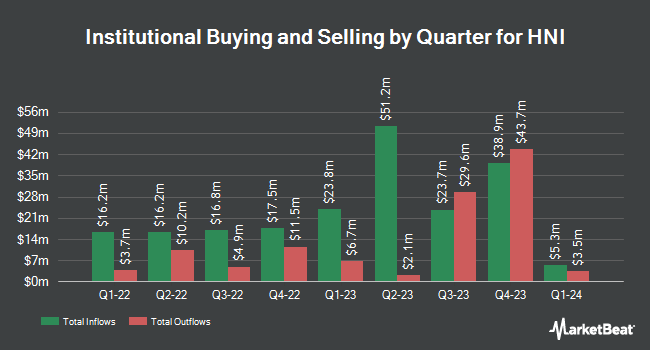

Vanguard Group Inc. grew its position in HNI Co. (NYSE:HNI - Free Report) by 1.1% in the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 5,718,014 shares of the business services provider's stock after acquiring an additional 62,476 shares during the period. Vanguard Group Inc. owned about 11.96% of HNI worth $288,016,000 at the end of the most recent quarter.

Several other institutional investors also recently modified their holdings of HNI. Smartleaf Asset Management LLC raised its stake in HNI by 85.1% in the 4th quarter. Smartleaf Asset Management LLC now owns 561 shares of the business services provider's stock valued at $28,000 after acquiring an additional 258 shares during the period. Vestcor Inc bought a new position in shares of HNI in the fourth quarter valued at about $176,000. Longboard Asset Management LP acquired a new stake in shares of HNI during the 4th quarter worth about $213,000. Cibc World Markets Corp acquired a new stake in shares of HNI during the 4th quarter worth about $224,000. Finally, Contravisory Investment Management Inc. grew its stake in HNI by 5.1% in the 4th quarter. Contravisory Investment Management Inc. now owns 4,501 shares of the business services provider's stock valued at $227,000 after buying an additional 220 shares during the last quarter. 75.26% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Separately, StockNews.com lowered HNI from a "strong-buy" rating to a "buy" rating in a research note on Friday, February 21st.

Get Our Latest Stock Report on HNI

Insiders Place Their Bets

In other news, insider Brian Scott Smith sold 556 shares of the firm's stock in a transaction dated Tuesday, February 18th. The stock was sold at an average price of $49.90, for a total value of $27,744.40. Following the completion of the sale, the insider now directly owns 14,394 shares in the company, valued at $718,260.60. This trade represents a 3.72 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at this link. 3.37% of the stock is currently owned by corporate insiders.

HNI Price Performance

HNI traded up $2.99 during trading on Wednesday, hitting $43.25. 411,803 shares of the stock traded hands, compared to its average volume of 297,039. The business has a 50 day moving average price of $45.59 and a 200 day moving average price of $50.18. The company has a debt-to-equity ratio of 0.36, a current ratio of 1.10 and a quick ratio of 0.68. HNI Co. has a twelve month low of $39.77 and a twelve month high of $58.42. The company has a market cap of $2.03 billion, a price-to-earnings ratio of 14.97, a PEG ratio of 1.14 and a beta of 0.78.

HNI (NYSE:HNI - Get Free Report) last announced its quarterly earnings results on Thursday, February 20th. The business services provider reported $0.87 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.74 by $0.13. The company had revenue of $642.50 million for the quarter, compared to analyst estimates of $657.03 million. HNI had a net margin of 5.52% and a return on equity of 18.27%. Equities research analysts forecast that HNI Co. will post 3.6 earnings per share for the current fiscal year.

HNI Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Wednesday, March 5th. Shareholders of record on Monday, February 24th were issued a $0.33 dividend. The ex-dividend date of this dividend was Monday, February 24th. This represents a $1.32 dividend on an annualized basis and a yield of 3.05%. HNI's payout ratio is currently 45.67%.

About HNI

(

Free Report)

HNI Corporation, together with its subsidiaries, engages in the manufacture, sale, and marketing of workplace furnishings and residential building products primarily in the United States and Canada. The company operates through two segments, Workplace Furnishings and Residential Building Products. The Workplace Furnishings segment offers a range of commercial and home office furniture, including panel-based and freestanding furniture systems, seating, storage, benching, tables, architectural products, and ancillary and hospitality products, as well as social collaborative items under the HON, Allsteel, Beyond, Gunlocke, HBF, HBF Textiles, HNI India, Kimball, National, Etc., Interwoven, David Edward, Kimball Hospitality, and D'style brands.

Featured Stories

Before you consider HNI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HNI wasn't on the list.

While HNI currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.