Hodges Capital Management Inc. decreased its position in AGCO Co. (NYSE:AGCO - Free Report) by 56.3% during the 3rd quarter, according to its most recent filing with the SEC. The institutional investor owned 7,654 shares of the industrial products company's stock after selling 9,866 shares during the period. Hodges Capital Management Inc.'s holdings in AGCO were worth $749,000 as of its most recent filing with the SEC.

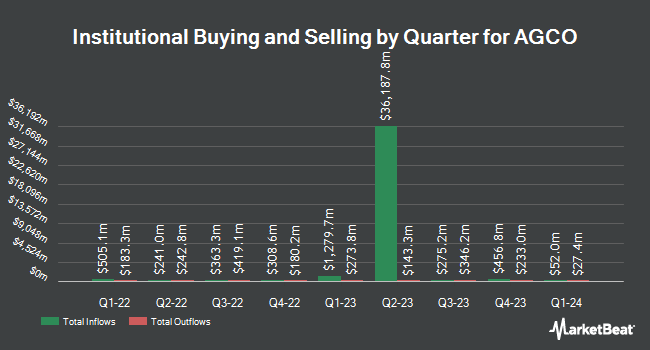

Several other institutional investors have also recently bought and sold shares of the company. Forum Financial Management LP lifted its stake in AGCO by 5.5% in the 2nd quarter. Forum Financial Management LP now owns 2,108 shares of the industrial products company's stock valued at $206,000 after acquiring an additional 109 shares in the last quarter. Capital Insight Partners LLC raised its position in AGCO by 2.6% during the second quarter. Capital Insight Partners LLC now owns 4,401 shares of the industrial products company's stock worth $431,000 after acquiring an additional 110 shares in the last quarter. First Horizon Advisors Inc. lifted its stake in AGCO by 28.6% in the third quarter. First Horizon Advisors Inc. now owns 526 shares of the industrial products company's stock valued at $51,000 after acquiring an additional 117 shares during the last quarter. Oppenheimer & Co. Inc. grew its position in shares of AGCO by 0.7% in the 3rd quarter. Oppenheimer & Co. Inc. now owns 17,022 shares of the industrial products company's stock valued at $1,666,000 after acquiring an additional 126 shares during the period. Finally, Farther Finance Advisors LLC increased its stake in shares of AGCO by 50.2% during the 3rd quarter. Farther Finance Advisors LLC now owns 416 shares of the industrial products company's stock worth $41,000 after purchasing an additional 139 shares during the last quarter. Institutional investors own 78.80% of the company's stock.

AGCO Stock Performance

Shares of NYSE:AGCO traded up $3.21 on Monday, reaching $99.66. 1,290,534 shares of the company's stock were exchanged, compared to its average volume of 789,893. The company has a fifty day moving average of $97.55 and a 200-day moving average of $96.52. AGCO Co. has a twelve month low of $84.35 and a twelve month high of $130.26. The company has a market capitalization of $7.44 billion, a price-to-earnings ratio of 44.10, a PEG ratio of 0.55 and a beta of 1.24. The company has a current ratio of 1.53, a quick ratio of 0.72 and a debt-to-equity ratio of 0.87.

AGCO (NYSE:AGCO - Get Free Report) last announced its earnings results on Tuesday, November 5th. The industrial products company reported $0.68 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.08 by ($0.40). AGCO had a return on equity of 15.79% and a net margin of 1.35%. The business had revenue of $2.60 billion for the quarter, compared to analyst estimates of $2.90 billion. During the same quarter in the previous year, the company earned $3.97 EPS. The business's revenue for the quarter was down 24.8% on a year-over-year basis. On average, research analysts predict that AGCO Co. will post 7.36 EPS for the current fiscal year.

AGCO Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Friday, November 15th will be given a dividend of $0.29 per share. The ex-dividend date is Friday, November 15th. This represents a $1.16 annualized dividend and a dividend yield of 1.16%. AGCO's dividend payout ratio is 51.33%.

Analyst Upgrades and Downgrades

AGCO has been the topic of a number of research analyst reports. Morgan Stanley initiated coverage on shares of AGCO in a report on Tuesday, December 3rd. They issued an "equal weight" rating and a $101.00 target price on the stock. Citigroup upped their target price on shares of AGCO from $95.00 to $100.00 and gave the company a "neutral" rating in a report on Monday. Oppenheimer dropped their target price on shares of AGCO from $131.00 to $111.00 and set an "outperform" rating on the stock in a report on Wednesday, November 6th. The Goldman Sachs Group dropped their target price on shares of AGCO from $112.00 to $99.00 and set a "neutral" rating on the stock in a report on Wednesday, November 6th. Finally, Truist Financial increased their price target on shares of AGCO from $118.00 to $127.00 and gave the company a "buy" rating in a report on Wednesday, October 9th. One research analyst has rated the stock with a sell rating, seven have assigned a hold rating and five have given a buy rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and an average price target of $113.18.

Get Our Latest Report on AGCO

AGCO Profile

(

Free Report)

AGCO Corporation manufactures and distributes agricultural equipment and related replacement parts worldwide. It offers horsepower tractors for row crop production, soil cultivation, planting, land leveling, seeding, and commercial hay operations; utility tractors for small- and medium-sized farms, as well as for dairy, livestock, orchards, and vineyards; and compact tractors for small farms, specialty agricultural industries, landscaping, equestrian, and residential uses.

Further Reading

Before you consider AGCO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AGCO wasn't on the list.

While AGCO currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.