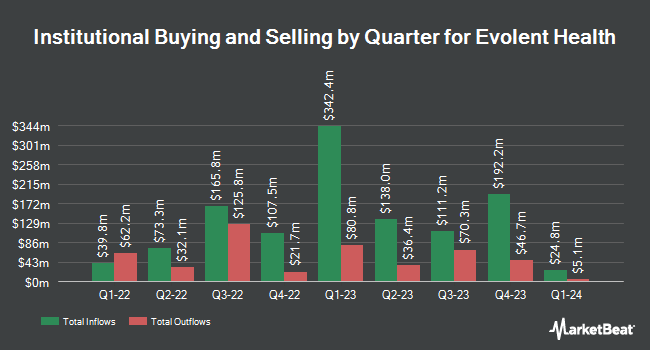

Holocene Advisors LP trimmed its stake in Evolent Health, Inc. (NYSE:EVH - Free Report) by 33.5% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 2,044,606 shares of the technology company's stock after selling 1,031,121 shares during the period. Holocene Advisors LP owned about 1.76% of Evolent Health worth $57,821,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other large investors also recently added to or reduced their stakes in the stock. Valeo Financial Advisors LLC bought a new position in shares of Evolent Health during the 2nd quarter worth approximately $2,705,000. Salem Investment Counselors Inc. raised its stake in shares of Evolent Health by 88.1% during the 2nd quarter. Salem Investment Counselors Inc. now owns 225,901 shares of the technology company's stock worth $4,319,000 after acquiring an additional 105,780 shares in the last quarter. Values First Advisors Inc. raised its stake in shares of Evolent Health by 53.0% during the 2nd quarter. Values First Advisors Inc. now owns 26,546 shares of the technology company's stock worth $508,000 after acquiring an additional 9,193 shares in the last quarter. SeaCrest Wealth Management LLC raised its stake in shares of Evolent Health by 6.3% during the 2nd quarter. SeaCrest Wealth Management LLC now owns 10,200 shares of the technology company's stock worth $195,000 after acquiring an additional 600 shares in the last quarter. Finally, HMS Capital Management LLC raised its stake in shares of Evolent Health by 42.5% during the 2nd quarter. HMS Capital Management LLC now owns 10,569 shares of the technology company's stock worth $202,000 after acquiring an additional 3,150 shares in the last quarter.

Evolent Health Stock Performance

NYSE EVH traded down $0.95 during mid-day trading on Tuesday, reaching $11.76. 1,913,992 shares of the stock were exchanged, compared to its average volume of 1,801,542. The business's 50 day moving average is $21.12 and its 200-day moving average is $23.26. Evolent Health, Inc. has a 1 year low of $11.17 and a 1 year high of $35.00. The company has a market capitalization of $1.37 billion, a P/E ratio of -13.69 and a beta of 1.45. The company has a debt-to-equity ratio of 0.58, a quick ratio of 1.04 and a current ratio of 1.04.

Analyst Upgrades and Downgrades

Several research firms recently commented on EVH. JMP Securities reduced their price objective on shares of Evolent Health from $34.00 to $31.00 and set a "market outperform" rating for the company in a research note on Friday, August 9th. Citigroup cut their price target on shares of Evolent Health from $33.00 to $21.00 and set a "buy" rating on the stock in a research note on Wednesday, November 13th. Royal Bank of Canada restated an "outperform" rating and set a $20.00 price target on shares of Evolent Health in a research note on Tuesday, November 12th. BTIG Research cut their price target on shares of Evolent Health from $36.00 to $29.00 and set a "buy" rating on the stock in a research note on Tuesday. Finally, Barclays cut their price target on shares of Evolent Health from $39.00 to $19.00 and set an "overweight" rating on the stock in a research note on Monday, November 11th. One equities research analyst has rated the stock with a hold rating, ten have issued a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Buy" and an average price target of $26.18.

Read Our Latest Stock Analysis on Evolent Health

About Evolent Health

(

Free Report)

Evolent Health, Inc, through its subsidiary, Evolent Health LLC, offers specialty care management services in oncology, cardiology, and musculoskeletal markets in the United States. The company provides platform for health plan administration and value-based business infrastructure. It offers administrative services, such as health plan services, pharmacy benefits management, risk management, analytics and reporting, and leadership and management; and Identifi, a proprietary technology system that aggregates and analyzes data, manages care workflows, and engages patients.

Featured Articles

Before you consider Evolent Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Evolent Health wasn't on the list.

While Evolent Health currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.