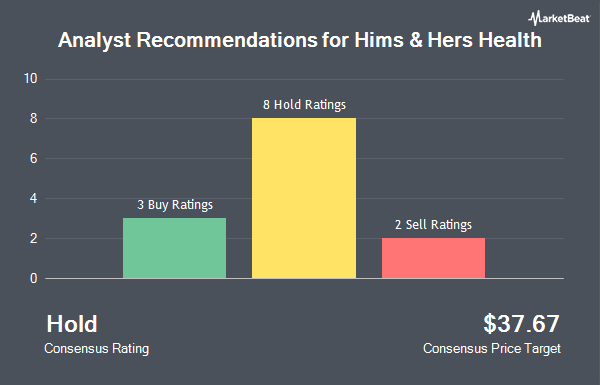

Hims & Hers Health, Inc. (NYSE:HIMS - Get Free Report) has received a consensus recommendation of "Hold" from the sixteen analysts that are currently covering the firm, MarketBeat Ratings reports. One investment analyst has rated the stock with a sell rating, eight have issued a hold rating and seven have issued a buy rating on the company. The average 1 year price target among brokerages that have updated their coverage on the stock in the last year is $21.43.

Several equities research analysts have recently issued reports on HIMS shares. Bank of America cut Hims & Hers Health from a "buy" rating to an "underperform" rating and reduced their target price for the stock from $32.00 to $18.00 in a report on Thursday, November 14th. Needham & Company LLC initiated coverage on Hims & Hers Health in a research report on Thursday, August 22nd. They set a "buy" rating and a $24.00 price target on the stock. Canaccord Genuity Group increased their target price on Hims & Hers Health from $28.00 to $38.00 and gave the company a "buy" rating in a research report on Monday, December 2nd. Deutsche Bank Aktiengesellschaft lifted their price objective on shares of Hims & Hers Health from $23.00 to $27.00 and gave the stock a "hold" rating in a research report on Wednesday, November 6th. Finally, TD Cowen restated a "buy" rating and set a $28.00 price target on shares of Hims & Hers Health in a research note on Wednesday, November 20th.

Read Our Latest Stock Analysis on HIMS

Hims & Hers Health Price Performance

NYSE HIMS traded up $1.21 on Monday, reaching $31.24. 9,315,207 shares of the company's stock traded hands, compared to its average volume of 9,926,419. The stock has a market cap of $6.82 billion, a PE ratio of 70.25 and a beta of 1.25. The stock has a 50-day simple moving average of $24.78 and a 200 day simple moving average of $20.98. Hims & Hers Health has a 12 month low of $8.09 and a 12 month high of $35.02.

Hims & Hers Health (NYSE:HIMS - Get Free Report) last announced its quarterly earnings data on Monday, November 4th. The company reported $0.32 EPS for the quarter, beating the consensus estimate of $0.06 by $0.26. Hims & Hers Health had a net margin of 8.19% and a return on equity of 10.97%. The company had revenue of $401.56 million for the quarter, compared to the consensus estimate of $382.20 million. During the same period in the prior year, the firm posted ($0.04) EPS. Hims & Hers Health's revenue for the quarter was up 77.1% on a year-over-year basis. As a group, analysts anticipate that Hims & Hers Health will post 0.29 EPS for the current year.

Insider Buying and Selling

In other news, insider Soleil Boughton sold 2,339 shares of the firm's stock in a transaction that occurred on Tuesday, September 17th. The shares were sold at an average price of $16.50, for a total transaction of $38,593.50. Following the completion of the sale, the insider now owns 176,952 shares of the company's stock, valued at approximately $2,919,708. This trade represents a 1.30 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Also, CEO Andrew Dudum sold 45,767 shares of the business's stock in a transaction on Friday, September 20th. The stock was sold at an average price of $16.33, for a total value of $747,375.11. Following the completion of the transaction, the chief executive officer now directly owns 67,015 shares in the company, valued at approximately $1,094,354.95. This represents a 40.58 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 1,067,315 shares of company stock valued at $25,435,489 over the last ninety days. 17.71% of the stock is owned by company insiders.

Hedge Funds Weigh In On Hims & Hers Health

Large investors have recently modified their holdings of the stock. Nisa Investment Advisors LLC boosted its stake in shares of Hims & Hers Health by 679.2% in the 2nd quarter. Nisa Investment Advisors LLC now owns 1,839 shares of the company's stock valued at $37,000 after purchasing an additional 1,603 shares during the last quarter. Quest Partners LLC lifted its stake in shares of Hims & Hers Health by 5,944.1% in the 2nd quarter. Quest Partners LLC now owns 3,566 shares of the company's stock valued at $72,000 after purchasing an additional 3,507 shares during the period. CWM LLC grew its stake in shares of Hims & Hers Health by 21.4% during the third quarter. CWM LLC now owns 5,982 shares of the company's stock worth $110,000 after purchasing an additional 1,054 shares during the period. Van ECK Associates Corp bought a new stake in shares of Hims & Hers Health in the 2nd quarter valued at about $111,000. Finally, Quarry LP raised its position in shares of Hims & Hers Health by 91.0% in the 3rd quarter. Quarry LP now owns 6,113 shares of the company's stock valued at $113,000 after acquiring an additional 2,913 shares during the period. 63.52% of the stock is currently owned by institutional investors and hedge funds.

Hims & Hers Health Company Profile

(

Get Free ReportHims & Hers Health, Inc operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally. The company offers a range of curated prescription and non-prescription health and wellness products and services available to purchase on its websites and mobile application directly by customers.

Featured Articles

Before you consider Hims & Hers Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hims & Hers Health wasn't on the list.

While Hims & Hers Health currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.