Robeco Institutional Asset Management B.V. increased its stake in Himax Technologies, Inc. (NASDAQ:HIMX - Free Report) by 32.4% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 1,665,858 shares of the semiconductor company's stock after purchasing an additional 407,400 shares during the period. Robeco Institutional Asset Management B.V. owned approximately 0.95% of Himax Technologies worth $9,162,000 as of its most recent filing with the Securities and Exchange Commission.

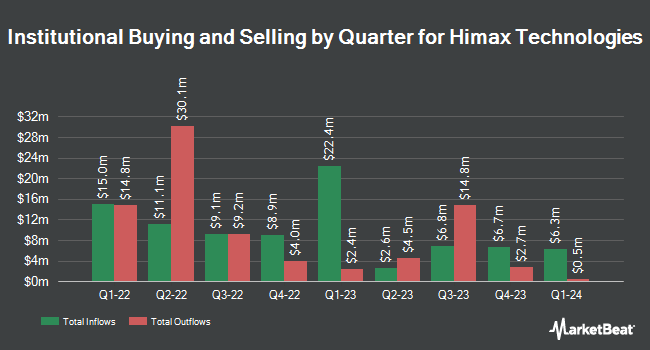

Other institutional investors have also made changes to their positions in the company. Allspring Global Investments Holdings LLC lifted its holdings in shares of Himax Technologies by 56.4% in the first quarter. Allspring Global Investments Holdings LLC now owns 6,897 shares of the semiconductor company's stock worth $37,000 after buying an additional 2,487 shares in the last quarter. Summit Securities Group LLC increased its stake in Himax Technologies by 1,400.0% during the second quarter. Summit Securities Group LLC now owns 4,500 shares of the semiconductor company's stock worth $36,000 after acquiring an additional 4,200 shares during the last quarter. Blue Trust Inc. grew its holdings in Himax Technologies by 77,712.5% during the 2nd quarter. Blue Trust Inc. now owns 6,225 shares of the semiconductor company's stock worth $49,000 after acquiring an additional 6,217 shares in the last quarter. SG Americas Securities LLC increased its holdings in Himax Technologies by 28.4% during the 2nd quarter. SG Americas Securities LLC now owns 31,728 shares of the semiconductor company's stock valued at $252,000 after acquiring an additional 7,013 shares in the last quarter. Finally, Susquehanna Fundamental Investments LLC purchased a new stake in shares of Himax Technologies during the second quarter worth about $79,000. Institutional investors own 69.81% of the company's stock.

Himax Technologies Stock Up 2.4 %

Shares of HIMX traded up $0.14 during mid-day trading on Friday, hitting $5.91. 608,753 shares of the company's stock were exchanged, compared to its average volume of 790,671. The company has a market cap of $1.03 billion, a PE ratio of 13.32 and a beta of 2.10. The company has a 50-day simple moving average of $5.78 and a 200 day simple moving average of $6.30. Himax Technologies, Inc. has a 52 week low of $4.80 and a 52 week high of $8.73. The company has a debt-to-equity ratio of 0.04, a current ratio of 1.58 and a quick ratio of 1.32.

Himax Technologies (NASDAQ:HIMX - Get Free Report) last issued its earnings results on Thursday, November 7th. The semiconductor company reported $0.07 EPS for the quarter, topping the consensus estimate of $0.04 by $0.03. The business had revenue of $222.40 million during the quarter, compared to the consensus estimate of $205.93 million. Himax Technologies had a return on equity of 8.94% and a net margin of 8.42%. The firm's revenue was down 6.8% compared to the same quarter last year. During the same quarter last year, the company earned $0.06 EPS.

Analysts Set New Price Targets

Separately, StockNews.com cut Himax Technologies from a "buy" rating to a "hold" rating in a research note on Friday, August 2nd.

Check Out Our Latest Stock Analysis on HIMX

About Himax Technologies

(

Free Report)

Himax Technologies, Inc, a fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States. The company operates in two segments, Driver IC and Non-Driver Products. It offers display driver integrated circuits (ICs) and timing controllers that are used in televisions, PC monitors, laptops, mobile phones, tablets, automotive, ePaper devices, industrial displays, and other products.

Featured Articles

Before you consider Himax Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Himax Technologies wasn't on the list.

While Himax Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.