Hitachi (OTCMKTS:HTHIY - Get Free Report) is projected to release its earnings data on Friday, April 25th. Analysts expect Hitachi to post earnings of $0.31 per share and revenue of $2,735.45 billion for the quarter. Hitachi has set its FY 2024 guidance at 0.910-0.910 EPS.Persons interested in listening to the company's earnings conference call can do so using this link.

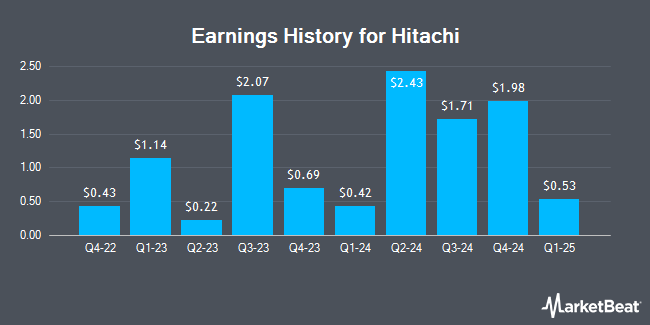

Hitachi (OTCMKTS:HTHIY - Get Free Report) last announced its quarterly earnings data on Friday, January 31st. The conglomerate reported $1.98 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.46 by $1.52. Hitachi had a net margin of 6.03% and a return on equity of 9.65%. On average, analysts expect Hitachi to post $0 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Hitachi Price Performance

OTCMKTS:HTHIY traded up $1.09 during trading hours on Friday, reaching $23.89. 390,920 shares of the company's stock were exchanged, compared to its average volume of 340,441. The company has a market capitalization of $109.42 billion, a P/E ratio of 7.31, a price-to-earnings-growth ratio of 3.43 and a beta of 0.75. Hitachi has a 12 month low of $16.80 and a 12 month high of $29.99. The business's 50-day simple moving average is $27.87 and its two-hundred day simple moving average is $42.92. The company has a quick ratio of 0.81, a current ratio of 1.08 and a debt-to-equity ratio of 0.13.

About Hitachi

(

Get Free Report)

Hitachi, Ltd. provides digital system and services, green energy and mobility, and connective industry solutions in Japan and internationally. It operates through seven segments: Digital Systems & Services, Green Energy & Mobility, Connective Industries, Automotive System, Hitachi Construction Machinery, Hitachi Metals, and Others.

Further Reading

Before you consider Hitachi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hitachi wasn't on the list.

While Hitachi currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.