Holocene Advisors LP acquired a new stake in shares of Mercury Systems, Inc. (NASDAQ:MRCY - Free Report) in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor acquired 27,366 shares of the technology company's stock, valued at approximately $1,013,000.

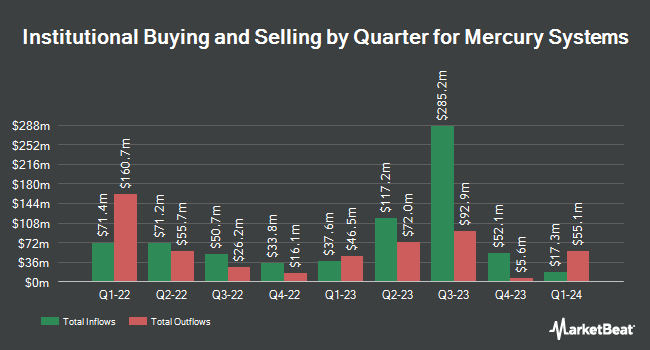

A number of other large investors have also made changes to their positions in MRCY. Price T Rowe Associates Inc. MD raised its position in shares of Mercury Systems by 5.5% during the first quarter. Price T Rowe Associates Inc. MD now owns 34,026 shares of the technology company's stock valued at $1,004,000 after buying an additional 1,760 shares during the last quarter. DekaBank Deutsche Girozentrale raised its position in Mercury Systems by 26.6% in the first quarter. DekaBank Deutsche Girozentrale now owns 5,826 shares of the technology company's stock worth $167,000 after purchasing an additional 1,223 shares in the last quarter. CWM LLC raised its position in Mercury Systems by 118.5% in the second quarter. CWM LLC now owns 11,493 shares of the technology company's stock worth $310,000 after purchasing an additional 6,232 shares in the last quarter. SG Americas Securities LLC acquired a new position in Mercury Systems in the second quarter worth about $401,000. Finally, Hunter Perkins Capital Management LLC raised its position in Mercury Systems by 24.5% in the second quarter. Hunter Perkins Capital Management LLC now owns 25,271 shares of the technology company's stock worth $682,000 after purchasing an additional 4,971 shares in the last quarter. Institutional investors and hedge funds own 95.99% of the company's stock.

Insider Activity

In other news, COO Charles Roger Iv Wells sold 1,527 shares of the stock in a transaction that occurred on Monday, November 18th. The shares were sold at an average price of $38.80, for a total transaction of $59,247.60. Following the sale, the chief operating officer now directly owns 113,488 shares of the company's stock, valued at $4,403,334.40. This represents a 1.33 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 1.60% of the stock is owned by insiders.

Mercury Systems Price Performance

Mercury Systems stock traded down $0.05 during trading hours on Friday, hitting $38.32. 362,297 shares of the stock were exchanged, compared to its average volume of 487,496. The company has a debt-to-equity ratio of 0.41, a quick ratio of 2.59 and a current ratio of 4.10. The stock has a market capitalization of $2.29 billion, a P/E ratio of -18.69 and a beta of 0.78. Mercury Systems, Inc. has a 12 month low of $25.31 and a 12 month high of $44.63. The business's 50-day moving average is $37.68 and its two-hundred day moving average is $34.91.

Wall Street Analysts Forecast Growth

Several research analysts recently issued reports on MRCY shares. StockNews.com raised shares of Mercury Systems from a "sell" rating to a "hold" rating in a research report on Thursday. Jefferies Financial Group raised shares of Mercury Systems from an "underperform" rating to a "hold" rating and increased their price target for the stock from $30.00 to $42.00 in a research report on Monday, November 11th. Royal Bank of Canada increased their price target on shares of Mercury Systems from $30.00 to $35.00 and gave the stock a "sector perform" rating in a research report on Wednesday, August 14th. JPMorgan Chase & Co. increased their price target on shares of Mercury Systems from $36.00 to $40.00 and gave the stock a "neutral" rating in a research report on Thursday, November 7th. Finally, Robert W. Baird upped their price objective on shares of Mercury Systems from $26.00 to $37.00 and gave the stock a "neutral" rating in a research note on Wednesday, August 14th. One research analyst has rated the stock with a sell rating, six have issued a hold rating and one has assigned a buy rating to the company's stock. According to MarketBeat, Mercury Systems presently has an average rating of "Hold" and a consensus target price of $36.29.

Read Our Latest Analysis on Mercury Systems

Mercury Systems Company Profile

(

Free Report)

Mercury Systems, Inc, a technology company, manufactures and sells components, products, modules, and subsystems for aerospace and defense industries in the United States, Europe, and the Asia Pacific. Its products and solutions are deployed in approximately 300 programs with 25 defense contractors and commercial aviation customers.

Featured Stories

Before you consider Mercury Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mercury Systems wasn't on the list.

While Mercury Systems currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.