value of $734,883.12. Following the sale, the director now directly owns 85,058 shares in the company, valued at approximately $7,786,209.32. The trade was a 8.62 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Insiders own 3.00% of the company's stock.

Analyst Ratings Changes

LRN has been the topic of a number of recent research reports. Barrington Research raised their target price on shares of Stride from $90.00 to $100.00 and gave the stock an "outperform" rating in a report on Wednesday, October 23rd. StockNews.com downgraded Stride from a "buy" rating to a "hold" rating in a report on Wednesday, October 23rd. Citigroup upped their price objective on Stride from $90.00 to $94.00 and gave the stock a "neutral" rating in a research note on Tuesday, October 29th. Canaccord Genuity Group raised their target price on Stride from $94.00 to $100.00 and gave the company a "buy" rating in a research note on Wednesday, October 23rd. Finally, BMO Capital Markets boosted their price target on shares of Stride from $84.00 to $88.00 and gave the company an "outperform" rating in a report on Thursday, October 24th. Three equities research analysts have rated the stock with a hold rating and five have issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $90.17.

View Our Latest Research Report on LRN

Stride Stock Performance

Shares of NYSE LRN traded down $1.60 during midday trading on Tuesday, reaching $106.29. 1,070,480 shares of the company traded hands, compared to its average volume of 829,656. The company has a market cap of $4.63 billion, a price-to-earnings ratio of 19.33, a PEG ratio of 0.83 and a beta of 0.30. The stock has a 50-day moving average price of $92.56 and a 200 day moving average price of $81.23. Stride, Inc. has a 52 week low of $54.81 and a 52 week high of $112.80. The company has a debt-to-equity ratio of 0.38, a current ratio of 5.60 and a quick ratio of 5.50.

Stride (NYSE:LRN - Get Free Report) last posted its quarterly earnings data on Tuesday, October 22nd. The company reported $0.94 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.22 by $0.72. Stride had a net margin of 11.38% and a return on equity of 21.23%. The business had revenue of $551.08 million during the quarter, compared to analysts' expectations of $504.29 million. During the same period last year, the firm posted $0.11 earnings per share. The business's revenue was up 14.8% on a year-over-year basis. Sell-side analysts anticipate that Stride, Inc. will post 6.66 earnings per share for the current fiscal year.

Stride Company Profile

(

Free Report)

Stride, Inc, a technology-based education service company, engages in the provision of proprietary and third-party online curriculum, software systems, and educational services in the United States and internationally. Its technology-based products and services enable clients to attract, enroll, educate, track progress, support, and facilitate individualized learning for students.

Recommended Stories

Before you consider Stride, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stride wasn't on the list.

While Stride currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.