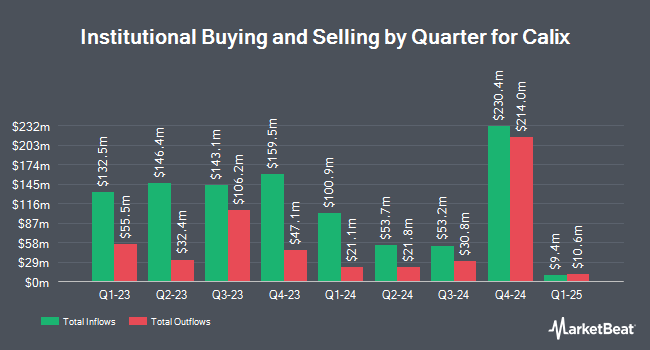

HighTower Advisors LLC purchased a new stake in Calix, Inc. (NYSE:CALX - Free Report) in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 90,623 shares of the communications equipment provider's stock, valued at approximately $3,513,000. HighTower Advisors LLC owned approximately 0.14% of Calix as of its most recent SEC filing.

Several other hedge funds and other institutional investors have also made changes to their positions in CALX. Rockefeller Capital Management L.P. increased its stake in shares of Calix by 34.8% during the 3rd quarter. Rockefeller Capital Management L.P. now owns 410,463 shares of the communications equipment provider's stock worth $15,921,000 after purchasing an additional 105,969 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its position in Calix by 5.7% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 129,608 shares of the communications equipment provider's stock worth $5,027,000 after buying an additional 6,984 shares in the last quarter. Zurcher Kantonalbank Zurich Cantonalbank increased its position in Calix by 29.4% during the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 11,024 shares of the communications equipment provider's stock worth $428,000 after buying an additional 2,505 shares in the last quarter. Townsquare Capital LLC raised its holdings in shares of Calix by 29.7% in the third quarter. Townsquare Capital LLC now owns 113,655 shares of the communications equipment provider's stock worth $4,409,000 after acquiring an additional 26,007 shares during the last quarter. Finally, BNP Paribas Financial Markets lifted its position in shares of Calix by 14.5% in the third quarter. BNP Paribas Financial Markets now owns 25,204 shares of the communications equipment provider's stock valued at $978,000 after acquiring an additional 3,190 shares in the last quarter. Institutional investors and hedge funds own 98.14% of the company's stock.

Analyst Ratings Changes

CALX has been the subject of a number of recent research reports. Rosenblatt Securities reiterated a "buy" rating and set a $45.00 price objective on shares of Calix in a research report on Thursday, October 3rd. StockNews.com upgraded shares of Calix from a "sell" rating to a "hold" rating in a research report on Tuesday, October 8th. Finally, Needham & Company LLC reaffirmed a "buy" rating and issued a $45.00 target price on shares of Calix in a research note on Tuesday, October 29th. Three equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $42.50.

Get Our Latest Analysis on CALX

Calix Stock Up 0.4 %

Shares of CALX stock traded up $0.13 during trading hours on Thursday, hitting $35.40. 454,248 shares of the company were exchanged, compared to its average volume of 758,429. The firm has a fifty day moving average of $35.01 and a 200 day moving average of $35.88. Calix, Inc. has a 1 year low of $26.76 and a 1 year high of $45.15. The firm has a market cap of $2.35 billion, a PE ratio of -147.50 and a beta of 1.70.

Calix (NYSE:CALX - Get Free Report) last posted its quarterly earnings results on Monday, October 28th. The communications equipment provider reported $0.13 earnings per share for the quarter, topping analysts' consensus estimates of $0.09 by $0.04. The company had revenue of $200.95 million for the quarter, compared to the consensus estimate of $201.06 million. Calix had a negative net margin of 1.79% and a positive return on equity of 1.33%. Calix's revenue was down 23.8% on a year-over-year basis. During the same quarter last year, the firm posted $0.25 earnings per share. Analysts expect that Calix, Inc. will post -0.34 earnings per share for the current year.

Calix Company Profile

(

Free Report)

Calix, Inc, together with its subsidiaries, engages in the provision of cloud and software platforms, and systems and services in the United States, rest of Americas, Europe, the Middle East, Africa, and the Asia Pacific. Its cloud and software platforms, and systems and services enable broadband service providers (BSPs) to provide a range of services.

Featured Articles

Before you consider Calix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Calix wasn't on the list.

While Calix currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.