Holocene Advisors LP acquired a new stake in shares of Henry Schein, Inc. (NASDAQ:HSIC - Free Report) during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm acquired 799,981 shares of the company's stock, valued at approximately $58,319,000. Holocene Advisors LP owned 0.64% of Henry Schein as of its most recent SEC filing.

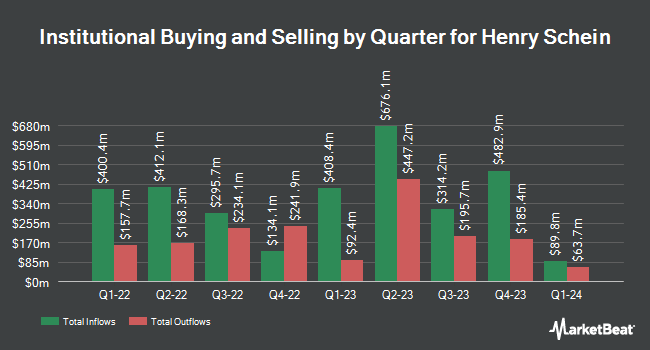

A number of other hedge funds also recently made changes to their positions in HSIC. Cromwell Holdings LLC raised its position in Henry Schein by 93.4% in the third quarter. Cromwell Holdings LLC now owns 352 shares of the company's stock worth $26,000 after acquiring an additional 170 shares in the last quarter. Studio Investment Management LLC lifted its holdings in shares of Henry Schein by 3.8% during the third quarter. Studio Investment Management LLC now owns 4,674 shares of the company's stock worth $341,000 after buying an additional 172 shares during the last quarter. Simplify Asset Management Inc. lifted its holdings in shares of Henry Schein by 5.0% during the second quarter. Simplify Asset Management Inc. now owns 3,695 shares of the company's stock worth $237,000 after buying an additional 175 shares during the last quarter. Sequoia Financial Advisors LLC lifted its holdings in shares of Henry Schein by 3.2% during the second quarter. Sequoia Financial Advisors LLC now owns 5,680 shares of the company's stock worth $364,000 after buying an additional 176 shares during the last quarter. Finally, Mather Group LLC. raised its stake in shares of Henry Schein by 16.8% in the second quarter. Mather Group LLC. now owns 1,502 shares of the company's stock valued at $96,000 after purchasing an additional 216 shares in the last quarter. Hedge funds and other institutional investors own 96.62% of the company's stock.

Insider Activity

In other news, SVP Lorelei Mcglynn sold 21,035 shares of the business's stock in a transaction dated Friday, September 6th. The shares were sold at an average price of $69.30, for a total value of $1,457,725.50. Following the sale, the senior vice president now directly owns 71,833 shares in the company, valued at $4,978,026.90. The trade was a 22.65 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, COO Michael S. Ettinger sold 12,240 shares of the business's stock in a transaction dated Monday, November 18th. The stock was sold at an average price of $75.00, for a total transaction of $918,000.00. Following the completion of the sale, the chief operating officer now owns 87,706 shares in the company, valued at approximately $6,577,950. This trade represents a 12.25 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 1.14% of the company's stock.

Henry Schein Stock Performance

Shares of Henry Schein stock traded down $1.36 on Tuesday, hitting $75.14. 630,729 shares of the company's stock were exchanged, compared to its average volume of 1,394,273. The company has a 50-day simple moving average of $71.57 and a 200-day simple moving average of $69.88. The stock has a market capitalization of $9.37 billion, a PE ratio of 31.48, a PEG ratio of 2.21 and a beta of 0.87. Henry Schein, Inc. has a 1 year low of $63.67 and a 1 year high of $82.63. The company has a debt-to-equity ratio of 0.46, a quick ratio of 0.82 and a current ratio of 1.42.

Henry Schein (NASDAQ:HSIC - Get Free Report) last announced its quarterly earnings data on Tuesday, November 5th. The company reported $1.22 EPS for the quarter, beating the consensus estimate of $1.17 by $0.05. The firm had revenue of $3.17 billion for the quarter, compared to the consensus estimate of $3.24 billion. Henry Schein had a net margin of 2.51% and a return on equity of 12.90%. The company's revenue was up .4% on a year-over-year basis. During the same period last year, the firm earned $1.32 EPS. As a group, equities analysts anticipate that Henry Schein, Inc. will post 4.78 EPS for the current year.

Wall Street Analyst Weigh In

A number of research analysts recently commented on HSIC shares. Evercore ISI upped their target price on Henry Schein from $70.00 to $74.00 and gave the company an "in-line" rating in a research note on Tuesday, October 8th. Barrington Research reissued an "outperform" rating and issued a $82.00 target price on shares of Henry Schein in a research report on Wednesday, November 6th. Robert W. Baird reduced their target price on Henry Schein from $92.00 to $82.00 and set an "outperform" rating for the company in a research note on Wednesday, August 7th. StockNews.com raised Henry Schein from a "sell" rating to a "hold" rating in a report on Thursday, November 7th. Finally, UBS Group dropped their price objective on Henry Schein from $75.00 to $72.00 and set a "neutral" rating for the company in a report on Wednesday, August 7th. Six equities research analysts have rated the stock with a hold rating, four have given a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, Henry Schein presently has a consensus rating of "Moderate Buy" and an average price target of $79.38.

Get Our Latest Report on HSIC

Henry Schein Profile

(

Free Report)

Henry Schein, Inc provides health care products and services to dental practitioners, laboratories, physician practices, and ambulatory surgery centers, government, institutional health care clinics, and other alternate care clinics worldwide. It operates through two segments, Health Care Distribution, and Technology and Value-Added Services.

Featured Articles

Before you consider Henry Schein, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Henry Schein wasn't on the list.

While Henry Schein currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.