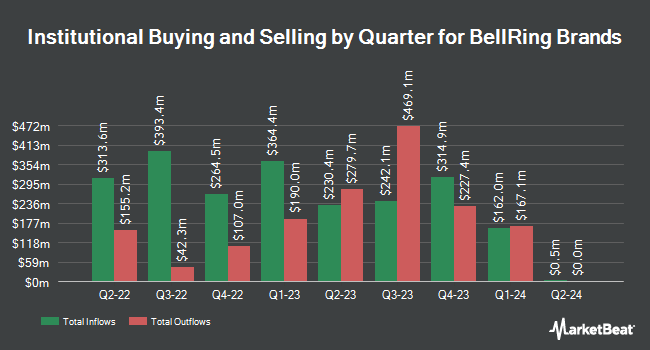

Holocene Advisors LP acquired a new stake in BellRing Brands, Inc. (NYSE:BRBR - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor acquired 1,152,807 shares of the company's stock, valued at approximately $69,998,000. Holocene Advisors LP owned about 0.89% of BellRing Brands as of its most recent filing with the SEC.

Other hedge funds have also recently added to or reduced their stakes in the company. Opal Wealth Advisors LLC purchased a new position in shares of BellRing Brands during the 2nd quarter worth $28,000. V Square Quantitative Management LLC purchased a new position in BellRing Brands during the 3rd quarter valued at about $31,000. Farther Finance Advisors LLC boosted its holdings in BellRing Brands by 243.1% during the 3rd quarter. Farther Finance Advisors LLC now owns 669 shares of the company's stock valued at $41,000 after acquiring an additional 474 shares during the period. Truvestments Capital LLC purchased a new position in BellRing Brands during the 3rd quarter valued at about $44,000. Finally, Quarry LP boosted its holdings in BellRing Brands by 65.3% during the 2nd quarter. Quarry LP now owns 957 shares of the company's stock valued at $55,000 after acquiring an additional 378 shares during the period. 94.97% of the stock is owned by institutional investors and hedge funds.

BellRing Brands Trading Down 1.2 %

NYSE:BRBR traded down $0.91 on Tuesday, reaching $76.71. 490,200 shares of the stock traded hands, compared to its average volume of 1,204,302. The company has a market capitalization of $9.88 billion, a price-to-earnings ratio of 41.51, a PEG ratio of 2.63 and a beta of 0.86. BellRing Brands, Inc. has a 12 month low of $48.06 and a 12 month high of $79.90. The company's fifty day simple moving average is $67.46 and its 200 day simple moving average is $59.99.

BellRing Brands (NYSE:BRBR - Get Free Report) last released its earnings results on Monday, November 18th. The company reported $0.51 EPS for the quarter, topping analysts' consensus estimates of $0.50 by $0.01. The company had revenue of $555.80 million for the quarter, compared to analysts' expectations of $545.00 million. BellRing Brands had a net margin of 12.35% and a negative return on equity of 103.89%. The firm's revenue was up 17.6% compared to the same quarter last year. During the same quarter last year, the business earned $0.41 EPS. Equities analysts anticipate that BellRing Brands, Inc. will post 2.16 EPS for the current fiscal year.

Analysts Set New Price Targets

BRBR has been the topic of a number of analyst reports. Bank of America increased their price target on BellRing Brands from $75.00 to $82.00 and gave the company a "buy" rating in a research report on Wednesday, November 20th. JPMorgan Chase & Co. reduced their price target on BellRing Brands from $65.00 to $64.00 and set an "overweight" rating on the stock in a research report on Wednesday, August 7th. Evercore ISI increased their price target on BellRing Brands from $70.00 to $78.00 and gave the company an "outperform" rating in a research report on Wednesday, November 20th. Truist Financial increased their price target on BellRing Brands from $60.00 to $75.00 and gave the company a "hold" rating in a research report on Wednesday, November 20th. Finally, Deutsche Bank Aktiengesellschaft raised their target price on BellRing Brands from $73.00 to $77.00 and gave the stock a "buy" rating in a research report on Wednesday, November 20th. Three equities research analysts have rated the stock with a hold rating and twelve have given a buy rating to the company's stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $75.60.

Read Our Latest Report on BellRing Brands

BellRing Brands Profile

(

Free Report)

BellRing Brands, Inc, together with its subsidiaries, provides various nutrition products in the United States. The company offers ready-to-drink (RTD) protein shakes, other RTD beverages, powders, nutrition bars, and other products primarily under the Premier Protein and Dymatize brands. It distributes its products through club, food, drug, mass, eCommerce, specialty, and convenience channels.

Recommended Stories

Before you consider BellRing Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BellRing Brands wasn't on the list.

While BellRing Brands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.