Holocene Advisors LP acquired a new position in Coty Inc. (NYSE:COTY - Free Report) during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm acquired 189,580 shares of the company's stock, valued at approximately $1,780,000.

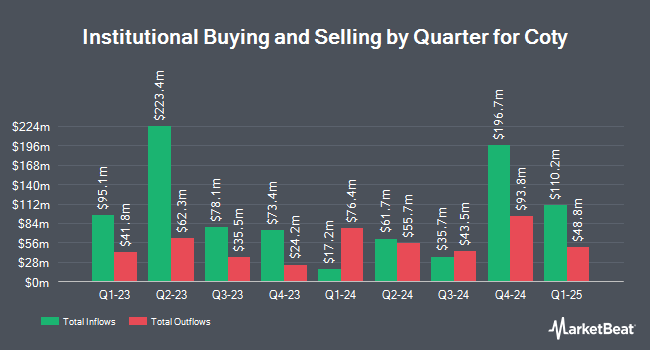

A number of other institutional investors and hedge funds also recently made changes to their positions in COTY. Point72 Asset Management L.P. raised its position in Coty by 789.3% in the second quarter. Point72 Asset Management L.P. now owns 5,582,064 shares of the company's stock worth $55,932,000 after acquiring an additional 4,954,362 shares during the period. SG Americas Securities LLC increased its stake in shares of Coty by 1,798.5% in the 3rd quarter. SG Americas Securities LLC now owns 1,847,328 shares of the company's stock worth $17,346,000 after purchasing an additional 1,750,021 shares in the last quarter. Vaughan Nelson Investment Management L.P. raised its holdings in Coty by 42.6% in the 3rd quarter. Vaughan Nelson Investment Management L.P. now owns 5,642,602 shares of the company's stock worth $52,984,000 after purchasing an additional 1,687,045 shares during the period. Assenagon Asset Management S.A. lifted its position in Coty by 733.0% during the second quarter. Assenagon Asset Management S.A. now owns 1,900,000 shares of the company's stock valued at $19,038,000 after purchasing an additional 1,671,897 shares in the last quarter. Finally, Dimensional Fund Advisors LP lifted its position in Coty by 10.5% during the second quarter. Dimensional Fund Advisors LP now owns 9,387,661 shares of the company's stock valued at $94,068,000 after purchasing an additional 890,626 shares in the last quarter. Hedge funds and other institutional investors own 42.36% of the company's stock.

Coty Price Performance

Shares of COTY stock traded down $0.03 during trading hours on Friday, hitting $7.61. The stock had a trading volume of 5,157,890 shares, compared to its average volume of 5,205,523. The company has a debt-to-equity ratio of 0.93, a current ratio of 0.85 and a quick ratio of 0.55. The stock has a market capitalization of $6.62 billion, a price-to-earnings ratio of 44.76, a PEG ratio of 0.76 and a beta of 1.89. Coty Inc. has a one year low of $6.93 and a one year high of $13.30. The stock's 50-day moving average price is $7.85 and its two-hundred day moving average price is $9.06.

Coty (NYSE:COTY - Get Free Report) last released its quarterly earnings data on Wednesday, November 6th. The company reported $0.15 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.19 by ($0.04). The firm had revenue of $1.67 billion during the quarter, compared to the consensus estimate of $1.67 billion. Coty had a return on equity of 9.16% and a net margin of 2.78%. The business's revenue was up 1.8% compared to the same quarter last year. During the same period in the previous year, the firm earned $0.09 EPS. Equities analysts forecast that Coty Inc. will post 0.51 EPS for the current year.

Wall Street Analyst Weigh In

Several research firms have recently commented on COTY. Deutsche Bank Aktiengesellschaft decreased their price objective on Coty from $14.00 to $12.00 and set a "buy" rating on the stock in a research note on Wednesday, October 16th. JPMorgan Chase & Co. reduced their target price on shares of Coty from $11.00 to $10.00 and set a "neutral" rating for the company in a report on Tuesday, October 15th. Evercore ISI reaffirmed an "outperform" rating and set a $15.00 price target on shares of Coty in a report on Wednesday, August 21st. Canaccord Genuity Group reiterated a "buy" rating and issued a $14.00 price target on shares of Coty in a research report on Tuesday, October 15th. Finally, TD Cowen downgraded shares of Coty from a "buy" rating to a "hold" rating and decreased their price objective for the company from $11.00 to $8.50 in a research report on Wednesday, November 13th. One analyst has rated the stock with a sell rating, five have issued a hold rating and ten have given a buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus target price of $11.56.

View Our Latest Analysis on COTY

Coty Company Profile

(

Free Report)

Coty Inc, together with its subsidiaries, manufactures, markets, distributes, and sells beauty products worldwide. It operates through Prestige and Consumer Beauty segments. The company provides fragrance, color cosmetics, and skin and body care products. It offers Prestige segment products primarily through prestige retailers, including perfumeries, department stores, e-retailers, direct-to-consumer websites, and duty-free shops under the Burberry, Calvin Klein, Chloe, Davidoff, Escada, Gucci, Hugo Boss, Jil Sander, Joop!, Kylie Jenner, Lancaster, Marc Jacobs, Miu Miu, Orveda, philosophy, SKKN BY KIM, and Tiffany & Co brands.

Recommended Stories

Before you consider Coty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coty wasn't on the list.

While Coty currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.