StockNews.com upgraded shares of Highwoods Properties (NYSE:HIW - Free Report) from a sell rating to a hold rating in a research report released on Wednesday morning.

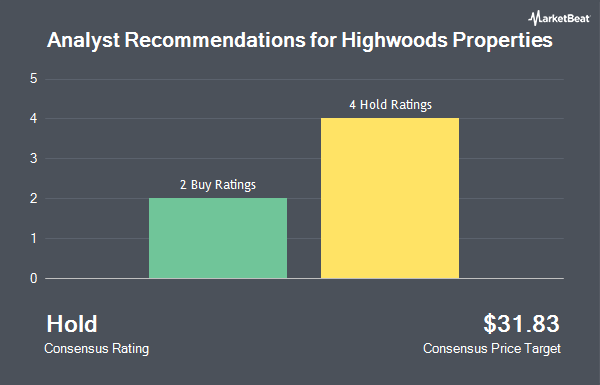

A number of other analysts also recently commented on the stock. Mizuho boosted their target price on shares of Highwoods Properties from $24.00 to $29.00 and gave the stock a "neutral" rating in a report on Tuesday, January 7th. Jefferies Financial Group dropped their target price on shares of Highwoods Properties from $35.00 to $31.00 and set a "hold" rating on the stock in a report on Thursday, January 2nd. Finally, Truist Financial dropped their target price on shares of Highwoods Properties from $33.00 to $32.00 and set a "buy" rating on the stock in a report on Thursday, February 13th. One analyst has rated the stock with a sell rating, six have assigned a hold rating and one has issued a buy rating to the company. Based on data from MarketBeat.com, Highwoods Properties presently has a consensus rating of "Hold" and a consensus price target of $30.71.

Read Our Latest Stock Analysis on Highwoods Properties

Highwoods Properties Stock Performance

Highwoods Properties stock traded up $0.96 during midday trading on Wednesday, reaching $29.45. 1,509,881 shares of the stock traded hands, compared to its average volume of 993,470. The company has a current ratio of 1.25, a quick ratio of 1.25 and a debt-to-equity ratio of 1.41. The firm has a fifty day moving average price of $29.37 and a two-hundred day moving average price of $31.43. The firm has a market cap of $3.17 billion, a price-to-earnings ratio of 31.00 and a beta of 1.25. Highwoods Properties has a fifty-two week low of $23.52 and a fifty-two week high of $36.78.

Highwoods Properties (NYSE:HIW - Get Free Report) last issued its quarterly earnings results on Tuesday, February 11th. The real estate investment trust reported $0.85 earnings per share for the quarter, hitting analysts' consensus estimates of $0.85. Highwoods Properties had a net margin of 12.37% and a return on equity of 4.33%. On average, equities research analysts forecast that Highwoods Properties will post 3.36 earnings per share for the current year.

Highwoods Properties Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, March 11th. Shareholders of record on Tuesday, February 18th will be issued a $0.50 dividend. This represents a $2.00 dividend on an annualized basis and a yield of 6.79%. The ex-dividend date of this dividend is Tuesday, February 18th. Highwoods Properties's dividend payout ratio (DPR) is presently 210.53%.

Institutional Trading of Highwoods Properties

A number of hedge funds have recently bought and sold shares of the stock. Wealth Enhancement Advisory Services LLC acquired a new stake in shares of Highwoods Properties during the 3rd quarter worth about $259,000. Van ECK Associates Corp grew its holdings in Highwoods Properties by 10.7% during the 3rd quarter. Van ECK Associates Corp now owns 19,856 shares of the real estate investment trust's stock worth $710,000 after acquiring an additional 1,914 shares during the last quarter. QRG Capital Management Inc. grew its holdings in Highwoods Properties by 7.7% during the 3rd quarter. QRG Capital Management Inc. now owns 25,099 shares of the real estate investment trust's stock worth $841,000 after acquiring an additional 1,795 shares during the last quarter. Harvest Portfolios Group Inc. grew its holdings in Highwoods Properties by 141.2% during the 3rd quarter. Harvest Portfolios Group Inc. now owns 36,647 shares of the real estate investment trust's stock worth $1,228,000 after acquiring an additional 21,455 shares during the last quarter. Finally, M&G PLC grew its holdings in Highwoods Properties by 26.8% during the 3rd quarter. M&G PLC now owns 631,159 shares of the real estate investment trust's stock worth $21,459,000 after acquiring an additional 133,575 shares during the last quarter. 96.31% of the stock is owned by institutional investors.

About Highwoods Properties

(

Get Free Report)

Highwoods Properties, Inc, headquartered in Raleigh, is a publicly-traded NYSE: HIW, fully-integrated office real estate investment trust (REIT) that owns, develops, acquires, leases and manages properties primarily in the best business districts (BBDs) of Atlanta, Charlotte, Dallas, Nashville, Orlando, Raleigh, Richmond and Tampa.

Featured Articles

Before you consider Highwoods Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Highwoods Properties wasn't on the list.

While Highwoods Properties currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.