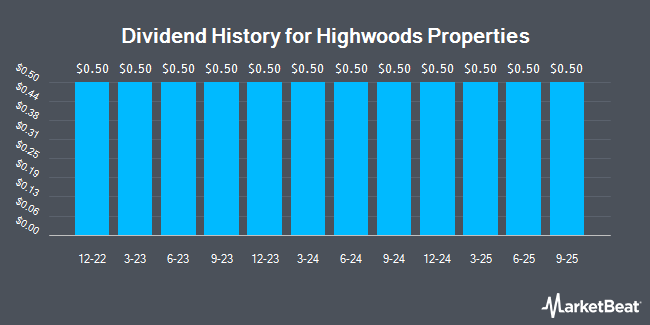

Highwoods Properties, Inc. (NYSE:HIW - Get Free Report) declared a quarterly dividend on Wednesday, January 29th,RTT News reports. Investors of record on Tuesday, February 18th will be given a dividend of 0.50 per share by the real estate investment trust on Tuesday, March 11th. This represents a $2.00 annualized dividend and a yield of 7.01%.

Highwoods Properties has increased its dividend payment by an average of 0.7% annually over the last three years. Highwoods Properties has a payout ratio of 350.9% meaning the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Research analysts expect Highwoods Properties to earn $3.44 per share next year, which means the company should continue to be able to cover its $2.00 annual dividend with an expected future payout ratio of 58.1%.

Highwoods Properties Stock Performance

NYSE HIW traded down $0.73 on Wednesday, hitting $28.54. 740,970 shares of the company traded hands, compared to its average volume of 785,698. The company has a market capitalization of $3.03 billion, a price-to-earnings ratio of 21.30 and a beta of 1.24. The company has a current ratio of 1.31, a quick ratio of 1.31 and a debt-to-equity ratio of 1.41. The business's 50 day moving average price is $30.58 and its 200-day moving average price is $31.63. Highwoods Properties has a 52-week low of $21.46 and a 52-week high of $36.78.

Wall Street Analyst Weigh In

Several equities analysts have recently commented on HIW shares. Mizuho boosted their price objective on Highwoods Properties from $24.00 to $29.00 and gave the company a "neutral" rating in a research report on Tuesday, January 7th. Deutsche Bank Aktiengesellschaft downgraded Highwoods Properties from a "buy" rating to a "hold" rating and boosted their price objective for the company from $31.00 to $35.00 in a research report on Tuesday, October 1st. Robert W. Baird boosted their price objective on Highwoods Properties from $30.00 to $32.00 and gave the company a "neutral" rating in a research report on Friday, November 1st. Wells Fargo & Company lifted their target price on Highwoods Properties from $32.00 to $35.00 and gave the stock an "equal weight" rating in a report on Monday, November 4th. Finally, Jefferies Financial Group reduced their target price on Highwoods Properties from $35.00 to $31.00 and set a "hold" rating on the stock in a report on Thursday, January 2nd. One investment analyst has rated the stock with a sell rating, five have given a hold rating and one has issued a buy rating to the company. Based on data from MarketBeat, Highwoods Properties presently has a consensus rating of "Hold" and an average target price of $30.86.

Read Our Latest Analysis on HIW

Highwoods Properties Company Profile

(

Get Free Report)

Highwoods Properties, Inc, headquartered in Raleigh, is a publicly-traded NYSE: HIW, fully-integrated office real estate investment trust (REIT) that owns, develops, acquires, leases and manages properties primarily in the best business districts (BBDs) of Atlanta, Charlotte, Dallas, Nashville, Orlando, Raleigh, Richmond and Tampa.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Highwoods Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Highwoods Properties wasn't on the list.

While Highwoods Properties currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.