HighTower Advisors LLC lessened its stake in shares of Northrop Grumman Co. (NYSE:NOC - Free Report) by 4.3% in the third quarter, according to its most recent filing with the SEC. The fund owned 59,521 shares of the aerospace company's stock after selling 2,699 shares during the period. HighTower Advisors LLC's holdings in Northrop Grumman were worth $31,545,000 at the end of the most recent reporting period.

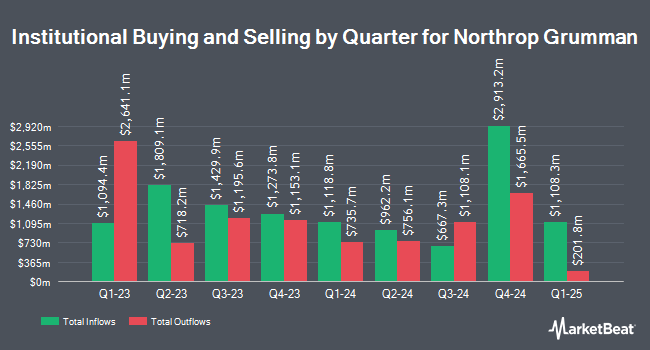

Other institutional investors and hedge funds also recently modified their holdings of the company. Optimum Investment Advisors lifted its position in shares of Northrop Grumman by 241.2% during the 2nd quarter. Optimum Investment Advisors now owns 58 shares of the aerospace company's stock valued at $25,000 after acquiring an additional 41 shares during the last quarter. RPg Family Wealth Advisory LLC acquired a new stake in Northrop Grumman during the 3rd quarter valued at $31,000. FSA Wealth Management LLC acquired a new stake in Northrop Grumman during the 3rd quarter valued at $36,000. Meeder Asset Management Inc. raised its stake in Northrop Grumman by 245.5% during the 2nd quarter. Meeder Asset Management Inc. now owns 76 shares of the aerospace company's stock valued at $33,000 after purchasing an additional 54 shares during the period. Finally, Catalyst Capital Advisors LLC acquired a new stake in Northrop Grumman during the 3rd quarter valued at $40,000. Institutional investors and hedge funds own 83.40% of the company's stock.

Northrop Grumman Stock Down 1.3 %

Northrop Grumman stock traded down $6.24 during mid-day trading on Friday, hitting $473.33. 915,666 shares of the company's stock were exchanged, compared to its average volume of 859,670. The company has a current ratio of 1.09, a quick ratio of 0.97 and a debt-to-equity ratio of 1.00. The stock has a market cap of $68.96 billion, a P/E ratio of 29.35, a P/E/G ratio of 0.98 and a beta of 0.33. Northrop Grumman Co. has a 1-year low of $418.60 and a 1-year high of $555.57. The stock has a 50 day moving average of $513.61 and a two-hundred day moving average of $487.60.

Northrop Grumman (NYSE:NOC - Get Free Report) last posted its earnings results on Thursday, October 24th. The aerospace company reported $7.00 EPS for the quarter, topping the consensus estimate of $6.07 by $0.93. Northrop Grumman had a net margin of 5.79% and a return on equity of 26.57%. The firm had revenue of $10 billion for the quarter, compared to the consensus estimate of $10.18 billion. During the same period in the prior year, the business posted $6.18 earnings per share. The business's quarterly revenue was up 2.3% on a year-over-year basis. As a group, analysts anticipate that Northrop Grumman Co. will post 25.93 EPS for the current fiscal year.

Northrop Grumman Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, December 18th. Shareholders of record on Monday, December 2nd will be issued a dividend of $2.06 per share. This represents a $8.24 dividend on an annualized basis and a yield of 1.74%. The ex-dividend date of this dividend is Monday, December 2nd. Northrop Grumman's dividend payout ratio (DPR) is 51.05%.

Insider Buying and Selling at Northrop Grumman

In related news, VP Benjamin R. Davies sold 1,156 shares of the stock in a transaction dated Monday, November 11th. The shares were sold at an average price of $532.93, for a total value of $616,067.08. Following the completion of the sale, the vice president now owns 537 shares in the company, valued at approximately $286,183.41. This trade represents a 68.28 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders sold 1,255 shares of company stock worth $666,461 over the last ninety days. Company insiders own 0.22% of the company's stock.

Analyst Ratings Changes

Several brokerages have issued reports on NOC. Royal Bank of Canada boosted their target price on shares of Northrop Grumman from $500.00 to $540.00 and gave the company a "sector perform" rating in a research note on Friday, October 25th. Alembic Global Advisors downgraded shares of Northrop Grumman from an "overweight" rating to a "neutral" rating and set a $560.00 target price on the stock. in a research note on Tuesday, August 27th. Citigroup boosted their target price on shares of Northrop Grumman from $521.00 to $587.00 and gave the company a "neutral" rating in a research note on Thursday, October 10th. Susquehanna boosted their target price on shares of Northrop Grumman from $560.00 to $625.00 and gave the company a "positive" rating in a research note on Friday, October 25th. Finally, StockNews.com raised shares of Northrop Grumman from a "buy" rating to a "strong-buy" rating in a research note on Friday. One investment analyst has rated the stock with a sell rating, ten have given a hold rating, five have assigned a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Hold" and a consensus price target of $550.56.

Check Out Our Latest Stock Analysis on Northrop Grumman

About Northrop Grumman

(

Free Report)

Northrop Grumman Corporation operates as an aerospace and defense technology company in the United States, Asia/Pacific, Europe, and internationally. The company's Aeronautics Systems segment designs, develops, manufactures, integrates, and sustains aircraft systems. This segment also offers unmanned autonomous aircraft systems, including high-altitude long-endurance strategic ISR systems and vertical take-off and landing tactical ISR systems; and strategic long-range strike aircraft, tactical fighter and air dominance aircraft, and airborne battle management and command and control systems.

See Also

Before you consider Northrop Grumman, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Northrop Grumman wasn't on the list.

While Northrop Grumman currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.