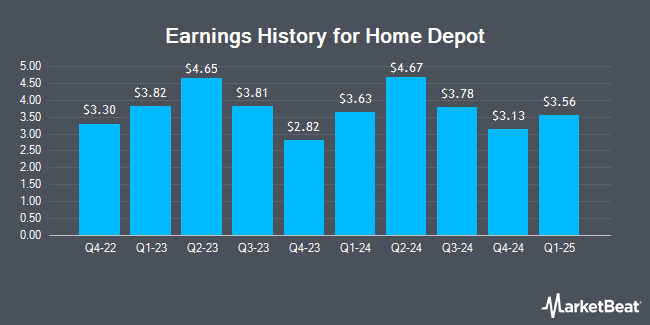

Home Depot (NYSE:HD - Get Free Report) is scheduled to issue its quarterly earnings data before the market opens on Tuesday, November 12th. Analysts expect the company to announce earnings of $3.64 per share for the quarter. Home Depot has set its FY 2024 guidance at 14.510-14.810 EPS.Investors that are interested in participating in the company's conference call can do so using this link.

Home Depot (NYSE:HD - Get Free Report) last issued its earnings results on Tuesday, August 13th. The home improvement retailer reported $4.67 earnings per share for the quarter, topping the consensus estimate of $4.59 by $0.08. The firm had revenue of $43.18 billion for the quarter, compared to analyst estimates of $42.57 billion. Home Depot had a return on equity of 733.61% and a net margin of 9.71%. The firm's revenue for the quarter was up .6% on a year-over-year basis. During the same period last year, the company earned $4.65 earnings per share. On average, analysts expect Home Depot to post $15 EPS for the current fiscal year and $16 EPS for the next fiscal year.

Home Depot Price Performance

Shares of Home Depot stock traded up $4.64 on Tuesday, hitting $400.21. The company had a trading volume of 2,491,282 shares, compared to its average volume of 3,347,601. The business has a 50-day simple moving average of $392.94 and a 200-day simple moving average of $362.47. Home Depot has a 52 week low of $286.79 and a 52 week high of $421.56. The company has a market cap of $397.53 billion, a PE ratio of 26.80, a PEG ratio of 2.72 and a beta of 1.01. The company has a debt-to-equity ratio of 11.74, a current ratio of 1.15 and a quick ratio of 0.33.

Home Depot Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Thursday, September 12th. Shareholders of record on Thursday, August 29th were given a dividend of $2.25 per share. This represents a $9.00 annualized dividend and a yield of 2.25%. The ex-dividend date was Thursday, August 29th. Home Depot's payout ratio is 60.57%.

Analysts Set New Price Targets

Several equities analysts recently weighed in on HD shares. Guggenheim raised their price objective on shares of Home Depot from $390.00 to $450.00 and gave the company a "buy" rating in a research report on Friday, October 4th. TD Cowen upped their price target on Home Depot from $440.00 to $460.00 and gave the company a "buy" rating in a research report on Monday, October 28th. Daiwa America upgraded Home Depot to a "hold" rating in a research report on Thursday, August 15th. Stifel Nicolaus lowered their price target on shares of Home Depot from $380.00 to $375.00 and set a "hold" rating for the company in a report on Wednesday, August 14th. Finally, Royal Bank of Canada reduced their price objective on shares of Home Depot from $377.00 to $363.00 and set a "sector perform" rating on the stock in a research note on Wednesday, August 14th. One investment analyst has rated the stock with a sell rating, eight have given a hold rating and twenty-two have issued a buy rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $415.26.

Check Out Our Latest Analysis on HD

Home Depot Company Profile

(

Get Free Report)

The Home Depot, Inc operates as a home improvement retailer in the United States and internationally. It sells various building materials, home improvement products, lawn and garden products, and décor products, as well as facilities maintenance, repair, and operations products. The company also offers installation services for flooring, water heaters, bath, garage doors, cabinets, cabinet makeovers, countertops, sheds, furnaces and central air systems, and windows.

Read More

Before you consider Home Depot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Home Depot wasn't on the list.

While Home Depot currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.