Honest (NASDAQ:HNST - Get Free Report) is scheduled to release its earnings data after the market closes on Tuesday, November 12th. Analysts expect Honest to post earnings of ($0.03) per share for the quarter. Investors interested in registering for the company's conference call can do so using this link.

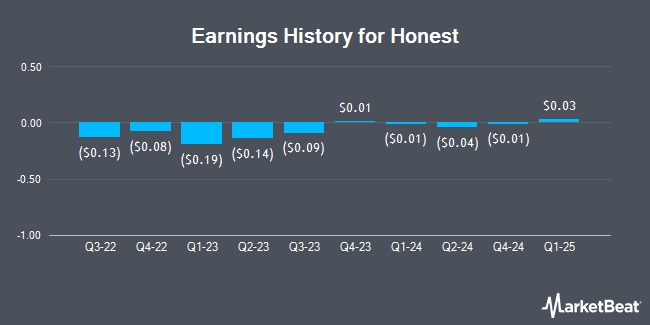

Honest (NASDAQ:HNST - Get Free Report) last released its earnings results on Thursday, August 8th. The company reported ($0.04) earnings per share (EPS) for the quarter, hitting the consensus estimate of ($0.04). The business had revenue of $93.05 million for the quarter, compared to analyst estimates of $87.63 million. Honest had a negative return on equity of 10.00% and a negative net margin of 3.50%. During the same quarter in the prior year, the company posted ($0.14) earnings per share. On average, analysts expect Honest to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Honest Stock Performance

Shares of NASDAQ HNST traded up $0.15 during trading hours on Tuesday, reaching $3.99. 1,352,111 shares of the stock were exchanged, compared to its average volume of 1,213,978. The stock's fifty day simple moving average is $3.82 and its 200 day simple moving average is $3.40. The firm has a market capitalization of $399.32 million, a price-to-earnings ratio of -30.69 and a beta of 1.85. Honest has a 52 week low of $1.19 and a 52 week high of $4.89.

Insider Buying and Selling at Honest

In related news, General Counsel Brendan Sheehey sold 8,176 shares of Honest stock in a transaction dated Wednesday, August 21st. The shares were sold at an average price of $4.28, for a total transaction of $34,993.28. Following the completion of the transaction, the general counsel now directly owns 517,861 shares of the company's stock, valued at approximately $2,216,445.08. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. In related news, General Counsel Brendan Sheehey sold 8,176 shares of the business's stock in a transaction that occurred on Wednesday, August 21st. The shares were sold at an average price of $4.28, for a total transaction of $34,993.28. Following the completion of the transaction, the general counsel now owns 517,861 shares in the company, valued at $2,216,445.08. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Also, major shareholder Shared Abacus Lp Thc sold 2,300,000 shares of the company's stock in a transaction that occurred on Wednesday, September 18th. The shares were sold at an average price of $3.50, for a total transaction of $8,050,000.00. Following the transaction, the insider now owns 9,869,803 shares in the company, valued at $34,544,310.50. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 2,531,187 shares of company stock worth $9,018,480. Insiders own 8.60% of the company's stock.

Analyst Upgrades and Downgrades

HNST has been the subject of a number of research analyst reports. Northland Capmk raised Honest to a "strong-buy" rating in a research report on Tuesday, August 6th. B. Riley began coverage on Honest in a research note on Tuesday, September 10th. They issued a "buy" rating and a $6.50 price objective on the stock. Finally, Northland Securities began coverage on shares of Honest in a report on Tuesday, August 6th. They set an "outperform" rating and a $6.00 target price on the stock. Two analysts have rated the stock with a hold rating, five have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $5.04.

Read Our Latest Report on Honest

About Honest

(

Get Free Report)

The Honest Company, Inc manufactures and sells diapers and wipes, skin and personal care, and household and wellness products. The company also offers baby clothing and nursery bedding products. It sells its products through digital and retail sales channels, such as its website and third-party ecommerce sites, as well as brick and mortar retailers.

See Also

Before you consider Honest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Honest wasn't on the list.

While Honest currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.