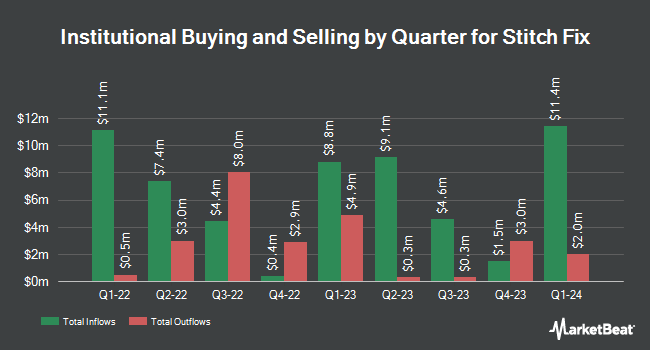

Hodges Capital Management Inc. boosted its holdings in shares of Stitch Fix, Inc. (NASDAQ:SFIX - Free Report) by 34.4% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The firm owned 3,375,200 shares of the company's stock after buying an additional 864,100 shares during the period. Hodges Capital Management Inc. owned approximately 2.66% of Stitch Fix worth $9,518,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors have also added to or reduced their stakes in SFIX. Disciplined Growth Investors Inc. MN lifted its stake in Stitch Fix by 34.9% in the second quarter. Disciplined Growth Investors Inc. MN now owns 9,273,817 shares of the company's stock worth $38,486,000 after purchasing an additional 2,396,920 shares during the last quarter. Renaissance Technologies LLC lifted its position in Stitch Fix by 11.7% in the second quarter. Renaissance Technologies LLC now owns 4,432,600 shares of the company's stock valued at $18,395,000 after purchasing an additional 465,900 shares during the last quarter. Jacobs Levy Equity Management Inc. purchased a new position in shares of Stitch Fix in the third quarter worth $2,862,000. Connor Clark & Lunn Investment Management Ltd. boosted its position in Stitch Fix by 32.0% during the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 499,142 shares of the company's stock valued at $1,408,000 after buying an additional 121,084 shares during the period. Finally, Captrust Financial Advisors boosted its holdings in shares of Stitch Fix by 14.6% during the third quarter. Captrust Financial Advisors now owns 337,846 shares of the company's stock worth $953,000 after purchasing an additional 42,939 shares during the period. 71.04% of the stock is currently owned by hedge funds and other institutional investors.

Stitch Fix Stock Performance

Shares of SFIX traded up $0.10 during trading hours on Friday, hitting $4.63. The company had a trading volume of 1,841,204 shares, compared to its average volume of 1,333,751. The stock has a market capitalization of $587.27 million, a price-to-earnings ratio of -4.29 and a beta of 1.99. The firm has a fifty day moving average price of $3.50 and a 200-day moving average price of $3.65. Stitch Fix, Inc. has a 52-week low of $2.06 and a 52-week high of $5.05.

Stitch Fix (NASDAQ:SFIX - Get Free Report) last issued its earnings results on Tuesday, September 24th. The company reported ($0.12) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.19) by $0.07. Stitch Fix had a negative net margin of 9.63% and a negative return on equity of 40.62%. The firm had revenue of $319.55 million for the quarter, compared to the consensus estimate of $317.48 million. Research analysts anticipate that Stitch Fix, Inc. will post -0.61 earnings per share for the current fiscal year.

Analysts Set New Price Targets

A number of analysts recently commented on SFIX shares. UBS Group raised their price target on Stitch Fix from $2.80 to $5.00 and gave the stock a "neutral" rating in a research note on Wednesday. Canaccord Genuity Group increased their price target on shares of Stitch Fix from $3.50 to $5.00 and gave the stock a "hold" rating in a research note on Monday, December 2nd. Finally, Telsey Advisory Group reaffirmed a "market perform" rating and set a $4.00 price objective on shares of Stitch Fix in a research report on Wednesday. Two analysts have rated the stock with a sell rating and eight have given a hold rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Hold" and an average price target of $3.57.

Check Out Our Latest Report on SFIX

About Stitch Fix

(

Free Report)

Stitch Fix, Inc sells a range of apparel, shoes, and accessories for men, women, and kids through its website and mobile application in the United States and the United Kingdom. It offers denim, dresses, blouses, skirts, shoes, jewelry, and handbags under the Stitch Fix brand. The company was formerly known as rack habit inc.

Featured Stories

Before you consider Stitch Fix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stitch Fix wasn't on the list.

While Stitch Fix currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.