Holocene Advisors LP grew its holdings in MSC Industrial Direct Co., Inc. (NYSE:MSM - Free Report) by 31.7% during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 80,380 shares of the industrial products company's stock after purchasing an additional 19,341 shares during the period. Holocene Advisors LP owned about 0.14% of MSC Industrial Direct worth $6,918,000 at the end of the most recent quarter.

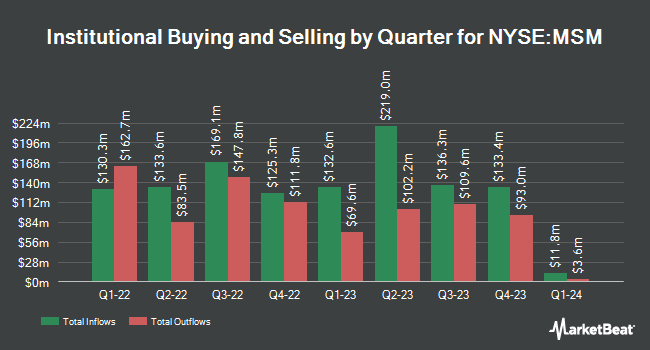

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Blue Trust Inc. raised its stake in MSC Industrial Direct by 1,142.3% in the second quarter. Blue Trust Inc. now owns 323 shares of the industrial products company's stock valued at $26,000 after purchasing an additional 297 shares in the last quarter. Ridgewood Investments LLC bought a new stake in shares of MSC Industrial Direct during the second quarter worth about $26,000. V Square Quantitative Management LLC bought a new stake in MSC Industrial Direct in the third quarter valued at approximately $26,000. UMB Bank n.a. boosted its holdings in MSC Industrial Direct by 442.1% in the third quarter. UMB Bank n.a. now owns 309 shares of the industrial products company's stock valued at $27,000 after acquiring an additional 252 shares during the last quarter. Finally, Quest Partners LLC boosted its holdings in shares of MSC Industrial Direct by 35,300.0% during the 2nd quarter. Quest Partners LLC now owns 354 shares of the industrial products company's stock worth $28,000 after buying an additional 353 shares in the last quarter. 79.26% of the stock is currently owned by institutional investors and hedge funds.

MSC Industrial Direct Price Performance

Shares of MSM stock traded down $1.08 on Wednesday, reaching $83.69. The company's stock had a trading volume of 808,995 shares, compared to its average volume of 579,028. MSC Industrial Direct Co., Inc. has a 12-month low of $75.05 and a 12-month high of $104.76. The company has a quick ratio of 0.90, a current ratio of 1.96 and a debt-to-equity ratio of 0.20. The company has a market capitalization of $4.68 billion, a P/E ratio of 18.51 and a beta of 0.89. The stock's 50 day simple moving average is $83.76 and its 200-day simple moving average is $82.76.

MSC Industrial Direct (NYSE:MSM - Get Free Report) last released its earnings results on Thursday, October 24th. The industrial products company reported $1.03 EPS for the quarter, missing analysts' consensus estimates of $1.08 by ($0.05). MSC Industrial Direct had a net margin of 6.77% and a return on equity of 19.35%. The firm had revenue of $952.30 million during the quarter, compared to the consensus estimate of $959.74 million. During the same period in the prior year, the company earned $1.64 EPS. The firm's revenue was down 8.0% compared to the same quarter last year. As a group, equities analysts predict that MSC Industrial Direct Co., Inc. will post 3.65 earnings per share for the current fiscal year.

MSC Industrial Direct Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Wednesday, November 27th. Stockholders of record on Wednesday, November 13th were paid a $0.85 dividend. This represents a $3.40 dividend on an annualized basis and a dividend yield of 4.06%. The ex-dividend date was Wednesday, November 13th. This is a positive change from MSC Industrial Direct's previous quarterly dividend of $0.83. MSC Industrial Direct's payout ratio is 74.24%.

Insider Buying and Selling

In related news, CEO Erik Gershwind sold 50,000 shares of the business's stock in a transaction dated Monday, November 11th. The shares were sold at an average price of $90.36, for a total transaction of $4,518,000.00. Following the sale, the chief executive officer now owns 1,402,849 shares of the company's stock, valued at $126,761,435.64. The trade was a 3.44 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, Director Philip Peller sold 900 shares of the company's stock in a transaction that occurred on Wednesday, November 13th. The stock was sold at an average price of $89.07, for a total transaction of $80,163.00. Following the completion of the transaction, the director now owns 4,044 shares in the company, valued at approximately $360,199.08. This represents a 18.20 % decrease in their position. The disclosure for this sale can be found here. 18.80% of the stock is owned by corporate insiders.

Wall Street Analyst Weigh In

MSM has been the topic of several recent analyst reports. Robert W. Baird raised their price objective on MSC Industrial Direct from $84.00 to $91.00 and gave the company a "neutral" rating in a research note on Wednesday, October 16th. Stephens lowered shares of MSC Industrial Direct from an "overweight" rating to an "equal weight" rating and set a $85.00 price objective on the stock. in a research report on Wednesday. Finally, JPMorgan Chase & Co. decreased their price target on shares of MSC Industrial Direct from $87.00 to $73.00 and set a "neutral" rating for the company in a research note on Friday, October 25th. Seven investment analysts have rated the stock with a hold rating, According to MarketBeat.com, the company presently has an average rating of "Hold" and a consensus target price of $85.20.

View Our Latest Report on MSM

About MSC Industrial Direct

(

Free Report)

MSC Industrial Direct Co, Inc, together with its subsidiaries, distributes metalworking and maintenance, repair, and operations (MRO) products and services in the United States, Canada, Mexico, the United Kingdom, and internationally. The company's MRO products include cutting tools, measuring instruments, tooling components, metalworking products, fasteners, flat stock products, raw materials, abrasives, machinery hand and power tools, safety and janitorial supplies, plumbing supplies, materials handling products, power transmission components, and electrical supplies.

Read More

Before you consider MSC Industrial Direct, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MSC Industrial Direct wasn't on the list.

While MSC Industrial Direct currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.