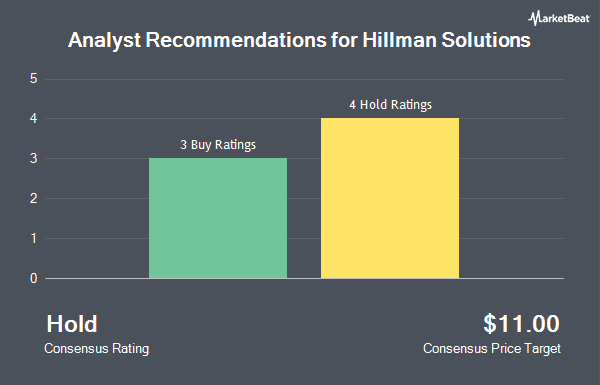

Shares of Hillman Solutions Corp (NASDAQ:HLMN - Get Free Report) have been assigned an average recommendation of "Moderate Buy" from the five brokerages that are currently covering the company, Marketbeat reports. One equities research analyst has rated the stock with a hold recommendation and four have assigned a buy recommendation to the company. The average 12 month price objective among analysts that have issued a report on the stock in the last year is $14.20.

A number of research firms recently weighed in on HLMN. Canaccord Genuity Group increased their price target on Hillman Solutions from $12.00 to $13.00 and gave the company a "buy" rating in a research note on Wednesday, October 16th. Robert W. Baird increased their price objective on shares of Hillman Solutions from $12.00 to $14.00 and gave the company an "outperform" rating in a research report on Wednesday, November 6th. Barclays lifted their target price on shares of Hillman Solutions from $10.00 to $12.00 and gave the stock an "equal weight" rating in a report on Wednesday, November 6th. Finally, Benchmark increased their price target on shares of Hillman Solutions from $13.00 to $16.00 and gave the company a "buy" rating in a report on Friday.

View Our Latest Stock Report on HLMN

Hillman Solutions Stock Performance

HLMN stock traded down $0.09 during trading hours on Friday, reaching $10.79. The stock had a trading volume of 1,110,468 shares, compared to its average volume of 879,427. The stock has a 50-day simple moving average of $10.88 and a 200 day simple moving average of $9.96. Hillman Solutions has a fifty-two week low of $8.32 and a fifty-two week high of $12.08. The stock has a market capitalization of $2.12 billion, a PE ratio of 269.75 and a beta of 1.65. The company has a debt-to-equity ratio of 0.62, a current ratio of 2.32 and a quick ratio of 0.76.

Hillman Solutions (NASDAQ:HLMN - Get Free Report) last issued its earnings results on Tuesday, November 5th. The company reported $0.16 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.16. The business had revenue of $393.30 million during the quarter, compared to the consensus estimate of $389.50 million. Hillman Solutions had a net margin of 0.57% and a return on equity of 8.81%. Hillman Solutions's revenue was down 1.4% on a year-over-year basis. During the same period last year, the business posted $0.11 EPS. Analysts predict that Hillman Solutions will post 0.53 EPS for the current fiscal year.

Insider Buying and Selling

In other news, Director Philip Woodlief sold 19,779 shares of the stock in a transaction on Friday, December 6th. The stock was sold at an average price of $11.18, for a total transaction of $221,129.22. Following the sale, the director now directly owns 55,811 shares of the company's stock, valued at approximately $623,966.98. This represents a 26.17 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, insider Scott Ride sold 72,523 shares of the business's stock in a transaction dated Monday, November 18th. The shares were sold at an average price of $10.66, for a total value of $773,095.18. Following the completion of the transaction, the insider now directly owns 70,369 shares of the company's stock, valued at approximately $750,133.54. This trade represents a 50.75 % decrease in their position. The disclosure for this sale can be found here. 5.10% of the stock is owned by insiders.

Institutional Inflows and Outflows

Hedge funds have recently added to or reduced their stakes in the company. First Horizon Advisors Inc. grew its position in Hillman Solutions by 231.7% in the third quarter. First Horizon Advisors Inc. now owns 3,317 shares of the company's stock valued at $35,000 after acquiring an additional 2,317 shares during the last quarter. Quarry LP bought a new stake in shares of Hillman Solutions during the 3rd quarter valued at approximately $43,000. Canada Pension Plan Investment Board acquired a new position in Hillman Solutions during the 2nd quarter worth approximately $57,000. Benjamin F. Edwards & Company Inc. lifted its stake in Hillman Solutions by 103.9% in the 2nd quarter. Benjamin F. Edwards & Company Inc. now owns 8,779 shares of the company's stock valued at $78,000 after purchasing an additional 4,473 shares during the last quarter. Finally, Institute for Wealth Management LLC. acquired a new stake in Hillman Solutions in the second quarter valued at approximately $101,000. 98.11% of the stock is owned by institutional investors.

Hillman Solutions Company Profile

(

Get Free ReportFounded in 1964 and headquartered in Cincinnati, Ohio, Hillman is a leading North American provider of complete hardware solutions, delivered with industry best customer service to over 40,000 locations. Hillman designs innovative product and merchandising solutions for complex categories that deliver an outstanding customer experience to home improvement centers, mass merchants, national and regional hardware stores, pet supply stores, and OEM & Industrial customers.

Further Reading

Before you consider Hillman Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hillman Solutions wasn't on the list.

While Hillman Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.