Holocene Advisors LP raised its stake in Camping World Holdings, Inc. (NYSE:CWH - Free Report) by 75.8% during the third quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 107,347 shares of the company's stock after acquiring an additional 46,273 shares during the period. Holocene Advisors LP owned approximately 0.13% of Camping World worth $2,600,000 as of its most recent SEC filing.

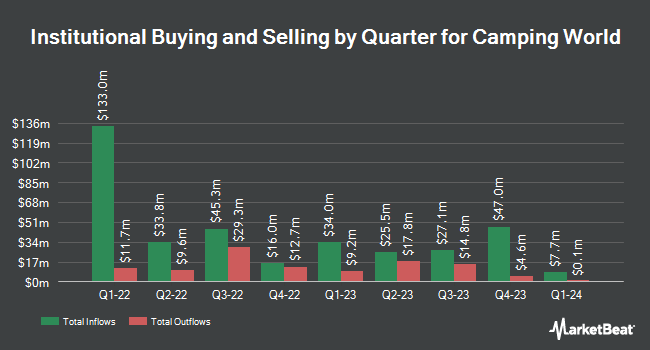

Other hedge funds have also bought and sold shares of the company. Coronation Fund Managers Ltd. lifted its holdings in shares of Camping World by 42.8% in the 2nd quarter. Coronation Fund Managers Ltd. now owns 228,676 shares of the company's stock valued at $4,084,000 after acquiring an additional 68,517 shares during the last quarter. Citigroup Inc. lifted its position in Camping World by 22.6% in the third quarter. Citigroup Inc. now owns 360,258 shares of the company's stock worth $8,725,000 after buying an additional 66,355 shares during the last quarter. Eminence Capital LP lifted its position in Camping World by 79.8% in the second quarter. Eminence Capital LP now owns 4,344,303 shares of the company's stock worth $77,589,000 after buying an additional 1,927,977 shares during the last quarter. Cubist Systematic Strategies LLC boosted its stake in Camping World by 419.3% during the second quarter. Cubist Systematic Strategies LLC now owns 48,812 shares of the company's stock worth $872,000 after buying an additional 39,412 shares during the period. Finally, Verdence Capital Advisors LLC increased its position in Camping World by 17.3% during the second quarter. Verdence Capital Advisors LLC now owns 61,638 shares of the company's stock valued at $1,101,000 after acquiring an additional 9,086 shares during the last quarter. Hedge funds and other institutional investors own 52.54% of the company's stock.

Insider Activity at Camping World

In related news, CEO Marcus Lemonis sold 125,000 shares of Camping World stock in a transaction that occurred on Friday, September 13th. The shares were sold at an average price of $22.84, for a total transaction of $2,855,000.00. Following the transaction, the chief executive officer now directly owns 155,268 shares of the company's stock, valued at $3,546,321.12. This trade represents a 44.60 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through this link. 43.80% of the stock is currently owned by corporate insiders.

Wall Street Analyst Weigh In

Several equities research analysts have recently issued reports on the stock. Truist Financial raised their target price on shares of Camping World from $26.00 to $28.00 and gave the stock a "buy" rating in a report on Friday, September 20th. Raymond James upgraded Camping World from a "market perform" rating to an "outperform" rating and set a $27.00 target price for the company in a research report on Wednesday, October 30th. JPMorgan Chase & Co. reiterated a "neutral" rating and issued a $24.00 price target (down from $25.00) on shares of Camping World in a report on Monday, October 21st. Monness Crespi & Hardt raised their price target on Camping World from $24.00 to $30.00 and gave the stock a "buy" rating in a research note on Friday, September 27th. Finally, StockNews.com raised Camping World from a "sell" rating to a "hold" rating in a research report on Thursday, November 14th. Two analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $27.75.

Get Our Latest Research Report on Camping World

Camping World Trading Up 2.9 %

NYSE:CWH traded up $0.70 during midday trading on Friday, hitting $24.69. The stock had a trading volume of 1,142,967 shares, compared to its average volume of 1,093,837. The company has a quick ratio of 0.19, a current ratio of 1.23 and a debt-to-equity ratio of 9.67. The stock has a 50-day moving average of $23.11 and a 200 day moving average of $21.51. The company has a market capitalization of $2.10 billion, a price-to-earnings ratio of -34.75 and a beta of 2.49. Camping World Holdings, Inc. has a one year low of $17.29 and a one year high of $28.72.

Camping World Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Monday, December 30th. Stockholders of record on Friday, December 13th will be paid a dividend of $0.125 per share. The ex-dividend date of this dividend is Friday, December 13th. This represents a $0.50 annualized dividend and a dividend yield of 2.03%. Camping World's dividend payout ratio is currently -72.46%.

Camping World Company Profile

(

Free Report)

Camping World Holdings, Inc, together its subsidiaries, retails recreational vehicles (RVs), and related products and services in the United States. It operates in two segments, Good Sam Services and Plans; and RV and Outdoor Retail. The company provides a portfolio of services, protection plans, products, and resources in the RV industry.

Featured Articles

Before you consider Camping World, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Camping World wasn't on the list.

While Camping World currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.