Holocene Advisors LP acquired a new position in Hess Co. (NYSE:HES - Free Report) in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 553,212 shares of the oil and gas producer's stock, valued at approximately $75,126,000. Holocene Advisors LP owned approximately 0.18% of Hess at the end of the most recent quarter.

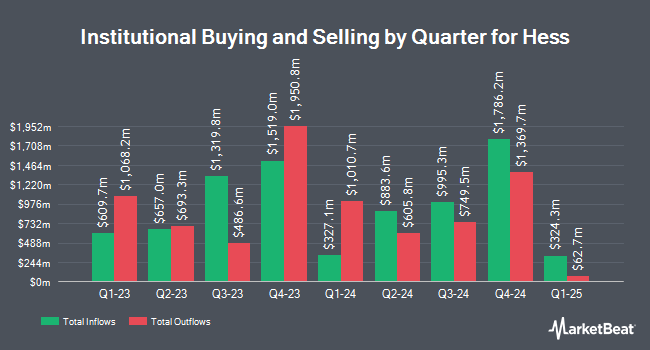

A number of other hedge funds also recently bought and sold shares of the company. Drive Wealth Management LLC lifted its stake in shares of Hess by 1.6% in the second quarter. Drive Wealth Management LLC now owns 4,599 shares of the oil and gas producer's stock valued at $678,000 after buying an additional 72 shares during the period. Cassaday & Co Wealth Management LLC lifted its stake in shares of Hess by 2.4% in the third quarter. Cassaday & Co Wealth Management LLC now owns 3,266 shares of the oil and gas producer's stock valued at $444,000 after buying an additional 78 shares during the period. UMB Bank n.a. lifted its stake in shares of Hess by 4.7% in the second quarter. UMB Bank n.a. now owns 1,771 shares of the oil and gas producer's stock valued at $261,000 after buying an additional 80 shares during the period. HB Wealth Management LLC raised its position in Hess by 0.6% in the second quarter. HB Wealth Management LLC now owns 14,629 shares of the oil and gas producer's stock worth $2,158,000 after purchasing an additional 87 shares in the last quarter. Finally, EverSource Wealth Advisors LLC raised its position in Hess by 47.6% in the first quarter. EverSource Wealth Advisors LLC now owns 273 shares of the oil and gas producer's stock worth $43,000 after purchasing an additional 88 shares in the last quarter. 88.51% of the stock is currently owned by institutional investors.

Hess Trading Up 0.6 %

HES stock traded up $0.88 during mid-day trading on Tuesday, reaching $147.84. The company's stock had a trading volume of 595,169 shares, compared to its average volume of 2,075,799. The company has a market cap of $45.55 billion, a price-to-earnings ratio of 17.13 and a beta of 1.17. The business's 50 day moving average price is $140.49 and its 200 day moving average price is $141.97. The company has a current ratio of 1.26, a quick ratio of 1.13 and a debt-to-equity ratio of 0.75. Hess Co. has a 12 month low of $123.79 and a 12 month high of $163.98.

Hess (NYSE:HES - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The oil and gas producer reported $2.14 EPS for the quarter, beating the consensus estimate of $1.88 by $0.26. The firm had revenue of $3.20 billion during the quarter, compared to the consensus estimate of $2.96 billion. Hess had a return on equity of 27.41% and a net margin of 20.58%. The company's quarterly revenue was up 12.7% on a year-over-year basis. During the same quarter in the previous year, the company posted $1.64 earnings per share. On average, equities research analysts predict that Hess Co. will post 9.74 EPS for the current year.

Hess Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Monday, September 30th. Shareholders of record on Monday, September 16th were paid a $0.50 dividend. The ex-dividend date was Monday, September 16th. This is a positive change from Hess's previous quarterly dividend of $0.44. This represents a $2.00 annualized dividend and a dividend yield of 1.35%. Hess's payout ratio is presently 23.31%.

Insider Buying and Selling at Hess

In other Hess news, CEO John B. Hess sold 90,476 shares of the firm's stock in a transaction dated Thursday, November 7th. The stock was sold at an average price of $142.47, for a total value of $12,890,115.72. Following the sale, the chief executive officer now owns 223,147 shares of the company's stock, valued at $31,791,753.09. This trade represents a 28.85 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, SVP Geurt G. Schoonman sold 6,000 shares of the firm's stock in a transaction dated Thursday, November 7th. The shares were sold at an average price of $141.91, for a total value of $851,460.00. Following the completion of the sale, the senior vice president now directly owns 27,581 shares in the company, valued at approximately $3,914,019.71. The trade was a 17.87 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 314,370 shares of company stock worth $45,856,309 over the last ninety days. 9.76% of the stock is currently owned by company insiders.

Analysts Set New Price Targets

Several analysts have recently weighed in on HES shares. StockNews.com began coverage on shares of Hess in a report on Tuesday, November 26th. They set a "hold" rating for the company. Mizuho lowered their price target on Hess from $210.00 to $194.00 and set a "neutral" rating for the company in a report on Monday, September 16th. Wolfe Research raised Hess from a "peer perform" rating to an "outperform" rating and set a $150.00 price target for the company in a research report on Monday, September 30th. BMO Capital Markets upped their price target on Hess from $155.00 to $160.00 and gave the stock an "outperform" rating in a research report on Friday, October 4th. Finally, Piper Sandler cut their price objective on Hess from $173.00 to $167.00 in a report on Friday, September 13th. Six research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus price target of $164.50.

View Our Latest Stock Analysis on Hess

About Hess

(

Free Report)

Hess Corporation, an exploration and production company, explores, develops, produces, purchases, transports, and sells crude oil, natural gas liquids (NGLs), and natural gas. The company operates in two segments, Exploration and Production, and Midstream. It conducts production operations primarily in the United States, Guyana, the Malaysia/Thailand Joint Development Area, and Malaysia; and exploration activities principally offshore Guyana, the U.S.

Featured Stories

Before you consider Hess, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hess wasn't on the list.

While Hess currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.