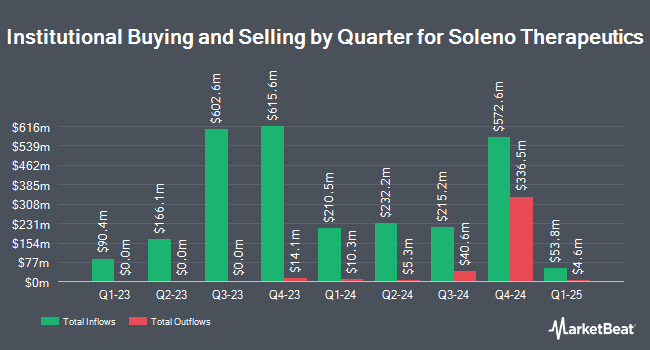

HighVista Strategies LLC acquired a new stake in Soleno Therapeutics, Inc. (NASDAQ:SLNO - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund acquired 11,085 shares of the company's stock, valued at approximately $560,000.

Several other institutional investors and hedge funds have also recently made changes to their positions in SLNO. Holocene Advisors LP raised its holdings in Soleno Therapeutics by 10.8% in the third quarter. Holocene Advisors LP now owns 594,364 shares of the company's stock worth $30,009,000 after purchasing an additional 57,913 shares in the last quarter. Checkpoint Capital L.P. raised its holdings in Soleno Therapeutics by 194.4% in the third quarter. Checkpoint Capital L.P. now owns 57,983 shares of the company's stock worth $2,928,000 after purchasing an additional 38,288 shares in the last quarter. Fred Alger Management LLC bought a new position in Soleno Therapeutics in the third quarter worth about $310,000. Martingale Asset Management L P bought a new position in Soleno Therapeutics in the third quarter worth about $1,110,000. Finally, Zurcher Kantonalbank Zurich Cantonalbank acquired a new position in shares of Soleno Therapeutics during the third quarter valued at about $155,000. 97.42% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

Several equities analysts have recently issued reports on SLNO shares. Cantor Fitzgerald restated an "overweight" rating and set a $67.00 price objective on shares of Soleno Therapeutics in a report on Friday, September 20th. Robert W. Baird restated an "outperform" rating and issued a $72.00 price objective on shares of Soleno Therapeutics in a research report on Monday. HC Wainwright reiterated a "buy" rating and set a $70.00 target price on shares of Soleno Therapeutics in a research report on Monday. Oppenheimer increased their target price on Soleno Therapeutics from $65.00 to $73.00 and gave the company an "outperform" rating in a research report on Monday, October 28th. Finally, Stifel Nicolaus reissued a "buy" rating and issued a $74.00 price objective on shares of Soleno Therapeutics in a research note on Monday. Six analysts have rated the stock with a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, Soleno Therapeutics currently has an average rating of "Buy" and an average target price of $74.83.

Get Our Latest Research Report on SLNO

Insiders Place Their Bets

In other news, CFO James H. Mackaness sold 8,077 shares of the business's stock in a transaction on Tuesday, October 1st. The stock was sold at an average price of $49.43, for a total value of $399,246.11. Following the completion of the transaction, the chief financial officer now directly owns 119,172 shares of the company's stock, valued at $5,890,671.96. The trade was a 6.35 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. Also, CEO Bhatnagar Anish sold 21,633 shares of the company's stock in a transaction on Tuesday, October 1st. The shares were sold at an average price of $49.43, for a total value of $1,069,319.19. Following the completion of the transaction, the chief executive officer now owns 719,553 shares of the company's stock, valued at $35,567,504.79. The trade was a 2.92 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 32,818 shares of company stock worth $1,622,194. 12.30% of the stock is owned by corporate insiders.

Soleno Therapeutics Price Performance

Shares of SLNO stock traded down $0.49 during midday trading on Wednesday, hitting $50.67. The company had a trading volume of 602,376 shares, compared to its average volume of 484,096. The company's 50 day simple moving average is $53.67 and its 200 day simple moving average is $48.75. Soleno Therapeutics, Inc. has a 52-week low of $27.27 and a 52-week high of $60.92. The stock has a market cap of $2.18 billion, a price-to-earnings ratio of -15.26 and a beta of -1.47.

Soleno Therapeutics (NASDAQ:SLNO - Get Free Report) last posted its quarterly earnings results on Wednesday, November 6th. The company reported ($1.83) earnings per share for the quarter, missing analysts' consensus estimates of ($0.61) by ($1.22). Analysts anticipate that Soleno Therapeutics, Inc. will post -3.76 EPS for the current year.

Soleno Therapeutics Company Profile

(

Free Report)

Soleno Therapeutics, Inc, a clinical-stage biopharmaceutical company, focuses on the development and commercialization of novel therapeutics for the treatment of rare diseases. Its lead candidate is Diazoxide Choline Extended-Release tablets, a once-daily oral tablet, which is in Phase III clinical trials for the treatment of Prader-Willi Syndrome.

Featured Articles

Before you consider Soleno Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Soleno Therapeutics wasn't on the list.

While Soleno Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.