Holocene Advisors LP bought a new position in Corpay, Inc. (NYSE:CPAY - Free Report) in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund bought 11,173 shares of the company's stock, valued at approximately $3,494,000.

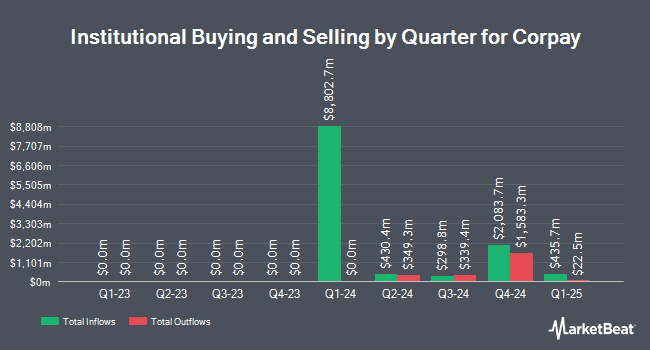

Other institutional investors have also made changes to their positions in the company. American Century Companies Inc. lifted its holdings in Corpay by 1,734.1% in the second quarter. American Century Companies Inc. now owns 400,662 shares of the company's stock worth $106,740,000 after acquiring an additional 378,817 shares during the last quarter. TD Asset Management Inc acquired a new position in Corpay during the 2nd quarter valued at approximately $41,475,000. Assenagon Asset Management S.A. bought a new position in Corpay during the 2nd quarter worth $35,655,000. International Assets Investment Management LLC acquired a new stake in Corpay in the third quarter worth $40,497,000. Finally, FMR LLC boosted its holdings in shares of Corpay by 3.0% during the third quarter. FMR LLC now owns 2,692,847 shares of the company's stock valued at $842,215,000 after acquiring an additional 78,880 shares during the period. 98.84% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

A number of research firms recently weighed in on CPAY. Jefferies Financial Group increased their price objective on shares of Corpay from $375.00 to $425.00 and gave the stock a "buy" rating in a report on Wednesday, October 16th. Citigroup increased their price objective on Corpay from $405.00 to $430.00 and gave the stock a "buy" rating in a report on Thursday, November 14th. Royal Bank of Canada reaffirmed a "sector perform" rating and set a $310.00 target price on shares of Corpay in a research note on Thursday, August 8th. Morgan Stanley increased their price target on Corpay from $325.00 to $350.00 and gave the stock an "equal weight" rating in a research note on Monday, November 11th. Finally, Wolfe Research upgraded shares of Corpay from an "underperform" rating to a "peer perform" rating in a research note on Tuesday, September 3rd. Four equities research analysts have rated the stock with a hold rating, ten have assigned a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $363.93.

Read Our Latest Report on Corpay

Corpay Price Performance

CPAY stock traded down $1.82 on Friday, hitting $365.76. 323,236 shares of the company's stock traded hands, compared to its average volume of 471,887. The company has a current ratio of 1.05, a quick ratio of 1.05 and a debt-to-equity ratio of 1.69. The stock has a market cap of $25.50 billion, a price-to-earnings ratio of 26.09, a P/E/G ratio of 1.47 and a beta of 1.24. Corpay, Inc. has a 1-year low of $247.10 and a 1-year high of $385.30. The stock has a fifty day moving average of $350.94 and a 200-day moving average of $306.91.

Insider Transactions at Corpay

In other Corpay news, CAO Alissa B. Vickery sold 8,000 shares of the company's stock in a transaction that occurred on Wednesday, November 20th. The shares were sold at an average price of $370.04, for a total value of $2,960,320.00. Following the transaction, the chief accounting officer now owns 1,797 shares in the company, valued at approximately $664,961.88. This represents a 81.66 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, Director Joseph W. Farrelly sold 2,975 shares of the business's stock in a transaction dated Wednesday, November 13th. The shares were sold at an average price of $375.18, for a total value of $1,116,160.50. Following the completion of the transaction, the director now owns 10,530 shares in the company, valued at $3,950,645.40. This trade represents a 22.03 % decrease in their position. The disclosure for this sale can be found here. 6.10% of the stock is owned by insiders.

Corpay Company Profile

(

Free Report)

Corpay, Inc operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally. The company offers vehicle payment solutions, which include fuel, tolls, parking, fleet maintenance, and long-haul transportation services, as well as prepaid food and transportation vouchers and cards.

Featured Stories

Before you consider Corpay, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corpay wasn't on the list.

While Corpay currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.