Hilltop Holdings Inc. boosted its holdings in shares of Texas Instruments Incorporated (NASDAQ:TXN - Free Report) by 27.1% in the third quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 29,072 shares of the semiconductor company's stock after buying an additional 6,203 shares during the quarter. Hilltop Holdings Inc.'s holdings in Texas Instruments were worth $6,005,000 at the end of the most recent reporting period.

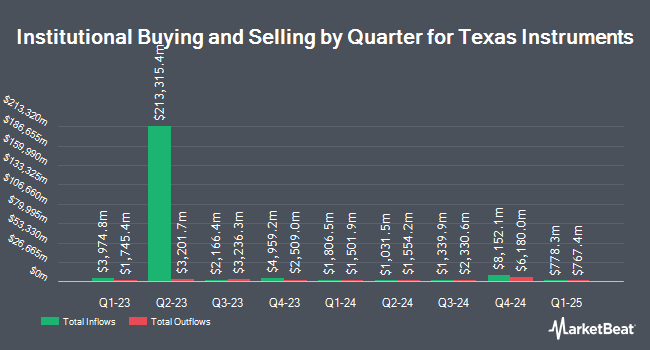

Other institutional investors also recently bought and sold shares of the company. MidAtlantic Capital Management Inc. purchased a new position in Texas Instruments in the 3rd quarter valued at about $28,000. Tsfg LLC lifted its stake in Texas Instruments by 82.0% during the third quarter. Tsfg LLC now owns 182 shares of the semiconductor company's stock worth $38,000 after purchasing an additional 82 shares in the last quarter. Capital Performance Advisors LLP acquired a new position in Texas Instruments in the 3rd quarter valued at about $39,000. FSA Wealth Management LLC acquired a new stake in Texas Instruments during the 3rd quarter worth approximately $41,000. Finally, McClarren Financial Advisors Inc. purchased a new stake in Texas Instruments during the 3rd quarter worth about $43,000. 84.99% of the stock is currently owned by hedge funds and other institutional investors.

Texas Instruments Stock Down 2.0 %

NASDAQ:TXN traded down $4.12 during trading hours on Tuesday, hitting $197.66. The stock had a trading volume of 2,365,835 shares, compared to its average volume of 6,068,400. Texas Instruments Incorporated has a 1-year low of $154.02 and a 1-year high of $220.38. The company has a current ratio of 4.31, a quick ratio of 3.14 and a debt-to-equity ratio of 0.74. The company has a market cap of $180.31 billion, a PE ratio of 36.74, a price-to-earnings-growth ratio of 4.41 and a beta of 0.97. The business has a 50 day simple moving average of $204.29 and a two-hundred day simple moving average of $200.89.

Texas Instruments (NASDAQ:TXN - Get Free Report) last released its earnings results on Tuesday, October 22nd. The semiconductor company reported $1.47 earnings per share for the quarter, topping the consensus estimate of $1.38 by $0.09. Texas Instruments had a net margin of 31.60% and a return on equity of 29.05%. The company had revenue of $4.15 billion during the quarter, compared to the consensus estimate of $4.12 billion. During the same quarter in the previous year, the firm earned $1.80 EPS. The company's revenue was down 8.4% on a year-over-year basis. Analysts predict that Texas Instruments Incorporated will post 5.08 EPS for the current year.

Texas Instruments Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Tuesday, November 12th. Shareholders of record on Thursday, October 31st were paid a $1.36 dividend. This is an increase from Texas Instruments's previous quarterly dividend of $1.30. This represents a $5.44 dividend on an annualized basis and a yield of 2.75%. The ex-dividend date was Thursday, October 31st. Texas Instruments's payout ratio is presently 101.12%.

Insider Activity

In other news, Director Robert E. Sanchez sold 9,990 shares of Texas Instruments stock in a transaction on Friday, October 25th. The stock was sold at an average price of $208.80, for a total transaction of $2,085,912.00. Following the transaction, the director now directly owns 20,461 shares in the company, valued at approximately $4,272,256.80. This trade represents a 32.81 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Ronald Kirk sold 10,539 shares of the firm's stock in a transaction dated Monday, November 25th. The shares were sold at an average price of $203.33, for a total value of $2,142,894.87. Following the transaction, the director now directly owns 14,323 shares of the company's stock, valued at $2,912,295.59. This represents a 42.39 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 0.68% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms recently commented on TXN. Morgan Stanley increased their target price on Texas Instruments from $154.00 to $167.00 and gave the company an "underweight" rating in a report on Wednesday, October 23rd. Barclays decreased their price target on shares of Texas Instruments from $210.00 to $200.00 and set an "equal weight" rating for the company in a research note on Wednesday, October 23rd. Susquehanna reduced their target price on shares of Texas Instruments from $250.00 to $240.00 and set a "positive" rating for the company in a report on Monday, October 21st. Robert W. Baird decreased their price objective on Texas Instruments from $200.00 to $175.00 and set a "neutral" rating for the company in a research report on Wednesday, October 23rd. Finally, Evercore ISI upped their price target on Texas Instruments from $268.00 to $298.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 23rd. Two equities research analysts have rated the stock with a sell rating, twelve have given a hold rating and nine have given a buy rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Hold" and an average target price of $210.05.

Read Our Latest Analysis on Texas Instruments

About Texas Instruments

(

Free Report)

Texas Instruments Incorporated designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States and internationally. The company operates through Analog and Embedded Processing segments. The Analog segment offers power products to manage power requirements across various voltage levels, including battery-management solutions, DC/DC switching regulators, AC/DC and isolated controllers and converters, power switches, linear regulators, voltage references, and lighting products.

Recommended Stories

Before you consider Texas Instruments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Texas Instruments wasn't on the list.

While Texas Instruments currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.