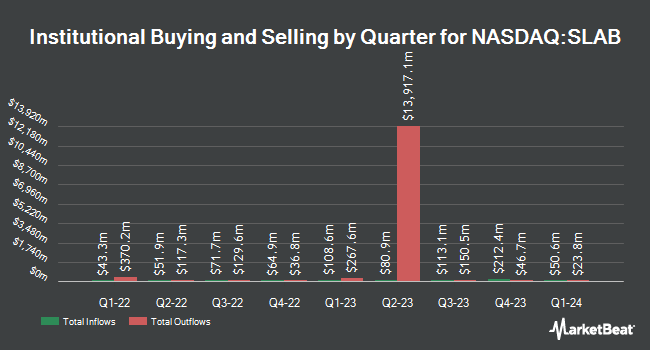

Holocene Advisors LP lifted its stake in shares of Silicon Laboratories Inc. (NASDAQ:SLAB - Free Report) by 60.1% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 41,111 shares of the semiconductor company's stock after acquiring an additional 15,439 shares during the period. Holocene Advisors LP owned 0.13% of Silicon Laboratories worth $4,751,000 as of its most recent SEC filing.

Several other large investors have also modified their holdings of SLAB. Clearbridge Investments LLC raised its holdings in Silicon Laboratories by 84.0% in the second quarter. Clearbridge Investments LLC now owns 273,776 shares of the semiconductor company's stock valued at $30,288,000 after buying an additional 125,022 shares during the period. American Century Companies Inc. raised its holdings in Silicon Laboratories by 29.5% in the second quarter. American Century Companies Inc. now owns 316,407 shares of the semiconductor company's stock valued at $35,004,000 after buying an additional 72,138 shares during the period. FMR LLC raised its holdings in Silicon Laboratories by 1.1% in the third quarter. FMR LLC now owns 4,843,370 shares of the semiconductor company's stock valued at $559,748,000 after buying an additional 54,708 shares during the period. Van Berkom & Associates Inc. raised its holdings in Silicon Laboratories by 8.4% in the second quarter. Van Berkom & Associates Inc. now owns 609,232 shares of the semiconductor company's stock valued at $67,399,000 after buying an additional 47,058 shares during the period. Finally, Davidson Investment Advisors raised its holdings in Silicon Laboratories by 36.7% in the second quarter. Davidson Investment Advisors now owns 131,453 shares of the semiconductor company's stock valued at $14,543,000 after buying an additional 35,317 shares during the period.

Silicon Laboratories Stock Performance

Shares of SLAB stock traded down $1.77 during mid-day trading on Thursday, reaching $109.77. 179,770 shares of the company were exchanged, compared to its average volume of 298,494. The company has a market capitalization of $3.56 billion, a P/E ratio of -15.07 and a beta of 1.21. The business's 50 day simple moving average is $110.93 and its 200 day simple moving average is $113.11. Silicon Laboratories Inc. has a fifty-two week low of $94.00 and a fifty-two week high of $154.91.

Silicon Laboratories (NASDAQ:SLAB - Get Free Report) last released its quarterly earnings data on Monday, November 4th. The semiconductor company reported ($0.13) EPS for the quarter, topping analysts' consensus estimates of ($0.20) by $0.07. The firm had revenue of $166.00 million during the quarter, compared to the consensus estimate of $165.50 million. Silicon Laboratories had a negative net margin of 46.93% and a negative return on equity of 12.60%. The firm's revenue was down 18.5% on a year-over-year basis. During the same quarter in the previous year, the company posted $0.48 earnings per share. On average, analysts forecast that Silicon Laboratories Inc. will post -3.56 EPS for the current year.

Wall Street Analyst Weigh In

SLAB has been the topic of several research reports. StockNews.com upgraded shares of Silicon Laboratories to a "sell" rating in a report on Friday, November 8th. KeyCorp dropped their price objective on shares of Silicon Laboratories from $150.00 to $115.00 and set an "overweight" rating on the stock in a research note on Tuesday, November 5th. Benchmark reiterated a "hold" rating on shares of Silicon Laboratories in a research note on Tuesday, November 5th. Barclays dropped their price objective on shares of Silicon Laboratories from $120.00 to $75.00 and set an "equal weight" rating on the stock in a research note on Tuesday, November 5th. Finally, Morgan Stanley dropped their price objective on shares of Silicon Laboratories from $123.00 to $97.00 and set an "equal weight" rating on the stock in a research note on Tuesday, November 5th. One analyst has rated the stock with a sell rating, five have issued a hold rating and five have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus target price of $121.50.

Read Our Latest Stock Analysis on SLAB

Silicon Laboratories Company Profile

(

Free Report)

Silicon Laboratories Inc, a fabless semiconductor company, provides various analog-intensive mixed-signal solutions in the United States, China, Taiwan, and internationally. The company's products include wireless microcontrollers and sensor products. Its products are used in various electronic products in a range of applications for the industrial Internet of Things (IoT), including industrial automation and control, smart buildings, access control, HVAC control, and industrial wearables and power tools; smart cities applications, such as smart metering, smart street lighting, renewable energy, electric vehicle supply equipment, and smart agriculture; commercial IoT applications, including smart lighting, asset tracking, electronic shelf labels, theft protection, and enterprise access points; smart home applications, comprising home automation/security systems, smart speakers, smart lighting, HVAC control, smart cameras, smart appliances, smart home sensing, smart locks, and window/blind controls; and connected health applications, including diabetes management, consumer health and fitness, elderly care, patient monitoring, and activity tracking; as well as in commercial building automation, consumer electronics, and medical instrumentation.

Featured Stories

Before you consider Silicon Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Silicon Laboratories wasn't on the list.

While Silicon Laboratories currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.