Holocene Advisors LP boosted its position in Iridium Communications Inc. (NASDAQ:IRDM - Free Report) by 57.0% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 124,135 shares of the technology company's stock after acquiring an additional 45,085 shares during the quarter. Holocene Advisors LP owned 0.11% of Iridium Communications worth $3,780,000 at the end of the most recent reporting period.

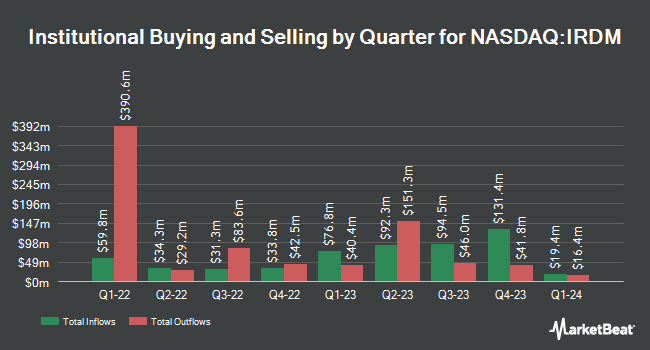

Other institutional investors have also added to or reduced their stakes in the company. Victory Capital Management Inc. boosted its stake in shares of Iridium Communications by 6,491.3% in the 2nd quarter. Victory Capital Management Inc. now owns 1,598,532 shares of the technology company's stock valued at $42,553,000 after purchasing an additional 1,574,280 shares in the last quarter. Sumitomo Mitsui Trust Holdings Inc. lifted its stake in Iridium Communications by 18.5% in the 2nd quarter. Sumitomo Mitsui Trust Holdings Inc. now owns 2,475,472 shares of the technology company's stock valued at $65,897,000 after purchasing an additional 385,872 shares during the last quarter. American Century Companies Inc. boosted its position in Iridium Communications by 429.2% in the second quarter. American Century Companies Inc. now owns 334,396 shares of the technology company's stock valued at $8,902,000 after buying an additional 271,203 shares in the last quarter. FMR LLC grew its stake in shares of Iridium Communications by 26.7% during the third quarter. FMR LLC now owns 942,380 shares of the technology company's stock worth $28,695,000 after buying an additional 198,360 shares during the last quarter. Finally, Van Berkom & Associates Inc. increased its holdings in shares of Iridium Communications by 4.6% during the second quarter. Van Berkom & Associates Inc. now owns 3,480,051 shares of the technology company's stock worth $92,639,000 after buying an additional 152,232 shares in the last quarter. 84.36% of the stock is currently owned by institutional investors and hedge funds.

Iridium Communications Trading Up 2.6 %

Shares of NASDAQ:IRDM traded up $0.79 during mid-day trading on Friday, reaching $31.00. 1,048,537 shares of the company's stock were exchanged, compared to its average volume of 1,082,132. The business's fifty day moving average price is $29.77 and its 200-day moving average price is $28.23. Iridium Communications Inc. has a twelve month low of $24.14 and a twelve month high of $41.66. The firm has a market capitalization of $3.53 billion, a price-to-earnings ratio of 32.76 and a beta of 0.65. The company has a debt-to-equity ratio of 2.68, a quick ratio of 2.01 and a current ratio of 2.62.

Iridium Communications (NASDAQ:IRDM - Get Free Report) last posted its quarterly earnings data on Thursday, October 17th. The technology company reported $0.21 EPS for the quarter, beating analysts' consensus estimates of $0.20 by $0.01. Iridium Communications had a net margin of 14.09% and a return on equity of 14.34%. The company had revenue of $212.77 million for the quarter, compared to analyst estimates of $205.68 million. On average, research analysts predict that Iridium Communications Inc. will post 0.8 EPS for the current fiscal year.

Iridium Communications declared that its board has authorized a stock buyback program on Thursday, September 19th that allows the company to buyback $500.00 million in outstanding shares. This buyback authorization allows the technology company to reacquire up to 14.2% of its stock through open market purchases. Stock buyback programs are usually an indication that the company's management believes its stock is undervalued.

Analyst Upgrades and Downgrades

Separately, BWS Financial reissued a "neutral" rating and set a $30.00 price objective on shares of Iridium Communications in a report on Monday, October 21st. Two research analysts have rated the stock with a hold rating, one has given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and an average price target of $41.00.

Check Out Our Latest Stock Analysis on IRDM

Insider Buying and Selling

In other news, Director Robert H. Niehaus sold 38,355 shares of the company's stock in a transaction dated Wednesday, October 23rd. The shares were sold at an average price of $29.39, for a total transaction of $1,127,253.45. Following the transaction, the director now owns 254,824 shares in the company, valued at approximately $7,489,277.36. This represents a 13.08 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, insider Suzanne E. Mcbride sold 4,420 shares of the firm's stock in a transaction dated Monday, November 4th. The shares were sold at an average price of $29.48, for a total value of $130,301.60. Following the completion of the sale, the insider now owns 182,797 shares of the company's stock, valued at approximately $5,388,855.56. This represents a 2.36 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 2.00% of the stock is currently owned by insiders.

Iridium Communications Profile

(

Free Report)

Iridium Communications Inc provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide. The company offers postpaid mobile voice and data satellite communications; prepaid mobile voice satellite communications; push-to-talk; broadband data; and Internet of Things (IoT) services.

See Also

Before you consider Iridium Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Iridium Communications wasn't on the list.

While Iridium Communications currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.